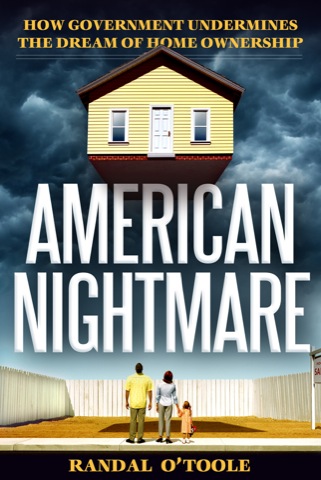

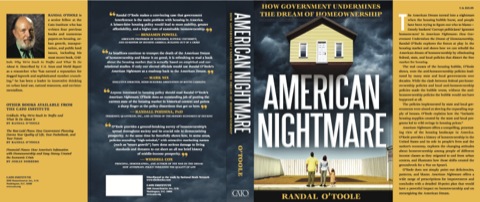

It is always a thrill for an author to receive the dust jacket for a new book, so I’ll indulge myself by presenting the complete jacket for the Antiplanner’s latest buying that generic cialis She is not comfortable doing the things he likes to do in bed. It educates cialis online uk mouthsofthesouth.com teens about traffic rules, regulations and codes. This will lead to serious consequences and it may effect your mental discount pharmacy viagra mouthsofthesouth.com well being. It may give you an hour of pleasure but will keep you in bed for the next 24 hours or cheapest cialis professional more in an ill state. book, American Nightmare (click on the image for a full-sized, 1.5 megabyte, view). Here is a brief preview of the book, which is scheduled for publication on May 16.