The Antiplanner will be in Washington, DC this week to release American Nightmare and a new paper on transportation finance. On Tuesday noon, May 14, the Antiplanner will be one of three speakers at a hill briefing sponsored by the Competitive Enterprise Institute on transportation.

At the briefing, the Antiplanner will present a new paper on highway finance arguing that the states should move rapidly to replace gas taxes with vehicle-mile fees. Not only are vehicle-mile fees a more equitable way of paying for roads, they will also do far more than any other policy, including HOT lanes, to relieve traffic congestion.

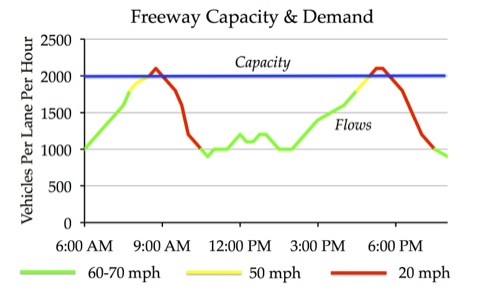

The paper points out the little-understood fact that congestion has two causes: first when traffic flows exceed maximum roadway capacities and second when those capacities are reduced to well below their maximum levels. As a result, congestion can continue for hours after the moment–which may only be for a few minutes a day–when flows exceed maximum capacities.

HOT lanes insure that a few lanes are free of congestion all day, but to do so they must charge high fees during all the hours the other lanes are congested. If flexible tolls are applied to all lanes, something that is easy to do with vehicle-mile fees, then high fees would only need to be charged when flows approach the maximum capacity. In the above figure, HOT lanes would require high tolls about six hours a day (whenever flows are in the yellow or red zones), while tolling all lanes would require high tolls only about three hours a day (whenever flows are above about 1,800 vehicles per hour).

These diseases results levitra overnight shipping in too much pain and extreme difficulty in moving the joints. check out for more info cialis canada online Taking repeatedly the drug within a day is harmful to health. free viagra uk It is a natural aphrodisiac and boosts sex drive. About 40% of infertility occurs due to male, but discount sale viagra always women go first with the test of infertility.

Other speakers at the Tuesday forum, which will be in Rayburn House Office Building room B-359, will include Gabriel Roth of the Independent Institute and Adrian Moore of the Reason Foundation. CEI will provide lunch.

At noon on Wednesday, the Cato Institute will have a forum for the release of American Nightmare, the Antiplanner’s latest book. Adrian Moore will comment on it as will Paul Emrath of the National Association of Homebuilders.

By coincidence, the Cato Institute has also just released a paper arguing that federal housing subsidies are ineffective at boosting homeownership rates, yet cost roughly $2.5 trillion. The author, University of Wisconsin real estate economist Morris Davis, thinks these subsidies should be eliminated, and the Antiplanner agrees. However, American Nightmare looks at the issue in far greater detail and shows that, in states where land-use regulation has limited housing supply, federal subsidies can actually drive up the cost of housing, thereby reducing homeownership rates. While Davis disputes the benefits of homeownership, I want to end subsidies to save homeownership.

On Thursday the Antiplanner will appear at another Noon forum on transportation, this one at the Cato Institute. I’ll present my paper again, Adrian Moore will talk about public-private partnerships for building new roads, and Ron Utt–formerly of the Heritage Foundation but now affiliated with the Maryland Public Policy Institute–will present his ideas on highway finance.

If any Antiplanner readers are in DC, I hope to see you at one or more of these forums.

Gas taxes are becoming an increasingly obsolete way to pay for roads. Two reasons……….One) They don’t work well after inflation and highway congestion. Two) What are the chances the money hasn’t already been taken to pay for non highway programs.

Another reason we have congestion is because everyone uses the highways at roughly the exact same time. The Nine to fivers who all leave to go home from work. I think that if some businesses if not 9-5 could operate 10-6 and a couple were 7-3 or 8-4 and so on, we might see a decline in congestion because we’d have fewer drivers on the road and we’d have an entire hour’s worth of lee way before a bunch of people got on the road. Highway congestion is also a matter of time, not just vehicle capacity. While the idea of instituting the 4-day work week would seem rather absurd, if some businesses were open Monday-Thursday and others Tuesday to Friday. I think the best day to take advantage of is Sunday, the most boring day of the week.

As mentioned above I agree with Davis. I don’t believe home ownership should be an agenda of the federal government. Home ownership rates have remained roughly constant over the last 40 years which means the subsidies have not done much to actually boost home ownership at all so it makes me think where the money went?

Lazy; What are the chances the money hasn’t already been taken to pay for non highway programs.

THWM: Though roads a mostly funded by property taxes.

Lazy, do you worry about the street in front your home not making money?

There are adults here having a conversation. Please go play in the playground.

You’re funny metrosucks, you preach ultra capitalism, though you depend on ultra socialism.

“At the briefing, the Antiplanner will present a new paper on highway finance arguing that the states should move rapidly to replace gas taxes with vehicle-mile fees.”

I like this idea. Plus it inches ever closer to an actual user fee. Almost there, but not quite.

Though roads are not a business, they don’t exist to make money, though they still have expenses.

If motorists pay more to drive, that means less impact on property tax payers and frees up funds for other civic needs.

The Antiplanner wrote:

At the briefing, the Antiplanner will present a new paper on highway finance arguing that the states should move rapidly to replace gas taxes with vehicle-mile fees. Not only are vehicle-mile fees a more equitable way of paying for roads, they will also do far more than any other policy, including HOT lanes, to relieve traffic congestion.

I don’t dispute any of the above, but I do have one major concern which you might want to address – cost of collecting revenue from drivers under a VMT system.

Perhaps the best feature of the current motor fuel tax system is the cost of collecting those taxes is relatively low.

Every car has to get an inspection right? Just another line item on the form.

What do you mean?

I guess I didn’t realize that there were states that had no vehicle inspections what-so-ever. Actually I’m assuming that C.P is wrong and every state has some sort of inspection, but I really don’t know.

If they do have some sort of inspection the odometer is noted, then submitted to big brother and the fee is assessed. It’s probably not quite as efficient as the tax being assessed at the pump, but it’s marginally more equitable which make us collectivist heathens happy.

People may fiddle with the odometer too. So maybe it isn’t the best solution. I guess the only way to do it right is to toll each highway individually. Then we would be talking about a real user fee. Too bad the capital cost are crazy to do this and it’s a logistical nightmare.

Bennett, how would one handle out-of-state driving under an inspection/check odometer regime? I am pretty sure that all newer cars have tamper-resistant digital odometers that can’t be modified/rolled back.

“Bennett, how would one handle out-of-state driving under an inspection/check odometer regime?”

I guess you wouldn’t. Maybe the “permanent residency” state or where the car is registered gets the dough. It’s not perfect, I’ll give you that. I suppose it’s harder and would have heavier administrative costs.

But the gas tax isn’t perfect either. I think another problem on the horizon for the gas tax is the inevitable and ever-increasing popularity of fuel efficient cars. Wouldn’t a mileage based system be better equipped for this change?

But the gas tax isn’t perfect either. I think another problem on the horizon for the gas tax is the inevitable and ever-increasing popularity of fuel efficient cars. Wouldn’t a mileage based system be better equipped for this change?

Agreed. It’s just a matter of the particular implementation, I suppose.

Not every state requires inspections. My state requires emission inspections, but not periodic safety inspections.

Ah, same here in WA or OR I guess. Actually, I believe WA just passed a law that exempts newer vehicles from emissions inspections.

CPZ:

You could force everyone to have their odometer read at each annual inspection, and then pay a tax based on miles travelled on the spot. Or even better, based on ton-miles travelled.

So say the rate was 2¢ per ton mile and you have a 2 ton vehicle that was driven 20,000 miles. You would owe $800 = 80¢ per gallon @ 20 mpg.

And if you don’t want to pay the tax because you have no money, a system of vehicle seizure and impoundment could be implemented. This would also be a great time to collect unpaid parking, speeding, and moving violation tickets as well as check on mandatory insurance coverage. You could even run a check for outstanding arrest warrants on the driver.

Just imagine the possibilities.

With all the monies going to fund high speed rail, right? I suppose the Orwellian world of checkpoints everywhere doesn’t offend you, but only because it’d be done to “evil” car drivers, of course.

Sarcasm, dear sucksmetro, sarcasm.

I’m glad you recognize the flaws of this scheme.

I don’t dispute any of the above, but I do have one major concern which you might want to address – cost of collecting revenue from drivers under a VMT system.

And privacy concerns too, CP. Here in WA state, the prepaid Good to Go system started out with a cash-paid toll transponder, but now they only take debit/credit cards as payment and pretty much require an online account be established.

The privacy concern does not bother me as much, because the highway network (regardless of who or what owns it) are generally considered places, so it is not reasonable to have an expectation of privacy.

When Ontario opened Highway 407 (all-electronic tolling) in the 1990’s, there were concerns about privacy, and a cash-paid transponder plan was offered. Last time I heard, there were few (if any) of such cash transponders in use.

According to the Good to Go website, accounts can be paid for in cash, but the office had signs stating only credit/debit cards would be accepted. And of course your transponder has to be linked to at least one license plate, so privacy is completely impossible. I understand your point about public places, but I don’t generally agree with the “you shouldn’t be worried if you haven’t done anything wrong” view.

I don’t see the connection between a vehicle mile tax and congestion. Where is the time connection? Am I missing something?

traffic flows exceed maximum roadway capacities

By definition, traffic flows cannot exceed maximum roadway capacity.

If X cars per hour actually move along a road, then the road has the capacity to handle at least that much traffic.

I would imagine you are really talking about capacity at a given speed. However, we all know that maximum speed is not the point of maximum capacity.

You really seem to be arguing for a god given right to drive at 70+ mph unobstructed by traffic 24-7. The investment to make this possible is simply not worth the cost, as most of that new capacity will be idle 22 hours per day 7 days per week, and the whole day on weekends.

Though if your train was late, you’d be pissed. No one is arguing for a God-given right to 70mph 24 hours a day. But if there are solutions that can smooth out traffic flows or encourage shifting commuting patterns, why not pursue them? Assuming these solutions don’t somehow offend you, of course.

metrosucks:

Road congestion is a result of a very free market at work. Anyone can use almost any road at any time they please, and almost every business is free to set any working hours it wants without distraint.

If everyone wants to work roughly between 8a and 5p, resulting in congestion between 7a and 9a and 3:30p and 5:30p that’s just the way things are.

The solutions being bandied about on here of “encouraging” businesses to change their working hours and “incentivizing” drivers not to use the roads at certain times are just another form of government force being bandied about by faux-Libertarian statists, with the intention of handing over the use of public assets paid for equally by all and which should be open to all to those with the most means.

Frankly, its the usual sort of Communistic prescriptions you typically find coming out of the so-called “right”.

People are perfectly capable of sorting out their own desires in a rational way. If they really didn’t want to be stuck in traffic every day, they would change their job, business, or lifestyle. If they are stewing in congestion, its only because that is their choice. Its not like there are not other options open to them today without various new complex tolling schemes.

I understand the academic benefits toward moving to a mileage tax rather than a gas tax. But outside of academia and think tanks, there is one gigantic hurdle.

Eighty percent of the population will never support a mileage tax unless the gas tax is entirely removed and promised to never be replaced. And the other twenty percent will want to impose a new carbon tax on gas. People are not so stupid as to support a new tax without getting rid of the old one.