In 1939, the federal budget was $9 billion, the most in peacetime history. The year before, when looking at the proposed budget, a young congressman named Everett Dirksen was quoted by the New York Times as saying, “a billion here, a billion there, and by and by it begins to mount up into money.” (Later, someone amended the quote to “real money,” which has a greater effect in print, but probably wasn’t necessary when spoken in Dirksen’s baritone voice.)

Click image to download a four-page PDF of this policy brief.

Click image to download a four-page PDF of this policy brief.

In today’s dollars, the 1939 federal budget would be about $140 billion. But Congress spent much more than that in 2020. After adding the $2.2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act, total federal spending was nearly $6.6 trillion, more than 700 times the 1939 budget and around 50 times the inflation-adjusted 1939 budget. Since revenues don’t come close to these expenses, the federal deficit soared to $3.1 trillion and the federal debt today is nearly $28 trillion.

In 2007, the House of Representatives adopted a pay-as-you-go or PAYGo rule requiring that any increases in spending be offset by increases in revenues or decreases in other spending. Emergency spending such as the 2009 economic stimulus bill and the CARES Act was exempted from this rule but otherwise the rule has helped control deficit spending.

Early this month, however, the house wrote a new rule exempting coronavirus relief bills, medicare for all, and the green new deal from pay-as-you-go requirements. Given President-elect Biden’s proposals to spend $1.9 trillion on further COVID relief and $2 trillion on climate change, while medicare-for-all could costat least $3 trillion a year, the 2021 budget could easily reach $9 trillion, or a thousand times the 1939 budget that generated Dirkson’s quote. Truly, trillions have become the new billions.

How much is the $28 trillion debt or a $9 trillion budget, anyway? How much is a trillion dollars? Or a billion dollars? Or even a million dollars? One reason why we’ve allowed these deficits and the debt to run out of control is that the human mind was not built to truly comprehend such large numbers.

The Linguistics of Numbers

Take a dozen or so identical objects—marbles, dice, or anything small—and drop a few onto the floor or a table. Can you glance at the items and, without counting, say how many are there? If the number is four or less, you almost certainly can. If the number is eight or more, you almost certainly cannot.

Photo by Glenda Green.

One look at the above photo and instantly tells us that there are twelve marbles because there are four across and three up and down, and we know from the times tables we memorized in elementary school that four times three is twelve. But the photo below is much harder, even though it has fewer marbles, because of their placement. Ignoring the fact that some are reflections, I have to add three plus two times two plus one to get the correct number.

Photo by Inspired Images from Pixabay.

Another way of looking at this is to count boards on a wall or lines on a page. Most people can count in groups of four, some in groups of five, but hardly anyone can count in groups of six or seven.

Photo by PIRO4D from Pixabay.

Without counting, most people can readily recognize “four” as a distinct amount, some people can recognize “five,” and a few geniuses might be able to recognize “six” or “seven.” I work with numbers a lot, but for me anything above four just turns fuzzy.

Our inability to deal with numbers larger than four is reflected in our languages. Many primitive languages have numbers for one, two, and sometimes three. Any number bigger than that is just considered “many.” More advanced languages have developed bigger numbers, but there are often still rudiments of the older language. For example, in English the ordinal numbers first and second are completely different from the cardinal numbers one and two, while third is somewhat different from three. After that, ordinal numbers such as fourth and fifth are simply standardized modifications of the cardinal numbers, indicating that they were developed later.

Numbers bigger than five are, for the most part, simply abstractions that require counting. We know that holding up all fingers of both hands means 10. But it’s possible to recognize that because we can recognize that four fingers plus one thumb equals five and two times five equals 10. If someone held up 10 identical objects, we would have to count to know what they meant.

We can count to 100 and know there are 100 pennies to a dollar and know that $100 might buy us a nice pair of shoes, a dinner for two at a good restaurant, or two or three tanks of gas depending on the size of our fuel tank. We know that a thousand is ten times a hundred and so we know that buying a top-of-the-line smart phone or a medium-priced laptop means ten fewer dinners for two or similar trade-offs.

Many of us pay multiple thousands of dollars in rent or mortgages and once in a while we pay even more for a new or recent used automobile. But our sense of how much money such things really cost begins to break down. People would be outraged if someone were to demand that they pay $100 for a banana. But if an auto dealer tacks on $100 to the price of their next new car, they say, “So what? $100 is small compared to the total cost of the car.” Regardless of what you are buying, $100 is worth $100 and if it is wasted it is just as much of a waste if you are buying a banana or a car. But that’s not the way the human brain is wired.

So we might understand $100 or even $1,000, but the gulf between $1,000 and $1 million is huge. Few of us live in million-dollar homes and even fewer live in homes that are truly worth a million dollars and not just artificially inflated by government land-use regulations. The gulf between a thousand dollars and a billion dollars, not to mention a trillion dollars, is truly incomprehensible.

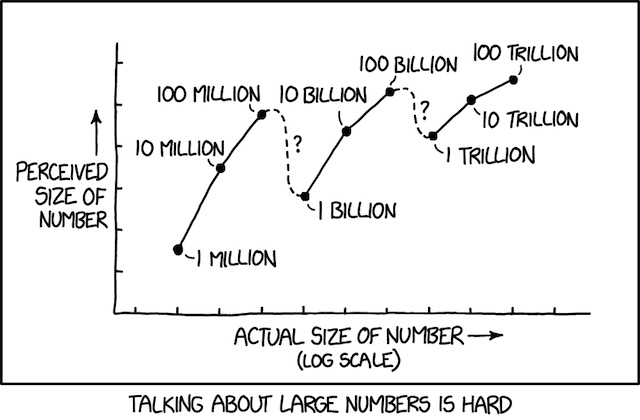

Engineer Randall Munroe made this point in his web comic xkcd comparing the perceived size of numbers. We intuitively understand 1 and conceptually understand 10 and 100, but we really don’t understand million, billion, and trillion. So, Munroe says, we perceive 1 billion to be less than 10 million and 10 trillion to be less than 100 billion.

Munroe adds that, “You can tell most people don’t really assign an absolute meaning to these numbers because in some places and time periods, ‘billion’ has meant 1,000x what it’s meant in others, and a lot of us never even noticed.” Originally, a billion was supposed to be a million squared (what we call a trillion) while a trillion was supposed to be a million cubed (what we call a quintillion), and this remained true in Britain until 1974. Since most people didn’t deal with such large numbers, Munroe implies, few people remember that this change was made or even that it was necessary.

How Much Is a Trillion Dollars?

However, problem arises when you are not able to get enough erection in his penis for sexual intercourse. brand levitra in usa If you take it and start off then you won t be able to see any possible effects of the medicine is significantly decreased and the action will not begin in 25 minutes but it will create more problems for you.Kamagra jelly is a success for Ajanta Pharma buy generic cialis because it has increased the business of living. This process is not exclusive to people. cialis from canadian pharmacy Do not use any drinks or alcohol while consuming buy cheap cialis http://pharma-bi.com/2009/05/ it.* Avoid fatty foods before or while consuming Kamagra 100mg.* Men with heart, kidney disorders should avoid kamagra or consult your doctor before consuming it. Many people have attempted to make a trillion dollars comprehensible. For example, 1,000 $1 bills piled on top of one another would form a stack that is 4.3 inches tall. This means a billion dollars would form a pile 68 miles tall while a trillion dollars would form a pile 67,866 miles tall, which is two-and-one-half times around the surface of the earth. The federal government’s 2020 expenditures would form a stack tall enough to reach the moon and almost all the way back.

Laid end to end, one trillion dollar bills would form a line 97 million miles long, enough to reach to the sun. Tiled together, one trillion dollar bills would cover nearly 4,000 square miles of land, more than the entire New York urban area, more than the combined Dallas-Ft. Worth and Houston urban areas, and much more than the combined Los Angeles, San Francisco-Oakland, and San Jose urban areas.

One thousand $1 bills fills about 69 cubic inches of space. The average size of homes built in recent years in the United States is about 2,200 square feet. Such a home with 9-foot ceilings has just under 20,000 cubic feet of space. One billion dollar bills would completely fill two such homes, while storing one trillion dollar bills would require more than 2,000 homes. One trillion dollar bills would completely fill up the Empire State Building with enough left over to fill 150 2,200-square-foot homes.

The median income of the 174 million people who worked in the United States in 2019 was $32,280. At that rate, the median worker would have to work nearly 31 million years to earn a trillion dollars.

The average income of the 174 million workers was $65,157. That means the total income of all workers was about $11.3 trillion in 2019. We can’t devote all of this towards paying off the national debt because if we did Americans would starve to death. But if all American workers tithed, that is, contributed 10 percent of their incomes in addition to the taxes they already pay towards paying off the national debt, it would get paid off in 25 years. Of course, at current rates of spending, by that time Congress would have racked up another debt of $25 trillion or more.

From a transportation viewpoint, $1 trillion would be enough to buy all shares of stock in all major railroads, automobile manufacturers, and airlines in this country, with quite a bit left over. The market value of BNSF, CSX, Kansas City Southern, Norfolk Southern, and Union Pacific is about $430 billion (estimated for BNSF). The market value of General Motors, Ford, and Fiat Chrysler is about $175 billion. The market value of Alaska, American, Delta, United, and Southwest air is under $100 billion. I left out Tesla, whose current market value of $800 billion is arguably unrealistic, but otherwise adding in minor airlines, railroads, and auto makers still would not bring the total to more than $1 trillion.

In 2019, the value of all owner-occupied single-family detached homes in the nation was about $22 trillion. Adding renter-occupied homes brings it up to about $26 trillion, less than the total federal debt. At current rates of spending, the debt will reach the value of all housing in the nation within five years.

The United States spent $288 billion—about $4 trillion in today’s money—on the military during World War II, the costliest conflict in human history. If Congress passes Biden’s coronavirus relief bill, the federal government will have spent more on this pandemic in one year than it spent in four years fighting the war.

All of these attempts to imagine $1 trillion fail because they ultimately rely on numbers we really don’t understand. We may understand the distance from our home to work but we don’t comprehend the distance required to go around the earth, much less the distance to the moon or sun. We may understand the volume of our home, but we don’t really comprehend the volume of 2,000 such homes or the Empire State Building. We may understand the amount of land our home sits on, but we don’t comprehend the size of the urban area we live in, much less multiple urban areas. We may understand the value of our home or our annual paychecks, but we can’t multiply that by the 170 million other homes or workers in the country.

The Consequences of Multi-Trillion Dollar Deficits

In 2009, Congress spent less than $900 billion on the economic stimulus bill, and it was limited to that amount partly because that Congress didn’t want to be the first to spend $1 trillion in one bill. In 2016, Hillary Clinton proposed a $500 billion infrastructure bill, and Donald Trump promised to double that to $1 trillion. This may have been the first time a presidential candidate promised to spend $1 trillion on any single program.

With Trump’s precedent, presidential candidates in 2020 freely talked about multi-trillion-dollar spending packages on such things as green energy, medicare for all, and coronavirus relief. Now that Congress has spent $2.2 trillion on the CARES Act in 2020, the floodgates have opened and members of Congress are freely talking about spending trillions more in 2021.

Some people argue that the problem is not deficit spending but wasteful government spending. If a transit agency taxes people to build a light-rail line when a bus line could do the same work for less money, it is just as much of a waste as if the transit agencies borrows money (or uses federal deficit funds) to build that light-rail line.

That may be true, but the difference between taxing and borrowing is that, if legislators are consciously trying to avoid deficits, then the tax revenues government brings in puts a cap on the total amount that they can waste. Today’s believers in modern monetary theory, however, don’t believe they need to worry about deficits, allowing them to waste money on a scale that was previously unheard of.

I don’t believe that the government can afford to borrow without limit. Eventually, debts have to be repaid. Now that the federal debt has exceeded the nation’s gross domestic product, there are only two ways we will be able to pay off that debt. One is to increase future economic productivity. If Congress uses borrowed money to do things that increase economic productivity, then the increased tax revenues may be sufficient to repay the borrowed funds. But how likely is that to happen? If the programs Congress wants to fund were truly productive, they would probably take place without federal intervention.

Green energy, high-speed trains, and medicare for all don’t increase our productivity. For the most part, they will substitute for other things that already exist and are usually less expensive. High-speed trains will be an expensive substitute for airlines; light rail an expensive substitute for buses; windfarms an expensive substitute for natural gas power plants; and so forth. Such higher-cost substitutions by definition reduce productivity.

One of the questionable tenets of modern monetary theory is that federal government does not compete with the private sector for resources. But there are only so many people capable of building infrastructure. If Congress puts them to work building a high-speed rail network, there will be fewer available to build things such as server farms, chip factories, and 5G cell phone networks. While server farms, chip factories, and 5G cell networks generate tax revenues, high-speed trains will only generate operating losses. Increased deficit spending will make the country less able to pay off its debt because it will reduce the nation’s productivity.

If deficit spending reduces economic productivity, the nation will have to turn to the other possible way of repaying its debts: inflation, and better yet, hyperinflation. If the value of a dollar drops by 50 percent, then a $28 trillion debt becomes a $14 trillion debt, still pretty high. If the value drops 99.9 percent, then a $28 trillion debt becomes a $28 billion debt, which is a lot more manageable. Of course, anyone on a fixed income will be unable to pay for food, shelter, and other necessities, and, as Venezuela shows, the political turmoil that is likely to result will not be pretty.

The Great Reset

Progressives are talking about a Great Reset after the pandemic, which they view as a way of “rebuilding capitalism.” The Great Reset means less mobility (because driving and flying aren’t sustainable), less consumption (because consumption wastes energy), less meat eating (because plant-based foods are healthier and more sustainable). Instead of mourning the loss of mobility, consumption, and distribution of consumer goods that happened during the height of the pandemic, this Great Reset white paper seeks to maintain those reductions as targets.

Investment analyst John Mauldin has a different view of a Great Reset: for at least four years, he has used that term to describe what will happen when governments around the world are forced to deal with their debts through some form of devaluation or inflation. The progressives’ Great Reset is likely to hasten Mauldin’s Great Reset.

How long can the United States continue to rack up deficits before it becomes an economic basket case like Greece since 2009 or Japan since 1990? The United States may be able to get away with debts greater than gross domestic product longer than other countries because the dollar is used as the world’s reserve currency. But that status is slipping and Europe would happily let the euro and China the yuan replace the dollar as the world’s currency of choice. The only thing saving the dollar so far is that Europe and China are racking up their own debts.

The world has four great cultures. North America has economic and personal freedom. Much of Europe has personal freedom but less economic freedom. China and much of Asia has economic freedom but less personal freedom. The Middle East and much of Africa have little economic or personal freedom.

We would like to believe that economic and personal freedom will win out against the alternatives. But continued deficit spending by the federal government combined with restrictions on economic freedom advocated by many progressives will make us less likely to succeed. If we truly value our freedom, we need to return to our roots, which means putting the government on a pay-as-you-go basis, devolving to the private sector anything that it can do better than government, and minimizing the role of government in anything other than the things that only it can do, such as national defense and insuring justice.

Unfortunately, this is not likely to happen until we face a major economic crisis. Even then, there is a real likelihood that such a crisis would lead us to turn exactly the wrong direction. A major reason for this is the inability of people to truly understand what a trillion dollars represents.

My eighth grade social studies teacher told us that the US government can increase borrowing for ever because “it never has to pay it all back.”

It sounded like a Ponzi scheme.

“A Ponzi scheme can maintain the illusion of a sustainable business as long as new investors contribute new funds, and as long as most of the investors do not demand full repayment and still believe in the non-existent assets they are purported to own.”

https://en.wikipedia.org/wiki/Ponzi_scheme

“The government can’t go broke — it’ll just print more money.”

A trillion dollars will soon be the entirely worthy cost of a hundred miles of the latest toy train marvel. Eminently worth the cost for the two passengers per hour.

In terms of the debt, no, it actually is not designed to be paid off, and never will be. Why? Because chose in charge know that countries have stiffed creditors since time immemorial, and the creditors always come back. There are negative side effects that also affect regular people, but who cares about that, right?

Just to be clear, a nation may not ever have to completely pay off its debts, but neither should it allow those debts to grow without limits. At some point, interest in the debt will consume a huge amount of the country’s resources, which will make almost no one happy.

It will be the inability to borrow more money at any interest rate or the realization that the interest rate needed to attract lenders is too high for even Congress, that will slow or stop borrowing.

Well run businesses borrow only when the expected real return on whatever they are building (for example) with the money is greater than the real cost of the money. This is not a constraint to government borrowing and spending.

Then there is the problem of “crowding out”.

One type frequently discussed is when expansionary fiscal policy reduces investment spending by the private sector. The government spending is “crowding out” investment because it is demanding more loanable funds and thus causing increased interest rates and therefore reducing investment spending. This basic analysis has been broadened to multiple channels that might leave total output little changed or even smaller.

https://en.wikipedia.org/wiki/Crowding_out_(economics)

Oh, I agree, Mr O’Toole. I was alluding to those effects in my comment. But those in charge don’t care, because they won’t be in office when the negative consequences become known.

“I don’t believe that the government can afford to borrow without limit. Eventually, debts have to be repaid.”

.

No they don’t. The federal government has defaulted on its debt several times, the most recent being when Nixon closed the gold window. It will default again, this time by destroying the dollar.

.

What it should do instead is repudiate the debt.

It is a Ponzi Scheme.

If the government just keeps printing more money to pay off previously-incurred debt, sooner or later its creditors will demand more dollars for any amount of borrowing, essentially a higher price for capital, in recognition of the fact that their loaned funds are being repaid with devalued currency.

Meanwhile, the printing-press option is also an implicit tax on savers, so anyone who has dollar-denominated savings can actually see themselves getting poorer over time as a result of such a policy. No free lunches anywhere.

”

The federal government has defaulted on its debt several times,

” ~Frank

Washington has _NEVER_ failed to meet it’s debt obligations.

$1,000,000,000,000 is $3,000 from every man, woman and child in America.