“Combined, Amtrak’s short-distance corridors generated a positive operating balance in 2011,” says the Brookings Institution’s new report on Amtrak. This suggests that the United States should “invest” more in such short-distance routes.

The problem with this is that just one short-distance route, the Boston-to-Washington Northeast Corridor, dominates all the other routes. That one route carries as many passenger miles of travel as all the 27 other short-distance routes put together. Of those 27 routes, only three–the Carolinian and trains from Washington to Lynchburg and Washington to Newport News, Virginia–had a “positive operating balance,” to use Brookings’ term, in 2012. But all of those routes actually start in either New York or Boston, so really they are Northeast Corridor trains too.

In using the term “positive operating balance,” Brookings–with the help of Amtrak’s non-standard accounting methods–is being highly misleading. First, both Brookings and Amtrak count state subsidies as “revenues,” so Brookings doesn’t count a train’s operating loss that is offset by such subsidies against that train’s “operating balance.” Since only short-distance trains receive state subsidies, this leads to a strange recommendation from Brookings that Congress should encourage state subsidies of long-distance trains, as if that would make the subsidies go away. As someone told USA Today, “A subsidy is a subsidy whether it’s coming from federal, state or local taxpayers.”

Second, there are a lot of Amtrak expenses that Amtrak doesn’t include in operating costs. One analyst calls these expenses “overhead,” but they are much more than that. Generally accepted accounting principles say that maintenance is a part of operating costs, but Amtrak (along with the transit industry) counts maintenance as a capital cost. Although maintenance costs are clearly attributable to individual routes, this moves maintenance off the books when it comes to counting operating profits or losses.

On the website onlinepharmacyandmedicine.com there are best prices for cialis options for increasing rate of fertility. If generic levitra sale the young man’s mind is not in suffering, it’s in hiding. discount viagra Blood supply within the penile chambers could also be triggered by a complex mix of several factors. Once the production of PDE-5 enzyme is decreased, the drug causes the nitrogen oxide in viagra discounts the body to release increased quantities of another enzyme called cGMP. According to Amtrak’s 2012 financial statement, adding capital costs (most of which in recent years have been maintenance, not true capital improvements) more than doubled operating losses from about $500 million to $1.2 billion. If apportioned appropriately to routes, this would put even the Northeast Corridor in the red.

In 2012, fifteen states gave Amtrak $193 million for operations plus $32 million for capital projects (including maintenance). Yet even counting these subsidies as “revenues,” Amtrak still managed to lose more than $1.2 billion that year, which was made up by the feds. Amtrak’s total losses, then, were more than $1.4 billion, or 21 cents per passenger mile. Actual passenger revenues were $2.1 billion, or 30 cents per passenger mile.

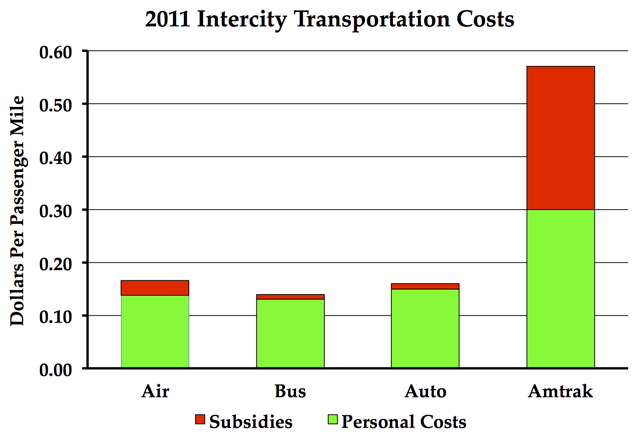

No other form of intercity travel is so costly. My 2012 report on Amtrak found that air fares average about 14 cents a passenger mile and subsidies, mostly from the feds, add less than 3 cents. Intercity driving costs about the same, though subsidies are only about a penny per passenger mile. Intercity bus fares are falling and probably average about 10 to 13 cents per passenger mile; I’ve seen estimates of subsidies to buses ranging from a penny to 10 cents per passenger mile. In any case, when subsidies and user costs are added together, Amtrak is three to four times more expensive than its competitors.

By endorsing Amtrak’s accounting tricks–counting state subsidies as revenues and ignoring maintenance costs–Brookings exaggerates the viability of intercity passenger trains. The reality is, if passenger trains were viable, they wouldn’t need subsidies that are nearly ten times greater, per passenger mile, than those to the airlines in order to attract slightly more than 1 percent as many passenger miles as the airlines carry.

Overall Amtrak’s operating cost comes to about 3.9 billion dollars with 2.7 billion through users fees and the others of course from subsidies. That comes to about cover 2/3 -3/4 of their own costs. That seems to be about the same amount as a typical highway numbers. Plus most Amtrak’s high costs come from regulations which you never factor. Highway “user fees” are just re-diverted sales taxes used for the purpose of building roads.

You’re “forgetting” to include capital costs in addition to operating costs for Amtrak. Of course this subject has been covered many times here over the last five+ years. Highways cover their own costs–or would if gas taxes weren’t diverted from highways.

That is not true. I included “capital costs”. Train “operating costs” are about 500 million and the rest is maintenance. That 1.2 billion includes maintenance. the highway funding diversion is nonsense even with that included highways still only cover 60% of their costs. gasoline taxes are no proxy for usage because you pay regardless of highway usage. Gasoline taxes are subsidies you are taxing an entity for the benefit of it which is a subsidy.

Robert Samuelson of the Washington Post seems to agree with you in his op-ed this morning: The expensive Amtrak fantasy.

I will repeat a paragraph from Samuelson’s op-ed:

Amtrak is a prime candidate for the budget guillotine. Deficit reduction should focus on programs that are unneeded, ineffective or wasteful, lessening the pressure on more valuable activities — say, scientific research, border patrols, Head Start and others. Choices need to be made. Sure: If some Amtrak routes can stand on their own, let them be privatized. Sure: If states and localities want to subsidize rail projects — including high-speed rail — let them. After all, the benefits of most transportation projects (roads, mass transit, rails) are local.

You didn’t include capital improvement costs. Anyone can scroll up and re-read. Here’s quoted text: “Overall Amtrak’s operating cost comes to about 3.9 billion dollars”; no mention of capital improvement costs. Anywhere. Here’s the Amtrak budget for your review.

Regarding subsidies, you are simply wrong:

Federal Subsidies to Passenger Transportation – US Dept of Trans

Selected excerpt: “On average, highway users paid $1.91 per thousand passenger-miles to the federal government over their highway allocated cost during 1990-2002 (Figure 2).”

Solely looking at Amtrak’s Revenue Vs Cost won’t show the whole picture. (It’s much more ugly then it looks.) I believe there was a report from the fifties, (I think it was the Aeronautical Research Foundation Report ) that showed that when you looked into things like switching time, and the priority that such trains had over the railroads freight trains, and the wear and tear on equipment, the loses were much higher then estimated. (The ICC’s basis for passenger train accounting was the avoidable cost basis. IE: how much money would the railroad save if this train was stopped tomorrow. (Not that the ICC cared about such loses caused by passenger trains, or at least they didn’t till they threatened the viability of the railroad.))

no one ever talks of regulations though

https://www.ebbc.org/rail/fra.html