Too much housing news is based on the failure to distinguish between affordable housing and housing affordability. Affordable housing is government-subsidized housing for low-income people. Housing affordability is the general level of housing prices relative to the general level of household or family incomes, often measured by dividing median home prices by median family incomes.

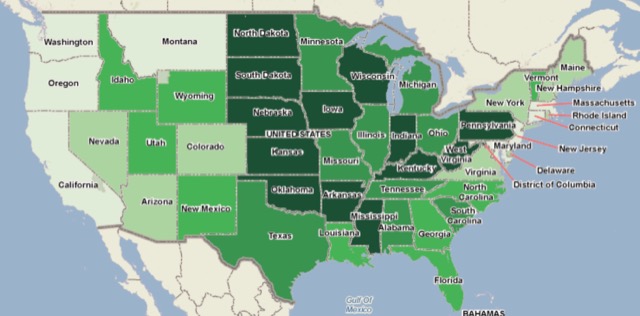

Areas where housing is affordable, such as Dallas or Raleigh, may still need some affordable housing for very poor people. But areas where housing is not affordable, such as Portland or San Francisco, will not solve their housing affordability problems by building more affordable housing. Despite this, politicians, reporters, and editors all promote more affordable housing to address housing affordability issues.

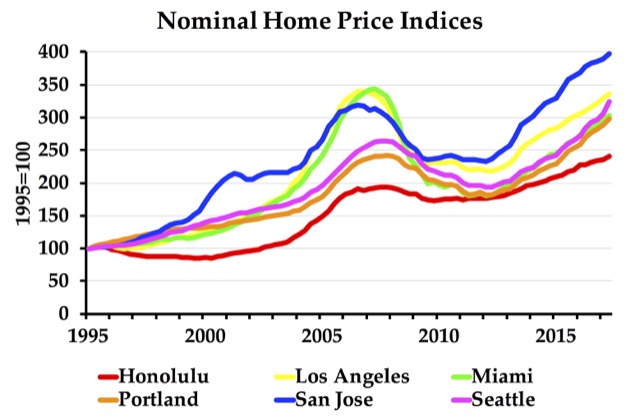

The San Jose Mercury News, for example, accuses Republicans of “sabotaging” the Bay Area’s affordable housing plans by cutting federal housing budgets. But the federal government didn’t impose urban-growth boundaries that have restricted development to 17 percent of the Bay Area, so why should federal taxpayers subsidize affordable housing that isn’t going to solve the region’s self-inflicted housing crisis? Continue reading