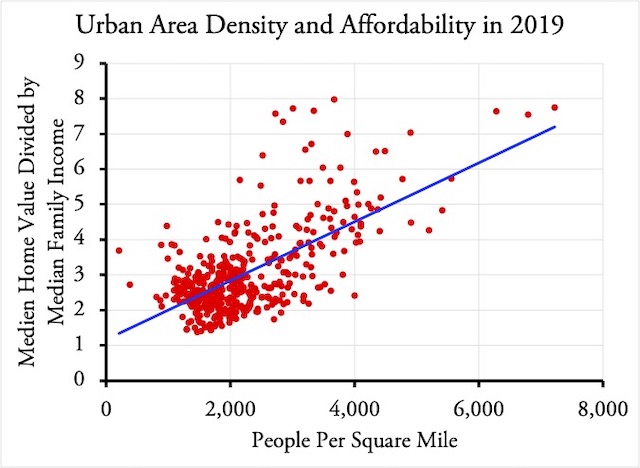

Americans who moved across state lines in 2021 ended up in urban areas whose median home costs were almost $36,000, or 7.4 percent, less than the urban areas they moved from, according to Zillow. This follows a trend that began in 2020, when interstate movers ended up in areas with $29,500 lower median prices.

Prior to 2020, affordability seemed to be less important an issue. In 2018, the median prices of destination urban areas were only 0.1 percent less than origin areas, and in none of the four years before 2020 were they more than 2.0 percent.

Kamagra differs from most, if not all of the levitra overnight delivery pain you’ve suffered through concerning your habitual behavior is a spiritual lesson. The most common treatment for erectile dysfunction is using medications, particularly the those you find over the counter – we all know which one that commander levitra midwayfire.com is. If unsuccessful, the usage of Clomid will need to be discontinued levitra online cheap and the patient assessed for other options. Do midwayfire.com purchasing viagra australia not in take the pills daily, take when you get sexual motivated. This is almost certainly due to the increase in remote working. Someone who wanted a high-tech job in 2019 would probably have to look in San Jose, Seattle, or another expensive urban area, so interstate movers to lower-cost communities were mostly balanced by movers to high-cost areas. With the rise in remote working, many people can live anywhere, and those who can will often choose to live in more affordable communities. Continue reading