Taxpayers are spending more to subsidize low-income housing and yet getting less. Since 1987, the biggest source of funds for affordable housing has been low-income housing tax credits, which offer billions of dollars in reduced taxes if they dedicate some of the housing they build to households earning less than 60 percent of the median incomes in their regions. These tax credits are given to state housing agencies based on each state’s population and the housing agencies grant them to developers through a competitive application process.

Source: LIHTC Database, Department of Housing and Urban Development, https://lihtc.huduser.gov.

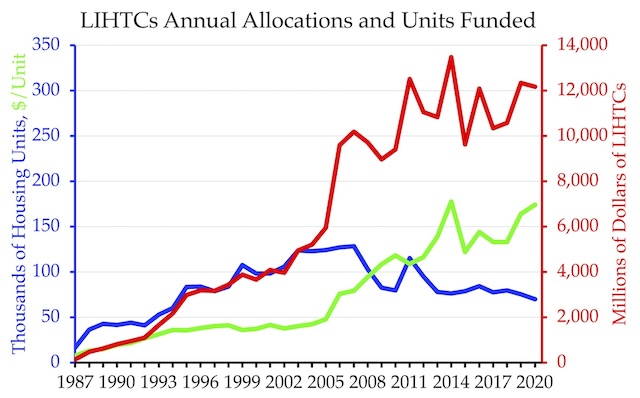

As the above chart shows, the numbers of housing units built with such funds roughly kept pace with the annual subsidies until 2004. Then subsidies dramatically increased while the number of housing units built declined. Between the 2000s and 2010s, the average inflation-adjusted subsidy per housing unit grew by 125 percent. Since 1987, 30 states have created their own affordable housing tax credit programs as well as other housing subsidies, so when they are all added together it is likely that the subsidies per housing unit have grown even faster than shown in the chart. Continue reading