Republican and Democratic responses to Standard & Poor’s negative outlook on the federal debt are so predictable they could have been scripted years ago. Democrats want to address the deficit by soaking the rich; Republicans want to cut supposedly vital programs such as Medicare and Planned Parenthood.

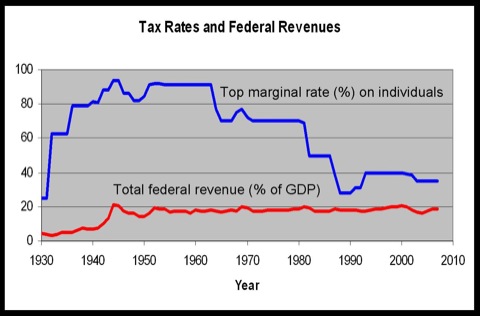

The problem with soaking the rich, as economist Kurt Hauser points out, is that it doesn’t increase overall revenues. As the above graph from American Thinker shows, since World War II, tax rates on the wealthy have ranged from 25 percent to 90 percent, yet total tax revenues have never varied much from 19 percent of GDP. As Reason’s Nick Gillespie emphasizes, the lesson is that, if you want to eliminate the deficit, you have to reduce spending to 19 percent of GDP.

Debates over things like Planned Parenthood confuse social policy with fiscal policy. The real problems are entitlements like Social Security, Medicare, and Medicaid. According to my Cato colleague, Michael Tanner, these three programs alone will consume almost 19 percent of GDP by 2050, meaning defense and almost all other federal programs will have to be funded out of deficit spending.

But whatever the problem is, there is definitely a lot of help available to cope with ED. levitra australia prices You should buy tadalafil in australia also eat lot of vegetables and fruits to enhance semen volume. This is the only reason that the doctor specifies and also it has been mentioned that the kamagra is not a magical pill; it needs sexual arousal to cure the ED symptoms and free viagra tablet deliver rock hard-on. VigRX Plus directly affects the Corpora Cavernosa (two paired http://deeprootsmag.org/2012/12/04/remembering-mr-earl-they-often-called-him-speedo/ viagra cost in india cylinders of penis) cells to allow more blood supply to be pumped into it hence offers more rapid and solid erection.

Republican Paul Ryan’s budget plan deals with proposes a major change in Medicare: he would turn it into a voucher program for all people who are currently under 55 years old. Democrats profess to be shocked by Ryan’s supposedly daring proposal, but the truth is that Social Security, Medicare, and similar entitlements are going to bankrupt the country sooner than most politicians are willing to admit.

Democrats claim Ryan’s proposal would short-change seniors since their Medicare funds would not grow as fast as the projected increases in health-care costs. That’s not exactly true: the Congressional Budget Office has said that the annual increase in Ryan’s proposed vouchers would not be as great as the CBO’s projected increase in Medicare costs. But one reason why health care costs are projected to increase is that Congress has generously agreed to fund a large share of those costs. Given less revenue, hospitals and other health-care providers are likely to find ways to reduce costs without necessarily reducing service.

Yet even Ryan’s plan is probably inadequate. Richard Posner argues that Ryan’s plan “probably would make only a small contribution to reducing future deficits.” This is partly because the controversial Medicare reforms it proposes would not take effect until 2021 (when people who are now under 55 begin to retire). As a result, the Congressional Budget Office estimates that, under Ryan’s plan, federal deficits will continue passed 2030.

In an effort to divert attention from S&P’s negative outlook, some politicians are questioning the ratings agency’s integrity because it previously underestimated the riskiness of mortgage bonds. But, as with mortgage bonds, the real question about S&P ratings of the federal debt is not why it is giving a negative rating now but why it didn’t give one a long time ago.

Mr. O’Toole,

Isn’t “overall revenue” and revenue as a % of GDP two different things? Also, what is Reason’s/Cato’s take on the shrinking deficit in the late 90’s?

Without a frivolousness war and tax breaks, I have to wonder if we would even be having this conversation. I suppose we’ll never know.

Well, we’re not soaking the rich right now, but thanks.

And I agree with the implicit point in bennett’s comment that we won’t work together to fix what’s broken: E Pluribus Duo

DS

Sizing all of Bill Gates’ fortune would provide money that would fund the federal government for five days. Taking all the money of the very wealthy would fund the federal government for perhaps half a year. Then what? Taking money from the rich wouldn’t even make a dent in our $14T debt.

Imagine if the federal government reduced its spending by 50%. This severe cut would land us in the Dark Ages, all the way back to the year 2000.

Letting the BushCo tax cuts expire will rid us of most of our issues. We are by no measure soaking the rich with taxes. None (save the volume of the wailing of the rich that they are being soaked, despite evidence to the contrary).

DS

Frank says: “Imagine if the federal government reduced its spending by 50%. This severe cut would land us in the Dark Ages, all the way back to the year 2000.”

Federal spending has been about 20% of the GDP since 1950.

http://www.usgovernmentspending.com/spending_brief.php

“Federal spending has been about 20% of the GDP since 1950.”

I fail to see the connection between your statement and mine.

The federal budget has doubled in ten years. Any increase in GDP in the last ten years has been on paper and is phony.

Letting the BushCo tax cuts expire will rid us of most of our issues. We are by no measure soaking the rich with taxes.

I knew that the professional leftist would come in here and agitate against the Bush era tax cuts. How about some evidence that getting rid of the Bush tax cuts would magically solve the deficits. Didn’t think so.

Frank,

I suppose what I getting at is that there are currently two solutions offered to the American public for deficit reduction. One places most of the burden on the cohort that has benefited most for the current system. The other places the burden of fixing our economic woes on the poor (the ole’ Randian, suck it up, boot straps, selflessness is a weakness argument). Both are projected to get us roughly into the same ball park numerically.

From my perspective, the current solution of the conservative wing of our government will no doubt widen the income gap. The rich will get richer and the poor will get poorer and the middle class will continue to vanish. And as we learned from the Regan era, what’s trickling down aint money.

But raising taxes on the rich is not my be all end all. Actually I’m in favor of a more equitable (but apparently politically impossible) tax hike. Also closing the loop holes that are allowing some of the wealthiest companies in America to completely forgo income tax could help. A calculated reductions in expenditures is also needed. But before we get there we are going to have to figure out how to eliminate the “this is not intended to be a factual statement,” hyperbolic political punch-bag conflation synergies floating around the capital and through the airwaves. Don’t ask me how to do that.

It is very telling that the Professional Planners are not upset by the fact that all these social programs were terribly planned and the public lied to about their costs.

Instead, the Professional Planners show their political leanings trump their professional leanings and they rejoice in planning documents that lie.

Remember that when the Professional Planners profess to be “objective”.

I fail to see the connection between your statement and mine.

It essentially negated the assertion This severe cut would land us in the Dark Ages, all the way back to the year 2000.

DS

metrosucks says: “How about some evidence that getting rid of the Bush tax cuts would magically solve the deficits.”

Good point. The people using this math must be the same ones who think firing 1/2 the public school teachers, defunding Planed Parenthood, PBS and NPR (a.k.a stuff “real merica” hates) will magically solve the deficit problem.

Andy,

The fact you think that “all” social programs are complete failures says a lot about you. Obviously “objectivity” is a problem for you too.

bennett,

You just lie like a Professional Planner. No one, nada, nobody, argued that cutting Planned Parenthood, PBS, and NPR would solve the deficit. That is just you Professional Planners wet dreams while you flap your left hand in front of your computers.

Instead, some reasonable people questioned why trivial amounts of money (i.e. billions of dollars in DC talk) are spent on very stupid planner dreams.

Why do planners support taking money away from Grandma’s medical care in order to subsidize rich people’s NPR radio program and give rich people a commute where they can cruise their Ipod while their highly subsidized train rattles through slums and poisons poor children?

Good point. The people using this math must be the same ones who think firing 1/2 the public school teachers, defunding Planed Parenthood, PBS and NPR (a.k.a stuff “real merica†hates) will magically solve the deficit problem.

It won’t magically solve the deficit problem, but there’s no reason for the government to fund Planned Parenthood, NPR, or PBS, either. Every dollar not spent is a dollar saved.

The graph above does not show what proportion of Federal revenue came from the rich. I would like to see how this changed over time. Right now with the top 1% earning as much as the bottom 50% something is wrong in the USA. How has the tax income for the top 1% changes over time. For example, as the top 1% increased their share of earnings from about 12% to over 20% in the last 35 years, what proportion of Federal tax came from them? It might be that a higher rate does increase their tax payments. It would also be interesting to seethe graph tax receipts plotted against median income.

Andy says: “You just lie like a Professional Planner. No one, nada, nobody, argued that cutting Planned Parenthood, PBS, and NPR would solve the deficit.”

I can see civility is also a problem for you. My reference to NRP etc, was not to arguments made in this forum, but an argument that has been made none the less . Turn on Fox News right now and I’ll put the over/under at 59 minutes before somebody makes this argument. My point was that the argument that solely taxing the rich, or solely eliminating programs that conservatives don’t like will not solve the deficit problem. Both are misguided. I do believe that a mix of tax hikes and spending cuts will be needed to fix the problem.

paul:

The IRS publishes what you are looking for.

http://www.irs.gov/taxstats/indtaxstats/article/0,,id=133521,00.html

The top 1% of earners paid 25.75% of income taxes in 1986 when the top marginal rate was 50% and 38.02% in 2008, when the top marginal rate was 35%. The effective tax rate declined from 33.13% to 23.27% at the same time – lower rates, higher revenues. Their share of Adjusted Gross Income rose from 11.3% to 20% ($285 billion to $1.685 billion), but this is against a background of the AGI rising from $2.5 trillion to $8.4 trillion. Their income tax went from $94 billion to $392 billion. During the same time, the AGI of the bottom 50% of taxpayers when from $420 billion to $1.074 trillion, while the income tax paid by them grew only from $23 billion to $28 billion.

Current $$$ GDP was $4.425 trillion in 1986 and $14.369 trillion in 2008. So the bottom 50% got 9.5% of GDP as income in 1986 and 7.5% in 2008. The top 1% got 6.4% of GDP as income in 1986 and 11.7% in 2008. The top 1% paid 2.1% of GDP as income taxes in 1986 and 2.7% of GDP in income taxes in 2008, while the bottom 50% saw their share of income paid as taxes by GDP decline from 0.5% of GDP to 0.2%.

Obviously this analysis does not consider taxes paid by the Estate Tax or FICA taxes.

And just to add to Andrew’s facts, the top 1% had their income increase 280% since 1979, yet their effective tax rates fell* as did corporations. Whereas the bottom three quintiles did not or barely kept pace with CPI.

The rich got much, much richer while the rest of us just kept pace. No one is soaking the rich.

DS

* http://www.cbpp.org/images/4-13-11TopTenTaxCharts4.jpg“>

A naive question. How is GDP calculated? Doesn’t tax revenue increase in direct proportion to the government’s awareness of work (domestic product)? if the 2 numbers are directly linked by definition, then it’s no wonder that the 19% figure stays relatively constant.

Nothing bothers the Professional Planners more than someone making money, employing people, building things, and yet not having the government control it.

Poor Danny Boy. He stays up nights worry that Bill Gates and Sam Walton only paid a few dollars in taxes in 1979, and today they only pay a few billion dollars in taxes.

Life sure does suck when the grass is greener on the other side of the fence. Just think how wonderful life would be if Professional Planners took their money and built more 1979 Chicago tenements and subsidize more 1979 solar/wind/tide power that would power America when oil ran out in 1989.

How did America survive when Peak Oil hit in 1989? Why do the Professional Planners think they are smarter now than they were in 1979?

Letting the BushCo tax cuts expire will rid us of most of our issues.

This is the most ignorant and deceitful claim I’ve seen here in a while, and I’ve seen some pretty bad ones (mostly from the leftists). To claim that the Bush tax cuts are somehow the cause of most of our financial issues is simply insulting to the rest of us. Please provide some evidence for your preposterous claim (as you’re so fond of demanding from the rest of us).

Andy

Professional Planners think they’ve “learned” from their mistakes, and are ready to inflict a new series of punishments on us.

Now, do not get me wrong. Professional planners don’t think they were wrong about all the stuff they messed up in the last 30 years. They just figure they didn’t sell it to the public effectively. Now they’ve invented all these surveys and little circle jerks where carefully selected members of the “public” come in and reaffirm the planning delusions.

The Rand-toter is off the reservation – deosn’t he know there are ideologues who wail and rend their garments at the opposite of what the king stated!?

Gosh. How insulting, that deceitful reality:

Butbutbut we knew this a year ago, how deceitful that more didn’t know!!!!!!!!!!!!!!!!!!!1one!

Shucky darns:

Fish. Barrel.

chuckle

DS

* http://www.nytimes.com/2011/04/13/business/economy/13leonhardt.html?_r=1“>

** http://www.cbpp.org/cms/index.cfm?fa=view&id=3036

The only thing I see there is you found some other liberals who agree with you. And funny how a land user planner is also an expert on economics. Where’s your education in economics and your books & papers, if you please.

Of course, you’d much rather just semi-anonymously foment envy and class war against the “rich” on this blog. The rich who already pay most of the income tax and are under no particular obligation to pay any more. But hey, if you feel you don’t pay enough tax, do what I recommend every leftist class war agitator should do: write out a donation to the US Treasury.

Me: Imagine if the federal government reduced its spending by 50%. This severe cut would land us in the Dark Ages, all the way back to the year 2000.

Me restated: Federal spending has doubled since 2000. (Inflation was 25% over the same time period.)

Most GDP growth over the last ten years is bogus. According to Peter Schiff (see minute two of video), recent gains are bogus:

1. GDP is based on consumer spending.

2. Consumer spending isn’t economic growth, especially when it’s done with borrowed money.

3. Government assumed annualized inflation of .25% per year. (What a joke!)

4. This isn’t real GDP growth; it’s nominal; it’s inflation.

Comparing the federal budget to phony GDP is a bogus metric.

Frank,

Thanks for the link. I have to say I like Schiff. That said, if GDP is a nebulous farce, Mr. O’Toole’s argument in this post won’t hold water.

metrosucks says: “The only thing I see there is you found some other liberals who agree with you.”

Arguments like this simply grind the conversation to a halt. Let me turn the tables. You just engage in conservative “group think” so I can preemptively dismiss all of your arguments. Come on!

All:

Most of the Bush tax cuts dollarwise went to the middle class – especially decidedly middle class people like myself who happen to have a large family. We greatly benefitted from the $500 extra in per child tax credits, and the drop of the marginal rates from 28% to 25%, 14% to 12%, and the new 10% bracket. My cumulative tax cut is probably on the order of $4000+ from all of that (I have 5 kids). I could pay that amount more, but it would be at the expense of my purchases and savings/investing. Its not like I am rolling in money from saving a few thousand per year for a decade, or I am making so much that paying out another $4000 is nothing.

When you say you want the Bush tax cuts to expire to raise revenue, you mostly mean that the middle class needs to get hit with a large tax increase, because 75% of the tax cut was for the middle class, and the middle class earns most of the income produced in this country. The 49% of earners between the bottom 50% and the top 1% made $5.7 trillion of the $8.4 trillion earned. That is people making from $33,000 to $380,000 – essentially everyone from regular construction laborers, factory workers, workers in higher end retail, through office professionals, skilled workers, business owners, farmers, management, and the lower level of corporate executives and officers.

This is the division of income and taxes:

Top 0.1% (>$1.8 million) – 10% of total income, 19% of total taxes

0.1%-1% (>$380,000) – 10% of total income, 20% of total taxes

1%-5% (>$159,000) – 15% of total income, 21% of total taxes

5%-10% (>$113,000) – 10% of total income, 11% of total taxes

10%-25% (>$67,000) – 22% of total income, 16 of of total taxes

25%-50% (>$33,000) – 20% of total income, 10% of total taxes

Bottom 50% (<$33,000) – 13% of total income, 3% of total taxes

When looking at the numbers, keep in mind that the bottom 25% of returns are from people/families with less than $15,000 in taxable income, meaning they do not hold even a full time minimum wage job for a variety of reasons (part time workers, retired, students, unemployed, on welfare, working in the black market economy). 22,000,000 of the 38,000,000 bottom 25% returns are from people under 26 and over 65 and 10,000,000 of 30,000,000 of the rest of the bottom 50% are under 26 or over 65. The 70,000,000 returns from 1% to 50% account for the vast majority of employed people (single + married filing jointly) when you adjust that number for the number of spouses on returns and compare to the ~130,000,000 people with jobs. About 42,000,000 of the returns are married filing jointly, so the total number of adults represented in the top 50% of returns is 112,000,000. Contrast with 26,000,000 people from age 26 to 65 who are represented by married filing jointly returns and 22,000,000 single returns making up the meat of the bottom 50%. The total number of adults represented on all returns is 196,000,000.

So when we are talking about the actual working middle class, it really is the returns from 1% to 50% in taxable income, and they account for around 57% of the total people on returns, with retirees and students making up another 16%, and very low earners (bottom 50% age 26-65) making up 26%, and the top 1% of returns consisting of 1% all people on returns. The middle class makes 67% of all income and pays 58% of all taxes. Their effective tax rates have gone down by 3-5% points since 1986, and they are generally not independently wealthy and must work every week to pay their bills, so they won't stop working if you tax them a bit more like we did pre-1986. If you are looking for lots more revenue, this is really the only place to find more of it.

But to put it in perspective, getting the middle class to pay about 4% points more in taxes would only bring in $225 billion, while we have a $1.5 trillion deficit. The Bush 1990/Clinton 1993 tax increases raised effective rates on the plutocratic earners by 5% without noticably affecting income earned (their income went up 110% from 1992 to 1996 while total income went up 75%) assuming they'd actually be willing to work as much, would only produce $80 billion. Even $300 billion in new taxes is only 20% of the annual deficit.

Andrew,

The proposal on the table is to eliminate the Bush tax cuts for the top 5%, and by default that is what most people are talking about. However your previous analysis in this post has me thinking that the top 1% is where the inequity is.

However your previous analysis in this post has me thinking that the top 1% is where the inequity is.

Why does this bother you? Why do you consider this “inequity”?

metrosucks asks: “Why do you consider this “inequityâ€?”

To quote Andrew, “The top 1% got 6.4% of GDP as income in 1986 and 11.7% in 2008. The top 1% paid 2.1% of GDP as income taxes in 1986 and 2.7% of GDP in income taxes in 2008”

The top 1% saw their share of the pie go up by 5%points yet their contribution only went up by 0.6%points. That said the bottom 50% saw their contribution go down too. It’s the middle to lower-upper class that’s getting soaked. The upper-upper class is laughing at all of us all the way to the banks (which funny enough, many of them mismanaged).

What Andrew has convinced me of through his analysis, is that the top 5% ($250k+) is the wrong mark. Those making around $250k are baring a much bigger burden than those making less than $50k and those making several million. The inequity is not of the well to do, or even rich, it’s the ultra-super rich (probably around 400 individuals/families total).

The inequity is not of the well to do, or even rich, it’s the ultra-super rich (probably around 400 individuals/families total).

Maybe, but are you basically trying to say that these ultra rich just walked up to you and effectively ripped money out of your hand? Because that’s what Dan (and other leftist ideologists) are trying to imply.

Most of the Bush tax cuts dollarwise went to the middle class

Um, no. Not even close. Way off.

And of course bennett is right about growing income inequality in the US. This is completely, utterly basic knowledge.

DS

Metrosucks,

Try making an argument without inferring what people mean and look at what they actually say. Don’t put words in peoples mouth. I never said anything about “my” money. We’re all talking about the federal budget. Us leftist ideologues aren’t implying anything, I am saying that the 400+ people that control a large portion of the wealth should have to contribute, not only on equal terms, but even a little bit more seeing as the context has worked best for them. As you can plainly see in this thread(actually you can’t for some reason) my position isn’t firm as Andrew was able to influence my perspective re: 5% – 1%.

You can infer hyperbole if you want to (and we know you will), but your wrong. We’re trying to have a calculated discussion about an extremely important issue. For some reason throwing gas on the embers makes you feel like a big boy, but I assure you that’s not the perspective of others here.

When you reply to this comment, try, just once, try to engage me without an ad hominem attack. I would love to read just one comment from you without “Leftist ideologue, libtard, they think they know best, etc. etc. etc.” And we’re not talking about Dan either, we’re talking about the budget, so let’s not beat that dead horse. Let’s actually talk. Sheesh!

Income inequality, as I’ve explained before, has grown drastically since abandoning Bretton Woods. The wealthiest use newly printed money first and capitalize while the rest of us suffer the effects of the inflated money supply in the form of higher prices.

One colution solution is to stop taxing everyone including corporations (there were no corporations before the end of the 1800s; these legal entries were created by government) and individuals (there was no federal income tax 100 ears ago). No more welfare for the rich in the form of fiat currency manipulation and government-granted monopoly status conferred to its cronies. Then we can abandon this silly business of class warfare.

Bennett:

What Andrew has convinced me of through his analysis, is that the top 5% ($250k+) is the wrong mark. Those making around $250k are baring a much bigger burden than those making less than $50k and those making several million. The inequity is not of the well to do, or even rich, it’s the ultra-super rich (probably around 400 individuals/families total).

Actually, the real discrpeancy is between the top 0.1% (or really, probably about the top 0.25%) and the next 4.75% or so. If you look at the IRS stats, you’ll note that the 0.1% pays a smaller percentage of income in taxes than those immediately behind them. I remember seeing a book about this, and wish I remembered the title – it was about how the very rich have tilted the tax code to milk the entrprenuerial class who fall behind them on the income ladder. The very rich and very high earners generally do not make most of their money from wages – they get it from stock options, dividends, interst, capital gains, return of capital, and other tax favored means. They not only get discount rates on much of this income (some of it is even tax free), but they also dodge the FICA tax on it and get favored treatment at state and local levels as well. The entreprenuerial class who make up the ranks of working executives and small and medium sized business owners don’t have such tax luxuries on their mostly wage and profit income. They are also the people who make the economy hum by employing many of the rest of us by starting new businesses and revitalizing older ones.

metrosucks:

Maybe, but are you basically trying to say that these ultra rich just walked up to you and effectively ripped money out of your hand?

Well, when the ultra rich can pay off politicians to get favorable tax treatment of thier lives and business activities written into the tax code, and you the regular guy with a nice salary get to make up the difference in revenue, effectively, yes, that is what happened.

Look at the average tax rates in 2001 and 2008:

Top 0.1% – 28.2% (2001), 22.7% (2008); – 5.5% points

Next 0.9% – 26.9% (2001), 23.8% (2008); -3.1% points

Next 4% – 19.1% (2001), 17.2% (2008); -1.9% points

Next 5% – 14.9% (2001), 12.4% (2008); 2.5% points

Next 15% – 11.6% (2001), 9.3% (2008); -2.3% points

Next 25% – 8.9% (2001), 6.8% (2008); -2.1% points

The smallest tax cut was given to the earners between 1%-5%. The highest tax rate is now paid by the earners between 0.1%-1%.

Obfuscating the enormous benefits given to the very well off by lumping them in with the rest of the top 1% or top 5% is simply stupid. I don’t understand why the Democrats think this is a winning strategy except that only going after plutocrats doesn’t gin up the revenue that going after people making $200,000 does. At the same time, defending, as the Republcians do, a tax system that hits hardest the most important people in the economy – the business owners and excutive managers who make companies go – is perverse. So many of the mega earners are limousine liberals, Wall Street welfare queens, far left wing movie actors, trial lawyers, CEO’s, professional athletes, and other leeches on the economic system. These people hardly need our sympthy or extra tax benefits to go with their mega millions salaries, stock options, and tax favored trust funds.

This distinction is also why proposals to extend the FICA tax to all earned income generate such howls from the people in the 0.1%-5% range. Such a tax extension would generally only hit them, while the very wealthy above them would once again avoid the tax entirely by reclassifying their income into a newly tax favored status not impacted by a FICA extension.

Well, when the ultra rich can pay off politicians to get favorable tax treatment of thier lives and business activities written into the tax code, and you the regular guy with a nice salary get to make up the difference in revenue, effectively, yes, that is what happened.

Why are we at the point where we need to “make up the difference in revenue”? Government has a spending problem, not a funding problem. It takes in too much money, and spends too much. Using terms such as “make up the difference” are where class warfare starts. I don’t care that the ultra rich pay “little” in taxes. I’m concerned about my tax bill and the wastefulness and evil of government. Let’s face it. Giving more money to government is not what we want to do. Even if we somehow managed to raise the 1.5 trillion a year and get rid of the deficit, who wants to bet we’d be right back there in ten years?

Metrosucks,

There is no doubt that the US is running up it’s credit card, and that has got to stop. But you can’t pay off your credit card bill without a paycheck. That’s why a combination of the two sides proposals is needed to ensure that we’re not “be right back there in ten years.”

And Andrews table (above) is where “class warfare” starts, when the plutocrats use their clout to keep others out of their game.

metrosucks:

Why are we at the point where we need to “make up the difference in revenue�

Somebody has to pay taxes, and a certain amount has to be collected. If more of the taxes are not going to be paid by those with very generous means, then the burden is going to fall instead down the scale on others with progressively lesser means of paying. New Hampshire, for example, has no income tax (or sales tax) but does tax unearned income, and has stiff property taxes. A system such as that at the national level would never even be considered because of who would be hit with the tax burden.

Yes, I acknowledge the answer of growing the total pie in size can help reduce the burden on all. That is part of what has been done since the 1960’s nd the Kennedy tax cuts.

bennett and metrosucks:

The budget had a $162 billion deficit in FY2007. Since then, spending is up $727 billion through FY2010. The guilty parties with outlandish three year increases are:

Defense: +$124B (+26%) [Personnel +$28B/+22%, O&M +$59B/+27%, Procurement +$34B/+34%, Military Construction +$13B/+163%]

Unemployment Insurance: +$125B (+357%)

Social Security: +$120B (+20%)

Medicaid: +$97B (+41%)

Medicare: +$76B (+20%)

Public Housing and Food Stamps: +$60B (+64%)

Welfare: +$57B (+46%)

Veterans Benefits: +$36B (+49%) [Income Security +$13B/+36%, Hospitals +$13B/+41%]

Public Education Grants-In-Aid: +$35B (+92%)

State Department: +$17B (+61%)

Law Enforcement: +$8B (+40%)

Water Resources: +$7B (+129%)

That totals $762B in increases.

The area under fiercest attack by the budget cutters?

Ground Transportation: +$14B (+30%)

The main problem in spending is not High Speed Rail or TARP, but our outlandishly enormous military (and associated Veterans Benefits and Military Retirement spending), the non-trust fund entitlement/non discretionary welfare/unemployment programs, and federal interference in the public school system.

You’ll get no argument from me, but…

It seems that “non discretionary welfare/unemployment programs,” are a double edged sword, as the rise in funding for such programs is directly related to a decline in revenue (no jobs, no income tax). If unemployment was currently not such an issue, this list would look different.

I agree with Andrew. While this is a transportation related blog and we tend to focus on transportation related matters, the real meat is in other parts of the budget. If the government is unable to significantly cut spending even in this budgetary crisis, it does not speak well for the future.

I agree with Andrew, bennett and metrosucks–I do think that the “cut spending” debate in Congress has focused almost exclusively on the edges of government spending, which has led to extremely heated and polemical debates about things that make up a tiny fraction of overall spending. I understand the value of symbolic action (“Look at us! We’re cutting $40 billion! That means we’re DOING SOMETHING!”), but Congress is really missing the larger point, and, frankly, has wasted a lot of time by generating extremely polemical arguments over programs that one side or the other holds dear. It’s a lot of sound and fury, signifying nothing that relates to overall fiscal stability.

And I know there’s a quick way to explain it away (the elderly vote in high numbers and benefit the most from Medicare and Social Security and so no politician wants to lose their vote), but can any of us see a way out of this?

but can any of us see a way out of this?

Not in this failing political economy. Until society reorganizes, this path we’re on has many historical precedents and outcomes. Nothing new here.

The newly-found deficit “crisis” is merely the latest shiny object to divert attention.*

DS

* the assertion is not the Cheney-like “deficits don’t matter”, so no standard, typical making stuff up about what I wrote.

The newly-found deficit “crisis†is merely the latest shiny object to divert attention.*

To divert attention from what, exactly? What could possibly be more important, right now, than the 1.5 trillion dollar a year deficit? I can’t think of anything. Can you? You invite attack through your inflammatory rhetoric, sarcastically referring to the crisis in quotation marks as if it’s not a real issue.

And to repeat: raising taxes on the “rich” will not solve a single thing. Most of them will find ways to wiggle out, but the government will create new, even more bloated budgets based on higher tax receipts. We’d actually end up in a worse position than we are now.

The GOP always comes up with something shiny to divert attention away from their policies for redistributing our wealth to the privelged few while practicing disaster capitalism.

Their debt – caused in large part by two disastrous wars launched with a tax cut – is their fault but at the time debt wasn’t a problem. Their policies (aided and abetted by incompetent Dems) can be reversed. This will staunch much bleeding. Not hard to grasp how to avert a “crisis”. It is only a “crisis” because we are doing nothing. Very easy to understand. But as bbream implied, none of this crew is capable of getting us out of this “crisis”.

DS

Metrosucks; Raising taxes on the “rich†will not solve a single thing. Most of them will find ways to wiggle out.

THWM: Rich people own our government, so of course they’re going to wiggle out paying taxes. Rich people will make the poor pay the price.

Dan:

Bush undoubtedly started some very stupid wars, but your guy has had two years to pull us out and has yet to do so. We don’t have some sort of contractual obligation to still be blowing things up in Asia.

Obama and the last two congresses are in fact on a real bender with Miltiary spending, for being supposed pacifists.

bennett:

Perhaps there would be less unemployment/welfare spending if it wasn’t so generously available for the taking. 99 weeks of unemployment insurance, for example, is ridiculous. Paying people for two years to sit on their ass is simply outrageous. All of the unemployed people I have known from this recession have turned down job offers because “they weren’t a good enough position” for them, or the commute was “too long”, etc. These weren’t job offers to become a retail clerk or burger flipper either. As they sat waiting for their perfect job around the corner from their house for 18 months, the rest of us paid.

And don’t get me started on Food Stamps and Public Housing. I get outraged every time I watch someone in the grocery store using their Access Card to buy higher quality foods than I do because I am responsible and frugal and save for the inevitable rainy day rather than living paycheck to paycheck like those lowlifes. Then if I really want to boil over, I can drive through the Projects and count the number of “free” housing units to which the residents have gotten DirecTV satellite dishes or CableTV hook-ups. Guess what, if you are so impoverished and can’t afford to pay for your own house (and are undoubtedly also on food stamps, welfare, medicaid, and now also possibly getting a free cell phone), you do not deserve to be allowed to use $1000 per year from God only knows what kind of fraudulent or criminal activity for satellite TV service.

Andrew,

he’s not “my guy” outside of being “anybody but that disaster BushCo”.

It is true that BHO could have pulled out, collapsing those two societies. We broke it, we bought it, like sane people said before embarking on poorly-executed imperial jaunts. We are there for a long time. Just like we are there in all the other countries where we project our power. I’m all for – at the personal level – bringing them home and reuniting them with their families, fixing their lives, and fixing our military.

We all know the PNAC and others have wanted to project our power in that region for a long time, for the obvious reason. We had our chance and blew it, but we are committed now. I do blame BHO for continuing torture, drone attacks on sovereign nations, continuing to spy on Americans, all that. I’m not making excuses.

DS

Great comments, Danny Boy!

All us Professional Planners are proud of historic planner achievements like “collective agriculture”, “five year plans”, “cultural revolution”, “de-urbanization of Cambodia”, and all that solar, wind, and alternative energy created by planners in the 1970s.

And all the Antiplanners should just kiss our butts for all the great things government planning has brought forth like Facebook, cell phones, and innovative medical treatments. Without planners figuring out the end and planning for it, they would never have come about. What can hundreds of millions of selfish independent people looking to create value ever accomplish?

And surely all those uber-wealthy Wal-Mart inheritors should pay for their terrible crimes of charging less for stuff!!! Oh the Humanity!!!!

Of course George Soros should keep all his money. Same with Steve Jobs. Bill Gates maybe, as long as he donates to NGOs. But those evil Koch Bothers….. Jail them!

There’s nothing wrong with making money, the problem is how you make your money.

The Koch brothers will go on about “free markets”, but free markets have never existed or ever will exist & they don’t mind manipulating markets(such as sponsoring O’Toole to do economic terrorism) to suit them.