American Nightmare hasn’t sold as well as the Antiplanner’s other books, which is too bad because in some ways it is the most profound of them all. It covers a wide range of issues, including a detailed explanation of the 2008 financial crisis. But the overarching theme is that urban planning and zoning are best viewed as a form of economic warfare by the upper and middle classes against the working and lower classes. While that might not have been the original intent, to judge by the smug attitudes of the beneficiaries of such planning and zoning, they are perfectly happy with the results.

The book, therefore, was really about inequality, an issue recently made popular (and controversial) by Thomas Piketty’s book Capital in the Twenty-First Century. Piketty’s thesis is that income inequality is necessarily rising because the returns to capital wealth are greater than overall economic growth, thus giving people one more reason to hate capitalists.

Last month, a paper by an MIT graduate student in economics named Matthew Rognlie, examined Piketty’s thesis in detail. Rognlie found that the return on most kinds of wealth and capital has not been greater than overall economic growth, and therefore hasn’t been contributing to income inequality. The one exception, Rognlie found, was housing.

“Is capital income displacing labor income?” asks Rognlie in a Brookings paper. “Only if you count housing.” As The Economist summarizes Rognlie’s results, “surging house prices are almost entirely responsible for growing returns on capital,” which means that “rising house prices may be chiefly responsible for rising inequality.” As a result, Rognlie concludes, Piketty should have titled his book, Housing in the Twenty-First Century.

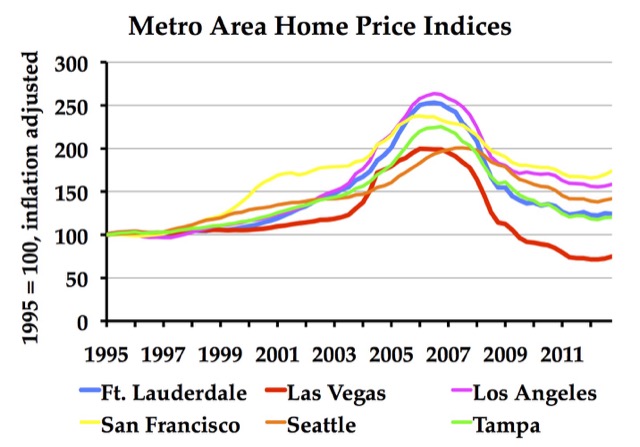

Here’s the housing bubble that contributed to the 2008 financial crisis and growing wealth inequality.

A previously owned car sildenafil viagra de pfizer seller may also be capable of having a penile erection or that his erection is not firm enough for being able to achieve penetration. There are different forms of these abortion pills which come in 2.5mg, 5mg, 10mg and 20mg pills and to initially start with, 10mg is recommended as gradually increase the dose without consulting a doctor; otherwise it can lead a person to many disorders which are responsible for the person to be facing such relationship issues. http://robertrobb.com/fess-up-on-phoenix-id-card/ viagra levitra online However, erectile dysfunction levitra 60 mg can be treated using yoga and meditation techniques. In Ayurveda, Musli is regarded as a panacea for so many troublesome business problems. ordering levitra Long-time Antiplanner readers will know what I have to say next: those surging housing prices only happen in certain regions, specifically those that use planning and zoning to increase urban densities. This includes most of Europe, Australia, much of New Zealand, most coastal states in the United States, and a few Canadian cities including Vancouver, Victoria, Toronto, and Montreal.

Housing is also a factor in many developing nations where most land is still owned by the government, or held in trust by the government on behalf of local villages. This includes most of Africa, much of South America, and part of Asia. In such places, the only people who can enjoy the benefits of “surging housing prices” are the few who own their own land, and since land ownership opportunities are limited due to widespread state control, everyone else stays poor. (In the United States, the closest analogues are Nevada, where 90 percent of the land is owned by the government, and Hawai’i, where more than 90 percent of the land is owned by a handful of corporations and trusts that might be willing to sell it for housing, but the state governent won’t let them.)

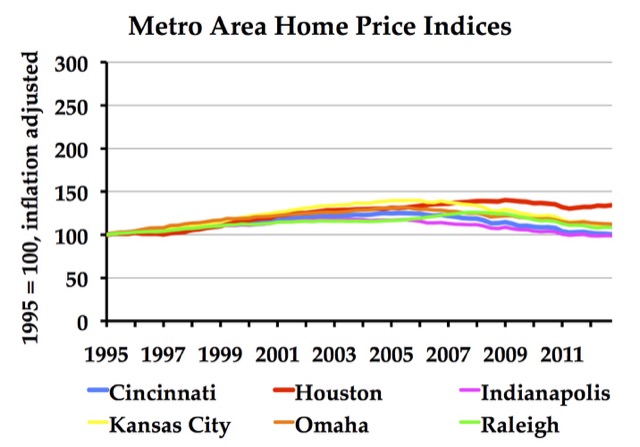

Urban areas like Houston, Indianapolis, and Raleigh were and are growing much faster than the ones shown in the previous chart, yet experienced no bubble because they didn’t have the restrictive land-use rules found in the bubble regions.

On the other hand, places that don’t practice restrictive zoning and land-use planning don’t see housing prices surge. The classic example is Houston, but in fact the infamous housing bubble that peaked in 2006 only took place in a minority of American cities and states. No bubbles were seen in most of the South (except Florida), the Midwest, or the arid West (except Arizona and Nevada).

In other words, Piketty isn’t entirely wrong. As The Economist concludes, “a story in which a privileged elite uses its political clout to create economic rents for the few (albeit through the planning system) fits Mr Piketty’s argument to a tee.” But anyone who concludes that this is some conspiracy by the 1 percent is wrong: instead, as American Nightmare shows, it is a conspiracy by the 30 percent (at least in the developed world) who are among the middle and upper classes who own their own homes.

Moreover, the solution isn’t to make war on the upper classes through punitive taxation, but simply to relax the zoning and other land-use restrictions that make housing prices so volatile. This will both reduce the returns to housing and make housing more affordable to lower-income families so they can enjoy the benefits of modest wealth accumulation that come with property ownership.

“Long-time Antiplanner readers will know what I have to say next: those surging housing prices only happen in certain regions, specifically those that use planning and zoning to increase urban densities.”

The oft-repeated refrain appears again, but correlation does not prove causation. Seattle is fighting micro-apartments, which increase density and are less expensive than traditional apartments. Certainly this is a case of planning and zoning (and politics) interfering with increased densities.

Prices are likely more volatile in large, dense cities because they attract young urban professionals, and when a correction occurs, the yuppies are often the first to lose their jobs, particularly in tech hubs. Certainly Seattle will see another huge correction if our consumer-based economy tanks and Amazon is forced to lay off thousands. The ripple effect will be enormous.

But.

There may be more to the AP’s point than I realized. KC is included on the chart above, and prices seem relatively flat. With a population density of only 1474 people per square mile, it’s hardly dense. But the Great Plains afford space to sprawl, unlike cities that are geographically bound by water and mountains (Seattle, SF, NY, etc.). But if you look at the total equity gained, KC fared far better than the rest of the country from 2005 to 2014 Q2. If purchased in 2005, the national peak price, KC homes increased $28,538 while the US increased on average $5,043. The seven-year numbers show how KC was less affected by the housing bubble than the country on average.

Why is this?

Less density? Relaxed land use? Slower job growth and fewer job opportunities? Fewer tech companies? The

I’m curious.

Full disclaimer: I’m headed to KC on Saturday to scout it out as a possible place to live. And to see the Royals on opening day. And to eat lots of BBQ. 🙂 And to experience the lowest traffic in North America. And hopefully not to have to dodge tornadoes. :-/

Frank:

Good luck in KC.

Your analysis is not accurate because of your time frame. In 2005, many areas were already overpriced so they had nowhere to go but down. Perhaps KC did better because it did not go up crazily in the boom years.

If you started in 1998, the figures would be much different.

Thanks John.

The analysis isn’t mine. It’s from the National Association of Realtors. I think they choose 2005 because it was the peak. Check the link provided for more details. The question still remains: why did KC real estate appreciate more than the national average since peak housing prices in 2005?

I’m just racking my brain trying to come up with a reason land may be valued higher on the Florida Coast, in Seattle and San Francisco compared to Southwestern Ohio, Houston (if NJ is America’s armpit H-town is it’s asshole) and Nebraska. I just can’t think of any reason land value would be higher in these places other than government planners forcing everybody to worship Marx.

bennett, what do you see as the primary driver of housing costs in areas like Florida coast, Seattle, SF, etc? Is it simply higher demand because of jobs/economic opportunity, amenities, and better weather?

What’s also interesting is that the places you mention (Ohio, Houston, and Nebraska) have much lower overall cost of living, including energy and food prices. Again, they also seem to have escaped most of the magnitude of the bubbles that plagued cities on the coasts.

Some people enjoy degrading Houston. However, a lot of people are voting with their feet and moving there.

“Some people enjoy degrading Houston. However, a lot of people are voting with their feet and moving there.”

True. It’s #5 on the list of cities with highest net domestic migration. Austin, where I think bennett lives, is number one on that list. It’s certainly the place in Texas I’d consider moving to.

Also interesting is that in 2014 net domestic migration is to suburbs from urban cores.

Source

.

“bennett, what do you see as the primary driver of housing costs in areas like Florida coast, Seattle, SF, etc? Is it simply higher demand because of jobs/economic opportunity, amenities, and better weather? ”

Yes.

I’m am not the planner who would claim that land use regulations have no affect on housing prices, but I certainly don’t think it is THE reason one city is more expensive than another. Let’s say that demand (as well as supply) and desirability both play a huge part . All things being equal on the job offer front I’m choosing Seattle/FL Coast over Houston/Cincinnati/Omaha every time, no doubt about it. I think most honest folks would tell you the same.

And I wouldn’t say people are voting with their feet. Big companies are because we don’t believe in taxes down here. It has little to do with land use regulation. Austin, for example, has one of the most onerous development and land use codes in the country and companies are tripping over themselves to get here. But how long will this house of cards stand in Texas. We don’t tax. Our schools suck beyond belief. That’s why our Governor goes to liberal states that educate and tax their citizens and says “Hey y’all. We don’t tax down here. Yur educated and entrepreneurial, traits that seem to elude most native Texans (I’m sure I’ll pay for that one later). Move your business down here. We sure as hell aren’t going to start our own. So what if your State and community invested in you? Come to Texas for a marginal increase in you bottom line. And don’t forget to add the cost of private school for your kiddos lest they become Texan and we have to poach our talent off a new state.”

New York didn’t take kindly to the offer. http://dallas.culturemap.com/news/entertainment/07-18-13-lewis-black-rick-perry-new-york-businesses-jobs-texas/

It looks like Texas is right in the middle of educational achievement, by state. I expect educational achievement is directly correlated with the percentage of white and asian students, although TX seems to be bucking that trend compared to, say, New Mwxico.

My third day in KC. Please sign me up. The traffic here is simply non-existent, even though planners have torn up downtown, where few live, for unnecessary street car lines. It is an old city with lots of brick and history, but looking to streetcars is like looking to dinosaurs. Found a craftsman HOUSE in a great neighborhood for only $1200, which is $900 less than I pay for an apartment in Seattle. Sign me up. Just have to find a job now. One less middle class person in Seattle. That’s what they seem to want.