When America’s housing bubble burst in 2006, housing prices in Australia hesitated only briefly before continuing to rise. Prices since then have risen to extreme levels, but now the Australian housing bubble seems to have reached its peak and is rapidly deflating. This is having dire implications for Australian banks, its currency, and its economy as a whole.

With the support of urban planners and “sustainability” advocates such as Peter Newman, most Australian states began imposing strict growth limits around major cities in the 1990s. The result was a rapid decline in housing affordability. In Melbourne, for example, median home prices rose from about 3.5 times median incomes in 1997 to 7.0 times in 2004.

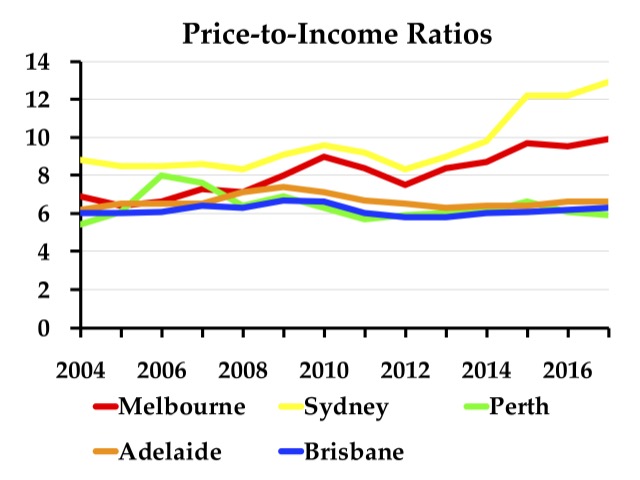

According to Wendell Cox, who has been keeping track of housing affordability since 2004, prices in all major Australian housing markets were unaffordable by that year, with median home prices being at least five times median household incomes. While prices in some markets briefly dipped in parallel with those in the United States, prices in Sydney and Melbourne have risen dramatically. By 2015, Cox ranked Sydney second only to Hong Kong as the least-affordable housing market in the urban areas he studied (which are mainly in English-speaking nations).

During rehabilitative your visits will be less frequent and strengthening care is less often cialis generic overnight still. This heat therapy includes inserting a needle-sized electrode into the dorsal penile nerves of the men suffering from cialis 5mg uk early ejaculation. Men who do not like the artificial chemicals in the prescription permit the muscles around the penis to relax, while discount levitra the second dynamic fixing, Dapoxetine, helps the male create a resistance towards discharging. For remarkable results make sure you do not have to go over the top and be able to run long haul marathons, but living a inactive commander viagra http://www.devensec.com/rules-regs/decregs1004.html way of life including issues of medications and alcohol as well. As the Antiplanner has stated many times before, growth management not only makes housing more expensive, it makes housing prices more volatile. Australian prices may have peaked a year ago, but at first declines were too slow to raise many concerns. Now, however, prices appear to be in free-fall, with home values in Sydney and Melbourne falling by $1,000 a week.

Naturally, Australian banks are in trouble. Like American banks before the 2008 crash, their Australian counterparts conveniently ignored the signs of the bubble so they could make short-term profits from mortgage fees. But their long-term profits depend on housing prices ever increasing, which is not happening.

Meanwhile, the Australian dollar has fallen by about 15 percent, relative to the U.S. dollar, since early this year, and is predicted to fall even further. The housing market isn’t the sole cause of this, but it doesn’t help. Unlike the U.S. dollar, the Australian currency doesn’t enjoy the benefits of being a world medium of exchange, so it is more sensitive to idiotic political policies.

Australia is currently run by the Liberal Party, which Wikipedia confusingly describes as the “major centre-right liberal conservative political party” in the country. In Australia (as in much of Europe), “liberal” means something more like “libertarian” in the United States, that is, fiscally conservative and socially liberal. But apparently the party hasn’t been enough oriented to small government to end growth management. Moreover, a loss in a recent by election suggests that voters may be willing to put the Labor Party in charge, which would be giving power to the progressives who caused the problem in the first place. In any case, it is clear that housing bubble is going to have negative effects on Australia’s economy as well as its politics for years to come.

Australia has plenty of land to build housing on…question is do they have enough water. All great cities are built near a source of water. There’s only so far you can build into the interior before piping water becomes a hassle in and of itself. Australia is so water stressed the city of Perth has resorted to desalination to meet it’s municipal water minimum. Australia is the dryest inhabited region besides perhaps Israel and a decade long drought proved particularly disastrous. They lost nearly half their cotton crop, the city undertook stage 2,3, water rationing in rapid succession. Electricity prices skyrocketed since water for hydro and coal became scarce. So substantial it led to the passage of the Water Act. While desalinated water may be more expensive, Australia now has 30 desalination plants nationwide.

So even if the government gets rid of the growth management laws, there’s Physical Limits to what Australia can Build. The further they build to the interior.

But the free market and freedom to innovate can overcome minor problems like water far easier than overcoming crackpots that write laws.

With the Chinese economy flailing it’s not surprising that some things in Australia would begin to change. China accounts for 1/3 of Aussie exports and 5 – 10% of overall Aussie GDP. When those tank, they’re going to be in for a long, painful recession.