A new report on housing decries the fact that many unaffordable housing markets have gotten even less affordable in the last few years. The report’s solution is in the name of the organization that published it: Up for Growth, as in “grow up, not out.”

Click image to download a 24.0-MB PDF of this report.

Click image to download a 24.0-MB PDF of this report.

The reports calls for cities to identify what neighborhoods to build in, “the appropriate increase in density for each location,” and the “optimal housing mix,” in other words, the mix of single-family vs. multifamily housing, for each neighborhood. Where people actually want to live and whether they prefer to live in single- or multifamily housing are not to be considered.

Ironically, the report specifically decries the high housing prices in places like San Francisco and Seattle. Yet these cities have arguably followed the up-not-out process for several decades. The density of these two urban areas have both significantly increased since 1970. The San Francisco-Oakland urban area had less than 4,400 people per square mile in 1970; as of 2020 it was more than 6,800 people per square mile.

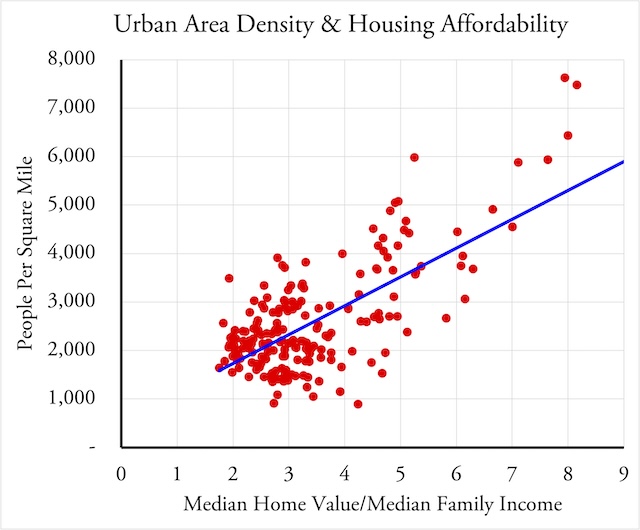

Based on median home prices, family incomes, and population densities for the nation’s 200 largest urban areas in 2021. Correlation = 0.7.

That increase in density was not accompanied by an increase in housing affordability. In 1970, median home prices in the Bay Area were 2.3 times median family incomes. As of 2022, prices were 7.7 times incomes. As shown in the above chart, there is a strong negative correlation between population density and housing affordability.

In short, the up-not-out principle is bankrupt. Though the report gives lip service to racial equity, it places a premium on “Consuming less land relative to each new unit of housing built.” In other words, stick the blacks, Latinos, and other low-income minorities in stack-and-pack apartments while the elites get to live in single-family homes.

More generally, we know that top-down planning doesn’t work, especially not for housing. The most recent example is from my home state of Oregon. The first thing the current governor did when she took office last January was to pledge to build 36,000 new homes–mainly apartments–per year. Now, ten months later, comes the news that apartment construction is down. Maybe she should have pledged to reduce construction.

https://finance.yahoo.com/news/over-5-million-semi-vacant-185618591.html

A recent study by Lending Tree found that America’s largest metropolitan areas have a combined 5.5 million vacant houses. We don’t have a housing shortage….. I don’t have a problem with people owning 2 or 3 homes and renting them out. I have a problem with corporations and short-term rentals.

Isle of Palms in SC was changing laws because people were selling houses to investors or turning their own houses into beach front short-term rentals. There are alot of short-term rentals in neighborhoods that people use for party houses.

As far as corporations, I have problems with them because no matter how much a person bids on a house, corporations can outbid and pay in cash so normal people don’t have a chance. Housing shortage is artificial…..

1) Lack of supply (especially in areas of rising demand) due to artificially induced real estate markets

2) Inflation of material, land and maintenance costs

3) Home ownership is out of reach (raising the demand for rental properties)

4) Parking minimums

5) Outdated zoning limitations

6) NIMBYism

Pricing isn’t getting better until they end the Fed.

They’re never be able to build houses faster than the Fed prints money.