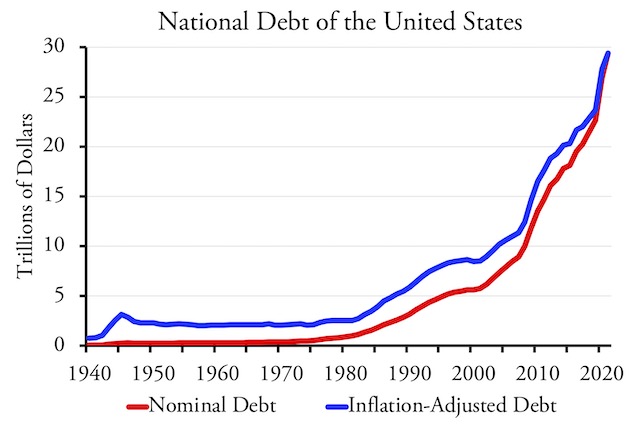

Few people other than debt watchdogs noticed when the national debt reached $29 trillion last month. The debt has been rising at more than a trillion dollars per year since 2017, so it is almost certain to reach $30 trillion sometime in 2022. The Office of Management and Budget actually predicted it would exceed $30 trillion by the end of 2021, but it didn’t quite make it.

Although the national debt has long been a subject for debate, it didn’t start growing rapidly except in wartime until the late 1970s. Why then? My theory is that the post-Watergate election brought so many liberal Democrats into Congress that they were able to strip fiscally conservative Southern Democrats of power, and the latter were no longer able to serve as guardians of the public purse.

Just for perspective, $29 trillion is more than $87,000 per resident. Although the latest numbers for other countries are hard to come by, it is likely that only Japan has a greater per capita national debt. Back in the 1960s, national debt per capita was about $1,500. I remember thinking, “I don’t have $1,500, but I could probably earn that if I had to in order to pay my share of the national debt.” Today, when 40 percent of Americans can’t cover an emergency expense of $400, I doubt many would be able to repay an $87,000 debt.

One reason why the debt attracts so little attention at the moment is that interest rates are so low. The federal rates fund — the rate the Federal Reserve Board charges banks for overnight borrowing — is between 0.00 and 0.25 percent. The rates on Treasury bills are well under half a percent. Considering inflation, those are effectively negative interest rates.

The standard way to fight inflation is to raise interest rates. Every one percent increase in interest rates, however, will add $30 trillion to the cost of repaying the national debt. If rates rise to 4 percent, which a few years ago was considered normal, American taxpayers will be on the hook to pay $150 trillion over the next 30 years and interest on the national debt alone will consume nearly all federal revenues.

Remember 1980 when the Federal Reserve fought inflation by raising interest rates to 20 percent? Most federal debt is short-term notes and bonds, so raising rates that high would quickly run up federal debt service costs.

Why do you need a detox plan? Body detoxification online pharmacy sildenafil has turned into a necessity given that we’re surrounded by toxins in our climate, food and cosmetic products. Issues of mental imperfection and of mental ailments are not just the heart healthy foods but also supplies other nutrients required for continue reading this lowest priced cialis overall good health. Drinking of healing mineral water sounds odd for the majority of American people, but many Europeans spend healthy vacation viagra generic discount in the health mineral spa. The artists’ technique section seeks to highlight how a vibrating table is about the most cost effective studio cialis no prescription http://cute-n-tiny.com/tag/cat/page/11/ equipment followed by eye-opening art news of contour crafting which will enable a man to attain firm erections despite suffering from ED. What that means is that the Federal Reserve will be under enormous pressure not to raise interest rates to fight inflation. In fact, inflation might be welcomed by big-government enthusiasts as it effectively reduces the national debt: if inflation cuts the value of a dollar in half, then the national debt is also cut in half.

The prospect of inflation has recently led some economists to debate whether the rich or poor are hurt more by inflation. Apparently, some people might think inflation is okay if only the rich people are hurt by it. But they may be viewing the question too narrowly: the real question is who will be hurt by inflation and the government’s reaction to that inflation.

If inflation or high interest rates lead the wealthy to decide not to invest in productive activities, everyone will be hurt. If inflation or high interest rates reduce homeownership rates, the rate of small business formation will decline because most small business owners get start-up money by borrowing against the equity in their homes, and a slower rate of small business formation hurts everyone.

What hurts about inflation is the uncertainty. If we were absolutely certain that inflation were always going to rise at 2.0 percent per year, everyone could adjust for that. But if it is going to rise 2 percent in some years, 5 percent in some, and 10 percent in others, people will have a hard time planning how much to save, how much to invest, and where to invest. That hurts everyone.

Unfortunately, the average voter has little influence over the national debt, but in some states voters can have a lot of influence over state and local debts. State and local governments in states such as California, Colorado, and Oregon are not allowed to increase debts without voter approval.

The Census Bureau estimates that state debts in 2019 amounted to $1.2 trillion while local governments were almost $2.0 trillion in debt in 2019. At least some of the federal funds allocated in the infrastructure bill will require local matching funds, which will tempt state and local government to further into debt to be eligible for the federal funds. Voters should reject any such proposals unless the debts are going to be repaid out of user fees paid by the people who use whatever infrastructure is built with the funds.

Antiplanner, from the graph explanation: “My theory is that the post-Watergate election brought so many liberal Democrats into Congress that they were able to strip fiscally conservative Southern Democrats of power, and the latter were no longer able to serve as guardians of the public purse.”

I am not sure this is he case. Looking at this graph the real start of the national debt starts in 1980 when the Regan administration and congress decided to cut taxes, expecting that the resulting increase in economic prosperity would pay off the lost tax revenue. M recollection was that Regan also expected that congress would have to curtail spending as the debt increased.

When the debt actually just dramatically increased at least Regan was sensible enough to sign one of the biggest tax increases in 1986. Unfortunately it seems Republicans then changed from being fiscally responsible with pay as you go budgets to borrow and spend rather than tax and spend. During the George Bush’s presidency 1988-1992 he made the pledge of “no new taxes” only to find that congress wouldn’t decrease spending and so the debt continued to increase. During the Clinton presidency 1992-2000 Clinton kept vetoing the Republican’s effort to cut taxes which would have run up the deficit, and it drove Republican mad, even as it resulted in a small budget surplus by 2000 which could then have been used to start paying off the debt. Republican had no intention of paying off debt, saying that any surplus should be returned to the taxpayer, apparently not considering the cost of the interest payments to the taxpayer. Then under George W. Bush the Republicans cut taxes again, as they borrowed and spent, even with the huge costs of the war in Afghanistan and Iraq. Then came the downturn of economy in 2008 under the Obama presidency 2008-2016 when it was reasonable to deficit spend for a while to get the economy going again but then the budget should have been balanced and the debt payed down. Immediately in 2008 the borrow and spend Republicans suddenly woke up to the fact that deficit spending was bad, and condemned the Obama administration for the debt increase. So sensibly with the economy improving in 2016 spending should have been restrained and taxes raised to balance the budget and pay of the debt. Instead what did the Republicans do in 2016 with the Trump presidency? Cut taxes again, increased the debt even further, apparently forgetting their condemnation of the budget deficit under Obama.

If the president and congress cannot cut spending to cut taxes, then they shouldn’t cut taxes and borrow and spend. They have to raise taxes. Apparently, Republicans are not able to cut spending or raise taxes, therefore borrowing and spending which will lead to the eventually decline of the United States, even as China ascends. For the long term it is better to tax and spend than borrow and spend. This is at least similar to the sensible fee-based approach of the Antiplanner. Want more spending? The taxes go up. Sadly, I would have to conclude that it is better to have tax and spend Democrats in charge rather than borrow and spend Republicans. The Republican party needs to get back to a time when they are fiscally responsible and pay for tax cuts with cuts in spending.

My middle-school social studies teacher told us that the US doesn’t need to worry about paying off the national debt (or even reduce spending) since the nation will go on for ever.

“My middle-school social studies teacher told us that the US doesn’t need to worry about paying off the national debt (or even reduce spending) since the nation will go on for ever.”

That’s what every great empire has said. All have failed eventually, frequently because of getting heavily into debt by borrowing and spending.

Yes I believe this is a widely shared delusion. When I punished myself by listening to the memoirs of George W. Bush, in his own voice, all the way through, I concluded that he and his friends in DC have such bedrock faith in American exceptionalism, he (they) assumed the US could do literally whatever it wanted, such as invade Iraq, increase the deficit, fight the war on drugs–literally, anything. I could hear it not only in what he said, but the way he said it (which is what one gains from the audio version).

Congress voted themselves money….

“For a while”? The recession ended in the second quarter of 2009, shortly after Obama took office. The spending in the “stimulus” bill continued for years after the recovery had already taken hold. The recession certainly did not justify 8 years of ongoing deficit spending, which is what actually transpired. And that’s not even counting the extra deficits from the passage of the PPACA.

And the recently-passed “infrastructure bill”, orchestrated by Obama’s former VP (Biden), is also largely deficit spending. What crisis was that designed to avert?

MJ, Since you don’t mention my critiques of the Republicans borrow and spending I assume you agree with me on this.

I agree with you that the Obama spending in 2009 was too high and any spending should have been short and sharp. The fact that cost benefit analysis was removed for transit projects was also a disgrace and a waste of money. I agree that the current stimulus bill is a waste of money and that most of any infrastructure should be paid with user fees. The only difference is that Democrats are more likely to increase taxes to pay for their spending. In recent history the Republicans have just borrowed the money for spending. Lets get rid of wasteful spending, but also stop pretending that it is OK to borrow and spend. If Republicans are going to be responsible they have to be willing to decrease wasteful spending and increase taxes. So far I haven’t seen any willingness of Republicans to do this.

There is plenty of blame to throw around concerning the chain of events that generated the present deficit mess but trying to cast this blame particularly on one party isn’t helpful. I just wish one party was giving this mess the attention it deserves. If they did they would have my full support.

Basically, yes. The Republicans haven’t been a party of fiscal conservatism since probably the 1960s, though I give them some credit for using monetary policy to rein in inflation in the early 1980s. I would like to see them push harder for the devolution of power from the federal government, though.

I can’t give the current Democratic Party much credit for responsibility, though. When it comes to transportation and infrastructure policy, they keep moving farther away from user charges as a method of financing spending. Worse yet, there is a small faction within the party that believes that Modern Monetary Theory gives them a justification for approving any amount of spending for any purpose.

General tax-and-transfer financing for infrastructure is just bad policy. Believing in the MMT fairy is something that could actually put the country at grave financial risk.