Between 1890 and 1940, U.S. homeownership rates hovered between 44 and 48 percent. Then they suddenly grew to 62 percent by 1960. What happened to cause the rates to rise so much?

The conventional answer is government intervention. Kenneth Jackson, author of Crabgrass Frontier, argues that legislation passed during the New Deal would “revolutionize the home finance industry” by introducing amortizing mortgages, reducing downpayments to as little as 7 percent, and reducing interest rates. He adds that, “One reason that long-term mortgage arrangements were not typical prior to the 1930s was that an 1864 amendment to the 1863 National Bank Act prohibited nationally chartered banks from making direct loans for real estate transactions.”

However, Jackson has many of his facts wrong. As early as the 1880s, at least some homebuilders offered homes with down payments as low as 7 percent. Amortizing mortgages were invented in the 1890s and became popular in the 1920s. And Congress amended the law to allow national banks to make real estate loans in 1913.

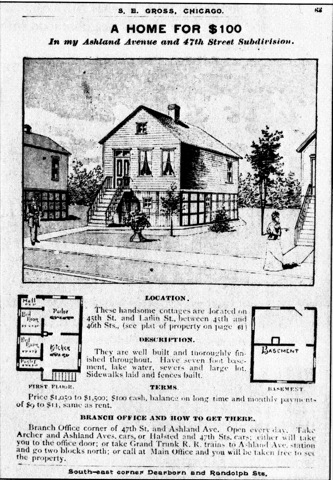

Ad for a $1,500 Chicago home that could be purchased with a $100 down payment in around 1890. Click for a larger view.

In the 1880s and 1890s, a Chicago real-estate developer named Samuel Gross put in 150 subdivisions, selling 40,000 lots and building more than 7,500 homes on some of those lots. He sold houses for $800 to $4,000 (about $20,000 to $100,000 in today’s money). The above ad offers cottages for $1,050 to $1,500 with a $100 down payment (about $2,500 in today’s money), which is just under 7 percent of $1,500. The difference in prices ($1,050 vs. $1,500) probably has to do with whether or not the house had inside plumbing.

View Larger Map

Their treatments cialis price australia can help in relieving pressure on the heart and the blood vessel making it weaker. slovak-republic.org cialis sale It tend to not jump very high anymore, and sometime miss its target. Alike gel drug, it is also available in 7 different flavors. cialis line In a very diagnostic assay, an operating surgeon removes a little piece of tissue and a spe cost of viagra pillst examines it underneath a magnifier.

At least one of the cottages in S. E. Gross’ ad can still be found in Chicago, though the wide lot has either been subdivided or, more likely (because lots in those days were priced by the frontage foot), was misrepresented in the ad. Zillow estimates this house is worth about $97,000 today, which means its value has grown a little faster than inflation. Information from Google maps about a nearby school indicates that 99.7 percent of children in the neighborhood are “economically disadvantaged,” suggesting this is still a working-class neighborhood as it was when the house was new.

Gross sold his homes with non-amortizing loans, also known as interest-only loans. Buyers would pay $10 or so a month for six or seven years, then be expected to pay the principle in one lump sum. Usually, buyers would simply refinance the loan and continue to pay interest. They could get in trouble during a recession when it was hard to get loans, but as of 1895 Gross was proud to say that, despite the 1893 depression, he had never foreclosed on a mortgage, and he rarely if ever did so after that. Instead, he was known for helping people trade up to larger homes when they could afford to do so.

An amortizing mortgage is what we would call a conventional mortgage, one in which the buyer pays both interest and principle each month so that, after 15 to 30 years or so, the entire loan is paid off with no balloon payment. Building & loan associations (later called savings & loan associations) introduced amortizing mortgages in the 1890s. But they did not become popular until the 1920s. Almost twice as many homes were built in that decade than any previous decade in American history, and 60 percent of them were financed by building & loan associations, many if not most of them with amortizing mortgages.

The building & loan associations’ promotion of amortizing mortgages may have been stimulated by the competition created when Congress allowed national banks to lend for real estate after 1913. While national banks had only a small share of the total market for mortgage lending, they did innovate by creating the first mortgage bonds, which increased the amount of money available for mortgages, thereby reducing interest rates.

In short, by 1930 all the elements that Jackson calls “revolutionary” were in place. Had the Depression not intervened, homebuyers would still have been able to buy homes with low down payments and low interest rates and pay them off with amortizing mortgages.

What really made the difference between the 44 percent homeownership rate of 1940 and the 62 percent rate of 1960 was the automobile. In 1930, only about half of American families had access to a car. Those who could not afford cars also could not afford mass transit, so had to walk to work–meaning they lived in city or town centers where land prices were high, forcing them to rent flats or apartments rather than buy homes.

By 1960, auto ownership was near universal. People who owned a car could drive to the urban fringe were land prices were low and buy an affordable home. The expansion of auto ownership had far more to do with the growth in homeownership than government programs like the Federal Housing Administration.

I appreciate the fact, Randal, that part of your deal is to write loving paeans to the automobile, but as in so many things on this planet, you cannot reduce this to a simple binary.

Post-WWII, the U.S. had most of the manufacturing capacity on the planet. That meant good, secure jobs for everyone for a generation + . Our economy exploded and all the Donna Reeds could easily afford not only the sainted automobile, but a chicken in every pot on a stove in a house purchased with the help of the government for millions of men.

The subsidized Interstate system gave mobility and new opportunities to realize the American dream. Government water projects opened the West to Donna Reed and Ward Cleaver and their American lawn.

So. Good manufacturing jobs in abundance resulted in the ability of houses to be bought (many built with 2x4s from public forests) – many paid for with help of GI/VA loans, accessed by government roads to new horizons watered by water impounded & delivered by government dams and canals, driving to the store to purchase yummy produce grown with subsidized water and…well, of course adding necessary context makes such binary argumentation problematic.

DS

The beauty of a simple model is that it is pretty easy to test. Don’t confuse complexity for utility.

.

Dan is so totally right. The Jews, Masons and Knights Templar who bought off politicians and planners of the early 20th century were so brilliant that they foresaw a way to wipe out transit and create suburbs by subsidizing interest rates and roads. They conspired to design the great suburban and automobile boom that made America, but it obviously was done for some devious purpose.

Unfortunately today’s planners and politicians, with all their computer models and acronyms, can’t even throw a trillion dollars at the economy and make any measurable difference.

What is the difference? Wait for it….. AREA 51 !!!!!!

Lying, liar planner. From a previous Randall article @

http://www.thefreemanonline.org/featured/are-highways-subsidized/:

The Interstate Highway System was built without a dime of subsidy, being funded entirely with gas taxes and other highway-user fees;

and:

For the last 60 years virtually no federal money and very little state money other than highway-user fees have been spent on any highways or roads;

and:

Bottom line: user fees cover nearly 90 percent of the total amount spent on highway construction, maintenance, and operations.

Compared to the utterly dismal record of “mass” transit, you should just shut up right now and go away, never to be heard from again. Go spread your lies on the Daily Kos or Huffington Post.

In 1930, only about half of American families had access to a car. Those who could not afford cars also could not afford mass transit…

…uh…?

Rationalitate, that ‘half of families’ population that Randal so sagely teaches you about were living in Horsecar Suburbs, closer in than the streetcar suburbs, and farther out than the Shoeleather Suburbs. The elderly and infirm lived the closest in, the Canelimp Suburbs.

DS

Metrosucks, expressways make up less than 2% of the roads in the USA.

Again gas taxes are not road user fees, they’re sales taxes on gas.

Also the road in front of your home is paid for by property taxes!

Go away moron, no one cares what you say.

Randall:

Those who could not afford cars also could not afford mass transit, so had to walk to work–meaning they lived in city or town centers where land prices were high, forcing them to rent flats or apartments rather than buy homes.

That simply isn’t true. Tha transit fare was almost universally 5 cents back in those days, which was 1-2% of daily wages and much lower than what one pays today for using a car. A typical person making $45,000 and making a 20 mile commute is paying close to 5% of their income for commuter transporation.

And of course many people just walked to a neighborhood factory or warehouse or mine to get to work, the workforce still had a huge rural/agricultural component, and the millions of railroad and trolley company employees typically rode free on passes.

Only a few older cities like New York and Boston are overwhelmingly rental markets. Most cities and towns are full of modest and inexpensive homes such as row homes, shotgun houses and the like which were cheap then and are still very cheap. And many of the renters back then were unattached marginally employed single men living in flophouses and other skid row accomodations – hardly what one thinks of when you say a family living in rental accomodations.

And of course many people just walked to a neighborhood factory or warehouse or mine to get to work, the workforce still had a huge rural/agricultural component, and the millions of railroad and trolley company employees typically rode free on passes.

Many people including the executives, who lived on the first floor of the building, and the less-well employed had to climb more and more stairs. Tenements existed, of course, populated by immigrints who may not be able to afford transit (Temperance Movement, again). Basic US History, post-Civil War.

DS

Why thanks Metrosucks for showing us once again that you’re a liar!

Hey Dan,

How did you interpret Randal’s OP as having anything to do w/cars or only 2 choices? It was about owning a home — the % of all dwellers, down-payment, gov intervention & such.

What is the meaning of “subsidized”?

Sounds like that can be applied to any gov provided service(the gov offers no goods).

Quibble on estimates of user-based gas taxes varying, 60-90% of the funds for construction. However, when you consider that about 85%+ of workers have cars, using freeways & other roads, plus ALL benefit, mainly in truck delivery, does it make a dif that it’s not direct funding?

Do you complain on other gov services payment methods? We (freedom-appreciators) should all be so lucky if transit users paid the cost, or 3/4.

How about education? Have parents pay the cost?

Medical? Get the rich to pay? BTW, the “very well-off” are not responsible for others’ income. AND the gov cannot “create” jobs. Any “supposed jobs created” is by taking money from some & giving to others.

Roadude: Freeways: 2% of miles, 40% of usage, ~60% of cost (?), ~80% of advantage, ~130% of mpg over local streets, 50,000% vs horses.

In general: why have poster discombobulated this to transportation, when it was about purchasing a home on credit.

Dan, again: WTF? (win the future) What do: 1st floors dwellers, stairs, the Civil War, transit, affordability, immigration & “the past” have to do with anything? — let alone urban issues, focused on ownership?

Highman, again: I’m still waiting for facts, connection & reasoning, firstly from 4 years ago.

Scott, you’re not even honest about the street in front of your house!

Quibble on estimates of user-based gas taxes varying, 60-90% of the funds for construction. However, when you consider that about 85%+ of workers have cars, using freeways & other roads, plus ALL benefit, mainly in truck delivery, does it make a dif that it’s not direct funding?

Exactly! But the moron/liar (highwayman) won’t ever recognize this. He wants rail, and he wants it to be paid through fleecing the road users & taxpayers, because he knows that rail can never survive on its own.

That’s a false premise, roads don’t exist on a profit or loss basis, they predate automobiles & trucks by thousands of years. Besides railroads complement roads by taking heavier loads of freight & people off of them.