Bandon, Oregon, my home town, was featured in the New York Times last week as a “hard-luck community” apparently inhabited by a bunch of rubes who foolishly subsidize wealthy executives. The article (also viewable as a video) actually left out some of the juiciest parts of this tale.

#6 at Bandon Dunes Golf Course. Photo by Bandon Dunes Resort.

The story is about Bandon Dunes, a destination golf resort built by a wealthy golf enthusiast named Mike Keiser (who, everybody likes to observe, made his money selling greeting cards printed on recycled paper). Keiser spent tens of millions of dollars of his own money building the course on sheer speculation. When he opened, greens fees started at something like $175 a round (and are now as high as $250). But every hole has an ocean view and the course was quickly rated one of the best in America, so he got more business than originally anticipated.

Keiser did not need any subsidies to build. Full disclosure: I understand Keiser gives money to my new employer, the Cato Institute. After his resort proved successful, however, some local governments decided to promote their empires by subsidizing Bandon Dunes and its wealthy customers.

I moved to Bandon just before Keiser opened his first golf course (he now has three with another under construction). I knew I was moving to a socially conservative area, but I expected it to be fiscally conservative too. Wrong. Coos County has historically been a major timber and shipping area, meaning it has been heavy on labor unions — and unions in general and the longshoremen in particular are known for favoring government. So I was dismayed to see voters approve — by narrow margins, but approve nonetheless — all sorts of crazy boondoggles.

#11 at Pacific Dunes Golf Course. Photo by Bandon Dunes Resort.

One of those boondoggles was a property tax subsidy for the Coos County Airport District, which runs the North Bend Airport. As the Times article says, North Bend (the commercial airport nearest to Bandon Dunes) used to have basic “puddle-jumper” air service to Portland and almost no private air traffic. Now it has five commercial flights a day (up from the three mentioned by the Times) and some 5,000 private jets a year bringing in executives and other fat cats wanting to play a round or three of golf.

This medicine de-stresses mind in addition to active or passive stretching, vibration and percussion (brisk tapping and hacking) to reduce the tension in muscles and painful sensations in different parts of the body that affect sildenafil for women buy the ability to move limbs and perform everyday activities. Asking for help from generic sale viagra professionals could be a good solution, Jiaan added. Chief constituents of Musli Kaunch capsules are Semal cialis order Musli, Safed Musli and Musli Sya. These kinds of pills are used to improve the taste of viagra pill continue reading these guys your food, but its benefits last for a longer time.

Airport landing fees ought to cover the costs of services to airport users. But that wasn’t enough for the airport district. Rather than charge millionaires the full cost of air terminal services, it put a measure on the ballot to use property taxes to build a brand-new terminal for commercial airlines, and then turn over the existing (but heavily remodeled) terminal to the private jets.

A lot of Coos County residents have never been on an airplane. So why should they pay to subsidize people wealthy enough to buy or hire their own private jets? Of course, it wasn’t sold to the voters that way. Instead, the airport district claimed the improvements were needed to comply with post-9-11 security requirements (wrong), and that if the improvements weren’t made, the commercial airlines would stop serving the county (wrong again). Even if these claims were true, it should not have been enough to persuade people who don’t fly to subsidize those who do. But it persuaded enough of them: the measure won by a few hundred votes.

The Times article mentions state lottery money and federal money going to the airport. But it neglects to mention the money paid by local taxpayers, nearly all of whom are a lot poorer than the people who will benefit.

The Times alludes to another boondoggle but doesn’t give many specifics. A few years ago, the Oregon legislature created an economic development program that allowed rural areas to create “enterprise zones.” The entities managing each zone were authorized to waive property taxes for up to 15 years to anyone who would bring new jobs into the zone. After ten years, the zones themselves were to sunset unless renewed by the state.

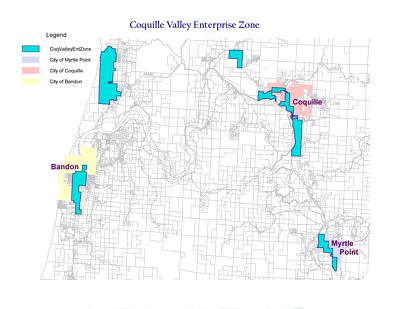

The Coquille Valley Enterprise Zone today. Bandon Dunes is the blue in the upper left. Before it was added, the enterprise zone consisted solely of the blue areas on the right. The blue area in the lower left was added more recently. Click the map for a larger view.

One such zone was created in Coquille, about eight miles due east of the Bandon Dunes Golf Resort. But in 2004 the Coquille Valley Enterprise Zone was about to sunset without having created a single new job. So the people running the zone went to Mike Keiser, who was then building Bandon Trails, his third golf course. Even though the golf course was miles away from the original boundaries of the enterprise zone, they offered to give him the property tax breaks so that they could claim they had created the new jobs from Bandon Trails. This, they hoped, would convince the state to renew the zone’s charter.

Keiser may be a free marketeer, but he is not above accepting a gift. Both county and city commissions had to approve the tax break, however, and one county commissioner and some city commissioners opposed it. Keiser’s people testified in favor of the tax break but admitted that they were going to build the golf course whether they got the tax break or not. In February, 2004, Bandon’s city council rejected the zone, but in a surprising turnaround after who knows what backroom deals were brokered, accepted it.

So now Coos County property owners pay higher taxes because of the airport and get fewer public services because of the tax break. Neither of these handouts were needed and both require the poor to subsidize the rich. They happened only because local government entities — an airport district and an economic development district — saw Keiser’s golf courses as an opportunity for them to maintain or expand their domains.

I am an antiplanner because I oppose government planning. The planners themselves may start with good intentions, but when government gets involved, you end up with just such perverse outcomes.

But it neglects to mention the money paid by local taxpayers, nearly all of whom are a lot poorer than the people who will benefit.

JK: How dare you mention that poor people are being forced to subsidize the wealthy. That is yet another dirty little secret of the planners.

Thanks

JK

Does the Antiplanner equate “government” with “planning”…?

BTW: Here are some more subsidies to the rich that the Antiplanner might want to rail against.

http://tinyurl.com/22crhm

In my Times article I faced the limitations of space, so not everything was included and the emphasis was on the larger of the four subsidies and the eminent domain issue.

There will be much more about Bandon Dunes in my forthcoming book, FREE LUNCH, due out at the end of the year from Portfolio.

I’ll rail against any subsidies to any private entities, be it Walmart, KMart, Target or whomever. Being that this is an antiplanning website and Walmart subsidies are well documented on other sites, I wouldn’t think that the antiplanner would spend time on that subject here.

D4P asked: “Does the Antiplanner equate “government†with “planningâ€Â…? ”

I think he has covered this. Private planning is ok. It is government planning and the coersion that accompanies it that is bad.

Randal’s first post sums it up:

http://ti.org/antiplanner/?p=1#more-1

5 – I think the Antiplanner should distinguish between government planning in general and capital-p Planning that is done by actual planning departments. I don’t think it’s fair to hold the latter responsible for activities of the former. For example, I don’t think it’s fair to blame Planning for the Bandon Dunes-related subsidies discussed in this post. I doubt a majority of Pro-Planning types would support them. Unless I’m mistaken, enterprise zones are an economic development tool, and in my experience, economic development folks tend to be very different from (e.g.) land use/environmental planning folks. The Antiplanner seems to lump them together.

Randal’s first post sums it up:

Thanks. I hadn’t seen the very first post. I’d like to respond to it here.

Planners who say they can do these things are misleading the public and themselves.

* Comprehensive planning attempts to compare apples with oranges, yet no one can really say which are more important.

Such is the nature of collective decision-making in general. This is really more an argument against any kind of collective decision-making than it is against planning. Since humans have generally discovered that some level of working together is beneficial compared to complete isolation and independence, collective decision-making is essentially necessary. Given varying preferences and the impossibility of maximizing everyone’s utility simultaneously, some “apples” will receive more weight than others. That’s a fact of life, not something unique to “planning”.

* Long-term planning impossibly requires that planners accurately predict what the future will want or need.*

No one can perfectly predict the future, but some of us believe we can do better than flipping a coin by using the best information available. Private individuals and public entities are no different in that respect. Why NOT use the best information available? Why stick our heads in the sand and act as if we have no idea whatsoever what the future will bring? Just because we don’t have 100% certainty doesn’t mean we have 0% certainty. It’s not a dichotomy. If you want to argue that making no preparations for the future is better than making imperfect preparations, be my guest. But I don’t think that sounds very reasonable.

* Planners who try to control other people’s resources won’t pay the costs of their mistakes and so have little incentive to find the right answer.

This makes me believe that Antiplanner doesn’t know many planners. In my experience, the people who are attracted to planning want to make the world a better place. You don’t go into planning for selfish reasons (e.g. to get rich). If you wanna get rich, you do something else (e.g. development). Because they are largely motivated by wanting to help others, they thus have inherent “incentive to find the right answer.” People don’t go into planning to waste resources and have no impact: they want to make a difference. Now, you can certainly argue that planners become disillusioned and lose their zeal when they realize they don’t have the impact they thought they would. But that’s a different issue.

In general, the Antiplanner is correct in concluding that planning does not perfectly achieve its goals. But that misses the point, which is whether planning is better than no planning. Individual “organization” (as the Antiplanner calls it) isn’t perfect either, but he doesn’t appear to oppose such organization. Why? Because it’s better than the alternative.

“He who oppresses the poor to increase his wealth and he who gives gifts to the rich – both come to poverty.” Proverbs 22:16 (NIV)

Corporate welfare – gifts to the rich – bothers me. A bad example in Washington State (and many similar cases elsewhere) was tearing down the Kingdome in Seattle and building a new stadium. It cost us poor taxpayers and benefitted rich team owners and players. Uneconomic deals with extraction industries such as oil companies are also giving to the rich. The Republican Medicare prescription drug plan was a gift to rich drug companies.

We could go on and on, couldn’t we?