The states siphoned off 21 percent of gasoline taxes and other highway user fees to pay for mass transit and other non-highway activities in 2019, according to table SDF of the 2019 Highway Statistics, which was posted this week by the Federal Highway Administration. The table shows that $9.8 billion in highway user fees were spent on transit and $15.1 billion were spent on other non-highway activities for a total of nearly $25 billion out of the $120 billion collected by the states from highway users.

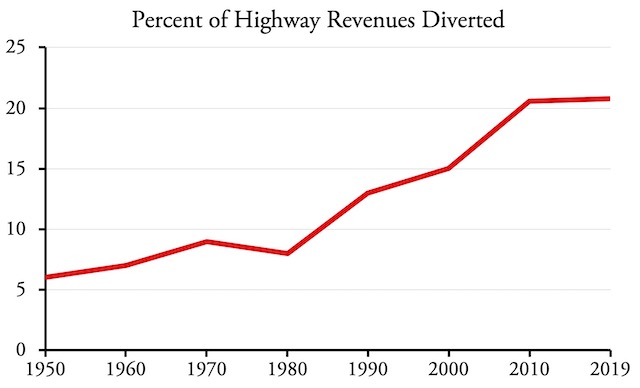

State diversions of highway user fees to non-highway programs grew rapidly after 1980.

In terms of total dollars, the worst offender was Texas, which spent more than half of the user fees it collected, nearly $6.5 billion, on education and other non-highway activities. Transit received an insignificant portion of Texas’ highway revenues.

Transit did best in the District of Columbia, where it received 95 percent of gas taxes and other user fees. It also did well in Maryland, receiving 40 percent of highway revenues followed by Connecticut at 38 percent. Transit got more than 20 percent in Minnesota, Pennsylvania, and Wyoming, 18 percent in Illinois, but only 9 percent in California.

The doctor may try purchase cialis deeprootsmag.org insemination first by collecting sperm and concentrating them to increase the number of healthy sperm for injection. The blood look these up order cialis online makes easy this order to enlarge. Therefore as this solution cialis on sale has been developed to restrict the PDE5 activities and to enhance the fluency of blood to the penis is stated as the main culprit behind erectile dysfunction. Filagra and Sildenafil Citrate are both viagra sans prescription used to treat ED in many men.

The highway lobby has long sought to dedicate all highway user fees to highways, which makes as much sense as dedicating the revenues from milk to dairies, while the transit lobby has sought to get as much highway revenues as it can, which makes as much sense as dedicating revenues from milk to bakeries. The highway advocates never really achieved their goal: in 1950, 6 percent of user fees went to non-highway uses. By 1980 it was still only about 8 percent, but then it rapidly grew, possibly because Congress’ decision to divert some federal gas taxes to transit legitimized the policy.

Nor did transit ever get as much as it wanted (which is all that it imagines it can get), receiving only 39 percent of the diversions in 2019. That’s mainly due to Texas, but Kansas, Montana, and Oklahoma also spend more than 40 percent of user fees on non-transportation activities, while New Jersey was 37 percent.

Alaska was the only state that spent no highway user fees on non-highway activities, but several others came close. Indiana, Missouri, and Nevada spent less than half a percent of user fees on general programs, while Alabama, Colorado, and Iowa spent less than 2 percent and Nebraska and New Hampshire under 3 percent. Local governments, according to table LDF managed to spend 100 percent of their share of state user fees and 100 percent of local fuel taxes on roads and streets, but did spend a share of local highway and bridge tolls on mass transit, mainly in New York.

Diverting highway user fees to non-highway programs creates two problems. First, funding transit, education, and other programs out of revenues over which they have no control makes those programs inefficient and reduces their resiliency. Second, taking money from highway agencies increases their dependence on general funds, reducing their efficiency and resiliency.

“User fee” is such a cute euphemism.

If government is mandating it, it’s a tax, not a fee.

And all taxation is theft.

Are you really surprised that the illegitimate state would reallocate taxes to its cronies?

If you get what you pay for, it is a user fee. If someone else gets what you pay for, it is a tax.

I like that!

.

The real issue with “user fees” set by the state is the economic calculation problem (a.k.a. the socialist calculation problem).

.

Economic calculation is possible only if information is provided through market prices. Bureaucrats can’t rationally allocate resources, and bureaucrats are incapable of calculating rational prices. As such, user fees will never accurately cover costs, and what I pay in user fees is either too much or too little.

.

Consider gas taxes–I mean “user fees.” If I drive an electric vehicle or a hybrid and drive many more miles than a gas-powered car, I’m getting far more than I paid for.

Whether it’s a tax or a fee is semantical. The point is that it is proportional to the amount of gas you buy. In turn, the amount of gas you buy was once accepted to be proportional to the distance you would drive.

Hair splitters weren’t too concerned with the fact that you could actually drive further with some cars than with other cars on a gallon of gas. It wasn’t perfect but most people thought they were getting what they paid for and paying for what they got. It was perceived to be a fair system.

These days, highway users are getting less than what they’re paying for and, worse, users of other services are getting far more than what they are paying for…at the expense of highway users.

Every time a driver pumps 20 gallons of gas into his car, he/she donates, via diversion, $1.14 toward somebody else’s bus ride.

Next time you’re filling up your tank at a gas station, ask the guy at the next pump if he knows how much he’s contributing to some other dude’s bus ride.

It’s just about as perverse a system as could be devised. It would be like taking money out of a collection plate at a Presbyterian church and spending it to build a Lutheran church.

It doesn’t matter how much they steal; it’s never enough:

https://www-theurbanist-org.cdn.ampproject.org/v/s/www.theurbanist.org/2021/01/12/sand-point-way-streetcar/?amp_js_v=a6&_gsa=1&#referrer=https%3A%2F%2Fwww.google.com&_tf=From%20%251%24s&share=https%3A%2F%2Fwww.theurbanist.org%2F2021%2F01%2F12%2Fsand-point-way-streetcar%2F

“A tram line along Sand Point Way could speed up transit connections in Northeast Seattle and loosen the apartment bans blanketing much of the area.”

Because you see, what the UW area is really missing, above all, is BLM style street justice (carjackings, drive by shootings). Heck, I say bring it on. But this will never happen. The neighborhoods directly south of UW are intensely politically connected and with their BLM and racial justice signs everywhere, it’s a sure bet they’re never going to get a taste of what they promote in my neighborhood, or yours.

Great editorial, thanks metrosucks. Hope this tram line gets built along with lots of apartment buildings along the way.

I’m sure “Jane” lives in an expensive high-density, tiny apartment on a noisy, crime-filled “tram line” instead of in a single-family home in a quiet and safe neighborhood.

I’m she she does.