While no Americans are happy about the “special military operation” in Ukraine, transit agencies and advocates are positively giddy about the effect of that operation on gas prices. Despite all their bombast about light rail, bus-rapid transit, and other expensive programs, they know that, historically, the only thing that really boosts transit ridership is rising fuel prices.

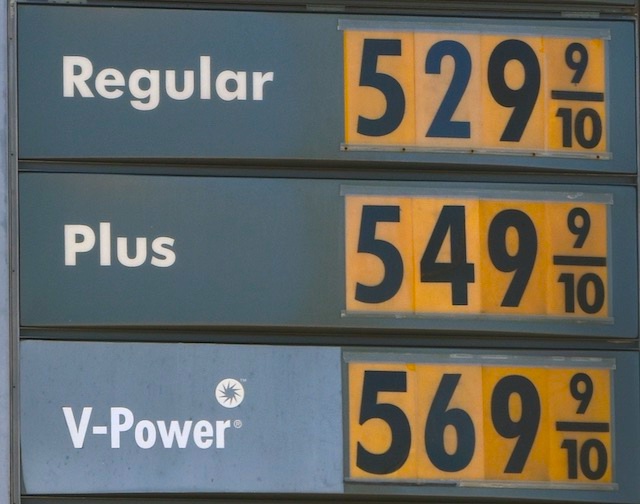

How high will prices go — and more important, how long will they remain high? Photo by Chris Yarzab.

The problem with that is that the forces against transit are much stronger than they were before the pandemic, when more than 7 million people a day marched to jobs in big city downtowns. That was transit’s target market, and now it has all but evaporated.

First, downtown businesses are closing or moving to other parts of the cities, chased away not just by the pandemic but by rising downtown crime. Second, many people who do return to downtown jobs are working there only three days a week and working from home the other two days — and not just high-tech workers. Third, people who work at home part time will need larger homes and, since they will commute fewer times a week, can move further away from their workplaces, putting them out of range of transit systems. Finally, people remain uneasy about jamming themselves into crowded containers, both because of infectious diseases and because of crime.

The bottom line is that downtowns will probably only host about half as many workers on any given day as before the pandemic, and many of them won’t be living in places where they have access to transit. Combine this with the effects of reduced congestion and transit loses any advantages it once had for most downtown workers. For people who don’t work downtown, transit remains as unattractive as ever.

On the other hand, the benefits to transit of higher gasoline prices are pretty small. While reports of $7 a gallon gasoline are scary, the reality is that — as of this writing — the nationwide average for regular gasoline hasn’t topped $4.35. Adjusted for inflation, that’s less than the price of gasoline in 2012, when prices briefly hit $3.90 a gallon or $4.82 in today’s dollars. Between 1999 and 2011, inflation-adjusted gas prices grew by 170 percent, yet transit ridership rose by only 12 percent. Such a small increase isn’t enough to offset more than a small portion of the declines caused by the other factors listed above.

Transportation modeler Charles Komonoff observes that a 50 percent rise in fuel prices leads to a short-term drop in driving of just 4 percent. Most of that doesn’t translate to increased transit ridership; instead, it is accounted for by people taking fewer trips or driving the more fuel-efficient vehicles in their family fleets. The long-run effects are a little greater, but the biggest effect is that people save energy by buying more fuel-efficient cars. That doesn’t translate to more transit ridership either.

Before the current rise in fuel prices, I predicted that transit would never recover more than 75 percent of its pre-pandemic ridership, and I suspect that was generous. Fuel prices are high only because of geopolitical events, not due to actual shortages of fuel. That means prices won’t remain high forever. Meanwhile, tt will take many months or even years for transit to even reach that 75 percent, and by that time fuel prices may come back down. While high gas prices may help transit agencies a little, I doubt that it will be enough to nudge ridership above that 75 percent.

“people remain uneasy about jamming themselves into crowded containers, both because of infectious diseases and because of crime”

But jamming themselves into containers that fly is just as predisposed to infectious diseases and “Crime” like being taken by box cutter wielding assailants and slammed into buildings.

With gasoline/diesel prices as it is, are gap solutions really all that promising…stunned people wont surrrender their convenience in trying times or evaluate what we spend on. American’s spend 50 billion dollars on Pet food, Pets are a luxury. U.S. households spent over $14 billion on soda. 20 billion on sweetened snack baked goods.

As long-time Antiplanner readers know, I call this the MCU school of transportation planning because it is based on a fantasy world, not on the real world where most people drive because it is faster, safer, and more convenient than riding a bicycle or odd exotic vehicle.

If you want something you cant afford, you save up or change jobs or sacrifice luxuries to accommodate the expenditure to obtain. If that’s not applicable, you accept substitutes. The persistent belief gas will stay cheap,is “Wishful thinking” and it heralds what US foreign policy turned into in order to keep gasoline and oil cheap… A minor military conflict between Russia/Ukraine, was sufficient to throw global petroleum availability into destabilization. What do you think will happen in a real war.

Outside western world, micromobility is ubiquitous… Most of the planet doesn’t own cars. Scooters, mopeds and three wheeled vehicles dominate many Asian cities and nations, because Cars are simply too costly and fuel imports would be highly expensive.

Taiwan Electric scooter manufacturer Gogoro is famous, unlike scooter ev users who charge which takes time. They swap batteries, which takes mere seconds.

https://i0.wp.com/electrek.co/wp-content/uploads/sites/3/2021/05/gogoro-network-header.jpg?w=2500&quality=82&strip=all&ssl=1

There are now as many Gogoro stations as gas stations in Taiwan.

I said it before…. ” Every 5-10 years SUV’s and Big trucks go through a cycle from Selling like hot cake sales to dinosaurs no one wants in their drive way. When gas is cheap SUV’s crank out faster than newspapers. When gas goes up a mere few cents, you find For Sale signs on every SUV on the side of the road. When SUV sales plummet, small car sales rise…and the foreign automakers are really good at making small cars that are not only fuel efficient and relatively inexpensive….but excellent build quality and aesthetically stylish.” This is the next cycle.

in fairness, it’s insufficient blame Ukraine conflict.

18 month adjusted price index of gasoline, between the timeframe of Biden elected and Ukraine war beginning…

Gas went from 2.09 a gallon in US, to 3.45 a gallon.

apparently, conservatives were right; senile old career politicians with no history of personal success make shitty presidents…

https://pbs.twimg.com/media/FN3sP40VcAMHMpX?format=jpg&name=large

“senile old career politicians with no history of personal success make shitty presidents…”

YES, but we must never forget that he is merely a puppet of the progressives, global warming, greenie idiots. Unfortunately that describes most DemocRats.

Building cars that get 100 mpg or equivalent is physically doable. Question is are they safe to use on US highways or relegated to local roads and slow moving streets and city traffic.

https://images.hgmsites.net/lrg/edison2-very-light-car-progressive-automotive-x-prize-winner_100321772_l.jpg

https://www.popsci.com/uploads/2019/03/18/F5KAO6MTJ7SWUFADYAA4G4EMGQ.jpg?auto=webp

”

Fuel prices are high only because of geopolitical events, not due to actual shortages of fuel.

” -anti-planner

The geopolitics is the fuel shortage. There’s nothing temporary about what’s going on. As some would say it’s the new norm. But really, it’s the old norm.

Bretton-Woods free global trade era was a blip.

Keep in mind that a lot of Russia’ oil production is in their far north. Wells that are shut down too long can require a lot of work to get them back online, often times nearly as much as a new well including drilling a new well because of the frozen soil, etc. If it goes off line – and current thoughts is that around 3 mbd is about to – that production may not come back for 10 or 30 years.

“The geopolitics is the fuel shortage. There’s nothing temporary about what’s going on.”

YES THERE IS! Our current shortage is a direct rssult of Putin Puppet as president that told the world that the USA will quit procuring oil. Only an ignorant fool (ie:DemocRat) thinks that had no effect on oil prices rising.

Keep in mind sanctions can impact production in that they just won’t be able to get the parts they need. This problem has plagued Russian domestic airliner production for jets like MC21. There are just components that they can’t make & aren’t being sold. ANd this was under _previous_ sanctions. Only can imagine what will happen if these new sanctions stuck around for long.

The antiplanner wrote, “On the other hand, the benefits to transit of higher gasoline prices are pretty small.”

And the gasoline cost to EVs is $zero. Cost of electricity is in the three to four cents per mile range. Advantage: Car.

Just wait til midterms……

To be fair, Taiwan is intersected with the Tropic of Cancer. Taipei is about the same latitude of Havana. I had to commute for a few weeks in Taipei, by car, and the traffic was sometimes terrible. A two-wheeled conveyance would have been advantageous but of course the weather for scooters is advantageous too.