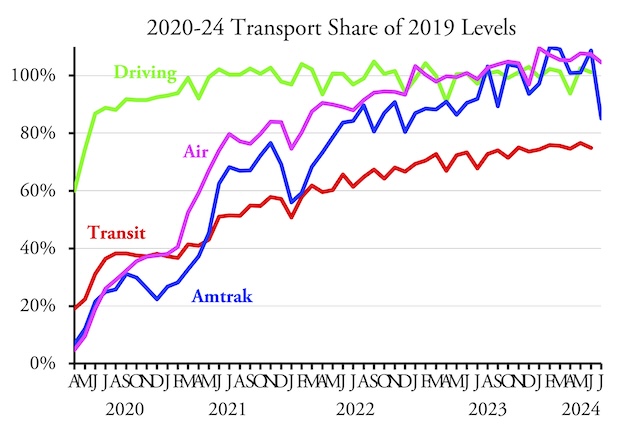

Airlines carried 4.5 percent more passengers in July 2024 than the same month in 2019, according to TSA passenger counts. But Amtrak numbers dramatically dropped, carrying nearly 15 percent fewer passenger-miles than July of 2019, according to the state-owned company’s monthly performance report.

July transit and highway data are not yet available.

The report shows that Amtrak’s Northeast Corridor carried 11 percent more riders in July than in 2019, but state-subsidized trains carried 8 percent fewer riders and long-distance trains carried 15 percent fewer. State-subsidized train ridership fell despite the fact that Amtrak added two new routes and extended a third one.

The state-subsidized route that did the worst was the Adirondack, which carried fewer than 25 percent as many passengers in July 2024 as 2019. Others that did poorly include the California Capitols (55%), Hiawathas (71%), Pacific Surfliner (71%), Vermonter (78%), Wolverines (78%), Keystone (81%), and San Joaquins (82%).

Only three long-distance trains carried more riders in July 2024 than 2019: the City of New Orleans, Lake Shore Limited, and Auto Train, though the Silver Star came close at 99 percent. All other long-distance trains did poorly, but particularly bad were the Southwest Chief (62%), Capitol Limited (70%), Sunset Limited (71%), California Zephyr (73%), and Coast Starlight (75%).

Meanwhile, Amtrak’s Acela carried 56 percent more riders in July 2024 than 2019. Other Northeast Corridor trains (which Amtrak calls “regionals”) gained 16 percent. Other than the Auto Train, these are the only trains in the Amtrak system that make money according to Amtrak accounting. That accounting ignores depreciation, which is why the Northeast Corridor is requiring tens of billions of dollars in subsidized restoration work.

It appears that a large share of those subsidies are going to elite riders who can afford the Acela‘s high fares, which are typically three to four times the lowest regional fares. Most of these riders are lobbyists, government officials, and others whose fares are paid by their employers. Would they still ride Amtrak if they also had to cover the costs of restoring and maintaining infrastructure? Should taxpayers have to pay to support these riders?

The above data use passenger-miles for Amtrak totals but riders for individual trains. I prefer passenger-miles over ridership as a more honest indicator of transportation value. Amtrak’s 2024 reports break down passenger-miles by individual routes, but reports from 2019 did not so it isn’t possible to compare passenger-miles from the two years for specific trains.

However, the fact that long-distance riders travel a disproportionate share of passenger-miles explains why July passenger-miles declined so much since 2019. In 2024 to date, the average long-distance trip was more than 500 miles, while Northeast Corridor trips were under 200 miles and state-subsidized train trips averaged about 125 miles.

“Airlines carried 4.5 percent more passengers in July 2024 than the same month in 2019 … ”

And July wasn’t a particularly good month for US airlines …

“In the five days following the outage, (Delta) canceled 7,000 flights, a sharply higher total than its peers.”

https://www.wsj.com/business/airlines/the-day-deltas-on-time-machine-broke-and-the-blame-game-it-sparked.

Meanwhile in China:

https://twitter.com/RnaudBertrand/status/1830971434270900660

“I still remember the “China watchers” who used to predict that China’s high-speed rail network could never be a profitable operation, it was “way too ambitious and costly”.

https://scmp.com/economy/china-economy/article/3276871/chinas-railway-operator-brings-gravy-train-posting-profits-and-lowering-debt-ratios

Yet here we are: it generated a net profit of 1.7 billion yuan in the first half of the year, with 2.1 billion passenger trips on its 45,000km (27,962 miles) network, by far the largest in the world. And its debt ratio got down to 64.6%, a 10-year low.

I have to say, this is a very significant achievement by China because the doubters had a point: it could very well have proven to be an immensely costly financial disaster. All the more impressive when you think it’s a relatively new investment: China only opened its first high speed rail line in 2008. They built it all up – the entire 45,000km of it – and turned it profitable in just 16 years ?

It’s also a great proof of concept for many countries that don’t have such infrastructure (looking at you America ?): very large domestic high-speed train networks can be made to work. Which is good news because of course traveling by train is infinitely better for the environment than virtually all other long-distance transportation methods.”

After 16 years and losing $900 billion, China claims a $270 million profit in one quarter and car hating foamers claim victory over the “China watchers” and do the I-told-you-so dance.

https://www.google.com/search?q=how+much+of+chinas+debt+is+from+high+speed+rail&ie=UTF-8&oe=UTF-8&hl=en-us&client=safari

“Americans love big cars, but new analysis suggests that

the heaviest vehicles kill more people than they save”

https://archive.ph/M1cBE

China HSR generated a net profit in operations.

Not infrastructure payoff.

Has had numerous accidents

It’s tofu dreg construction of sub quality materials

And 240 million people in China are barred from travel thanks social crediting systems…

But other than that it’s very successful

LazyReader, from what I understand, the Chinese are begging the AP for help since he knows so much about trains. Might be a chance to finally get a job after getting fired from Cato

July is peak travel season. What’s going wrong at Amtrak?