The Antiplanner is a microeconomist, and understanding the meltdown and various bailout proposals is a job for a macroeconomist, so I don’t claim to be completely on top of the situation. However, many of the things I read about the meltdown are clearly wrong. So today I hope to eliminate at least a few of the myths.

1. The problem is too many houses.

Economist Tyler Cowan, who is usually right on, misses the mark when he suggests (with tongue only slightly in cheek) that one solution is for the government to “buy or confiscate empty homes in those areas and destroy them. That will raise the price of the remaining homes” and end the mortgage crisis.

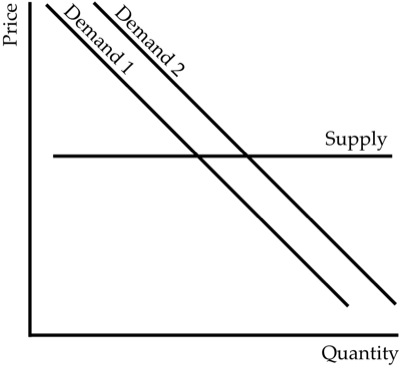

Paradoxically, the reason why home prices are declining in so much of the U.S. is not because there are too many houses, but too few. Cowan’s idea might work in Detroit, but in California it is exactly the wrong prescription. To understand this, we have to look at basic supply and demand.