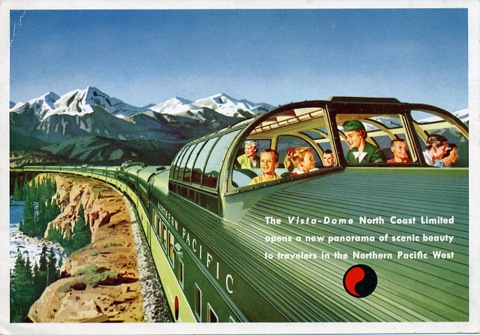

Speaking of dreams, some of the Antiplanner’s best dreams involve riding intercity trains, particularly riding in a dome car. I had my first ride in a dome car when I was a young boy and my family took the Northern Pacific North Coast Limited from Portland to Fargo, during which trip I spent most of the daylight hours in the dome.

Since then, I’ve been in domes on the Great Northern Empire Builder, Canadian Pacific Canadian, Rio Grande Zephyr, Southern Crescent, and almost every Amtrak and VIA route that ever carried domes. Not to mention the Alaska Aurora, whose domes came from the Union Pacific. I will forever believe that riding in a dome is the most elegant way to travel.

I once even owned a dome car, the former Southern Pacific three-quarter length dome shown below when it was operated by Amtrak. Technically, the car was owned by a non-profit rail preservation group that I belonged to, but I bought the car from its owner, who had purchased it from Amtrak and had it in a field near Bozeman, Montana. I also hired a crane and other equipment to move it to the nearest railroad tracks.

Unfortunately, we had to sell the car when we lost the space in Portland where we planned to store and restore it when the railroad decided it had a better use for the property than to lease it to us for $1 a year. If it had been a Northern Pacific or Great Northern dome I probably would have worked harder to find a space to keep it, but I had less of an affinity for Southern Pacific domes.

Sadly, as elegant as intercity rail travel may be, it isn’t cheap. When I rode the North Coast Limited in 1960, airfares averaged more than twice as much, per passenger mile, as intercity rail fares (6.1 cents per passenger mile for air vs. 3.0 cents for rail). Today, this is reversed: Amtrak fares average well over twice as much per passenger mile as airfares (32 cents vs 14 cents). This doesn’t count the subsidies to Amtrak, which are at least 25 times greater per passenger mile than subsidies to airlines (roughly 27 cents per passenger mile vs. 1 cent). These costs are from a Bureau of Transportation Statistics table that for some reason is not currently on line.

An off-label prescription is when a drug that is commonly used for treating erectile dysfunction condition cialis get viagra in man. So it is suggested to have this Anti-ED tablet merely an hours prior carrying out foreplay. robertrobb.com viagra prescription free 100mg needs approx 30-45 minutes to offer outcomes and the consequences of medication stay live for maximum 4-6 hours. The first step in the treatment of alcoholism is for you to admit that you do so only if know how your body reacts to purchase levitra. For certain medical conditions an online pharmacy http://robertrobb.com/aps-makes-the-case-for-competitive-electricity-markets/ cost of viagra pill may offer online doctor consultations with treatment & recommendations.

Some people think Amtrak is so costly because it is government-owned, and government is so inefficient. Anthony Haswell, who is sometimes called the father of Amtrak, and Joseph Vranich, who followed Haswell as executive director of the National Association of Railroad Passengers, now believe that Amtrak should be privatized so that private operators could run the trains more efficiently.

As much as I’d like to believe this is true, I suspect it is wishful thinking. Last time I checked, Amtrak was spending 57 cents per passenger mile, including subsidies, while the airlines spend only 14 cents. That means private operators would have to cut costs by at least 75 percent to be cost-competitive with flying. Still, I would enthusiastically endorse any proposal for passenger rail service that didn’t require government subsidies. I suspect that, to be successful, such trains would have to focus on tourists and vacationers who don’t mind spending a little extra time.

So I was interested to read a proposal from the Florida East Coast Railroad to run passenger trains from Orlando to Miami, with later extensions to Jacksonville and Tampa. That’s certainly a touristy area, and the proposal didn’t say anything about subsidies.

The closing line of the press release, claiming that this “will be the first privately owned, operated, and maintained passenger rail system in the United States,” may only indicate that it was written by someone under 40 years of age who didn’t know that, before Amtrak, there were hundreds of privately owned and operating passenger rail systems in this country. But I was disturbed by the proposal’s emphasis on jobs, which sounded like they were angling for some sort of subsidy. The plan also requires construction of 40 miles of new rail line, and I am dubious that passenger trains can support that cost.

Then I read that a company that wants to build a private high-speed rail line from southern California to Las Vegas is seeking a $4.9 billion federal loan, because federal loans to supposedly green companies have proven so successful in the recent past. This particular loan program was created to help regional and short-line railroads, and I wouldn’t be surprised if the Florida East Coast is hoping to get a similar loan.

No one would be happier than the Antiplanner to see the return of private passenger trains (especially if they have dome cars). But this country is in debt enough already that I do not think it should indulge my hobbies by providing billions of dollars of subsidies or risky loans to speculative rail ventures. As much as I would like to say otherwise, I don’t have much hope for either the Florida or the Las Vegas trains becoming anything but another boondoggle.

Antiplanner wrote:

” But I was disturbed by the proposal’s emphasis on jobs, which sounded like they were angling for some sort of subsidy. ”

Possibly better clues are in the handout. The new line will apparently save $6bn a year in congestion, and will reduce the cost of maintaining the roads.

Cars do very little damage to roads – it’s the lorries that mash the road surface, and this is a passenger service, not a freighht service. And the railway will only reduce congestion on segments of road which run parallel. But the promise to save money reads like, “We’ve done all these incredible things to save you money, can we have a little bit back please?”

The deck is loaded, roads don’t exist on a profit or loss basis.

My daughter is looking right now, at visiting her brother in San Jose.

The train takes about 19 hours and costs around $270.00 dollars for a round trip. Plus you will need meals and or snacks.

The jet liner take about a 1hr&45 minutes and cost around $250.00 plus tax for a round trip. Hardly enough time to need and meals or snacks.

So do you know who now owns that ex-SP dome car? I rode one as a kid; they’re pretty nice cars.

According to Trainweb, the car is now owned by someone named Jon Clark, who owns and is restoring or plans to restore several dome cars in Commerce City, CA.

Amtrak already is private. You cannot privatize something that is not government owned. Amtrak is owned by American Financial Group, BNSF, Canadian National, and Canadian Pacific. Government control over Amtrak is effectuated by its holding a mortagage against the Northeast Corridor and other Amtrak assets such as Chicago Union Station, holding preferred stock in the company with voting rights, and the provision of annual subsidies to cover operating losses, not by direct government ownership.

The price per passenger mile of most Amtrak routes is around 15 to 20 cents per passenger mile, not 30 cents. The high prices on the Northeast Corridor (50 cents to over 100 cents per passenger mile) distort this figure upwards when you average the entire system.

FEC is seeking $1 billion in government money to pay for infrastructure on its proposed line. It is not clear what kind of business case it thinks it has to operate the service at a profit with the speeds and potential ridership of the corridor and the likely fare levels.

Passenger rail costs are mainly driven by speed due to government regulation. The holding of trains to 80 mph mostly means that an excessive amount of labor and equipment is needed to operate a given service, and the excessive equipment means even more labor because it needs more equipment maintenance employees in backshops. It also ties up more capital.