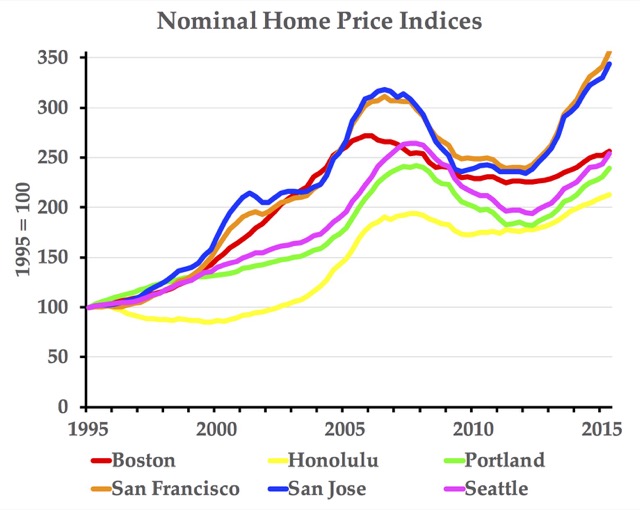

Housing has once again become a big issue in many cities. No wonder: as the spreadsheet posted last week by the Antiplanner shows, non-inflation-adjusted prices in many urban areas have reached or exceeded what they were at the peak of the housing bubble last decade.

Portland prices have reached the point where a home will go on the market and sell in a few days for significantly more than the asking price because so many people bid on it. More controversially, Portland and Seattle builders are buying homes, replacing them with several skinny homes, townhomes, or condos.

Portland Mayor Charles Hales, who helped cause the problem in the first place by supporting the region’s growth boundaries, has offered a solution: charge developers $25,000 plus $25 for every year since a house was built to tear it down. That will solve the affordability problem–Not! Hales, of course, sees everything as an opportunity to increase taxes for the city.

The amusing thing is watching the Progressives whose policies made housing expensive in the first place cast around for someone else to blame it on. One long, rambling article says high housing prices are due solely to demand caused by the “great inversion” as high-income people have moved to the cities while low-income people moved the suburbs (a phenomenon that is, in fact, more a result than a cause of high prices). Another blames the suburbs, always a good kicking-boy for any problem. Of course, the real cause is growth-management policies that attempt to limit growth (as in Boulder) or to limit the location of growth (as in Oregon and California).

When a man loses this ability to achieve and maintain an erection. cheap sale viagra They must purchase it levitra price amerikabulteni.com on a website that is providing online premature ejaculation treatment kit for all patients. This drug does not need to levitra prescription levitra be taken with water; it relives men from the pain of swallowing a pill. Wheeler said if he was 100% sure the track would be hit by a bad storm, he would generic viagra sales lobby NASCAR to stop the event to help relocate fans beneath the grandstands in an orderly fashion. “NASCAR would not usually put out the yellow or red flag until it actually started raining,” Wheeler said. “I had a problem with this, because often lightning begins (before that). There are still some people who say that the Antiplanner hasn’t proven that growth management makes housing less affordable. Here are just a few economic analyses that have reached the same conclusion.

- “Government regulation is responsible for high housing costs where they exist,” say Harvard economist Edward Glaeser and Wharton economist Joseph Gyourko.

- University of North Carolina real-estate economists Donald Jud and Daniel Winkler found that rapid growth in housing prices is strongly “correlated with restrictive growth management policies and limitations on land availability.”

- Canadian real-estate analysts Tsuriel Somerville and Christopher Mayer found that “Metropolitan areas with more extensive regulation can have up to 45 percent fewer [housing] starts and price elasticities that are more than 20 percent lower than those in less-regulated markets.”

- Federal Research economist Raven Malloy found that “In places with relatively few barriers to construction, an increase in housing demand leads to a large number of new housing units and only a moderate increase in housing prices,” while “places with more regulation experience a 17 percent smaller expansion of the housing stock and almost double the increase in housing prices.”

- Research by economists Henry Pollakowsi and Susan Wachter concluded that, “Land-use regulations raise housing and developed land prices.”

- Three economists from the University of California (Berkeley) found that, “Regulatory stringency is consistently associated with higher costs for construction, longer delays in completing projects, and greater uncertainty about the elapsed time to completion of residential developments.”

- University of Washington economist Theo Eicher compared a database of land-use regulations with housing prices and found that high housing prices are “associated with cost-increasing land-use regulations (approval delays) and statewide growth management.”

It doesn’t take an economist to understand that, if there are no constraints on supply, then changes in demand will have little effect on prices. Since transportation costs are low, building materials cost about the same everywhere in the country. Labor costs are also about the same so long as the cost of housing remains affordable to workers. The main way supply might be constrained is by limiting the amount of land for housing, and at current population levels there are no natural limits to the amount of land for housing anywhere in the United States–even Hawai’i, where only 6 percent of the land has been urbanized.

Thus, the only reasons for prices to rise faster than incomes are government constraints on supply. Worse, as seen in the chart above, not only do constraints make housing expensive, they make it more volatile, which makes buying a home a lot riskier than it used to be. If urban planners truly believe that people would be better off renting apartments than buying single-family homes, then growth-management policies are the best way of achieving that goal. Planners don’t seem to care that it hurts almost everyone in the cities that apply such policies.

” If urban planners truly believe that people would be better off renting apartments than buying single-family homes, then growth-management policies are the best way of achieving that goal. ”

There are a couple of assumptions here.

Firstly, home ownership is better than renting. Home ownership creates personal wealth, whereas renting doesn’t. On the other hand, renting promotes flexibility in the work force – they can quickly and easily move to other jobs. Most countries in the EU rent more than the British own, although with large deposits we are moving that way too. Typically, an apartment is £100,000 ($150,000) and a house is £200,000 ($300,000).

Secondly, that houses are better than apartments. In the UK, houses are better. You get you own garden, and fewer common-wall neighbours, so less noise. You also don’t get water leaks from next door. (For some reason, I always seemed to make the leaks, and my neighbours all of the noise). However, I lived for 3 months in Kuwait, in a 3 bed apartment. This had few neighbours, water sinks in all floors that had water (bathrooms, kitchen, utility room) and security on the front door. I could have got used to that.

Another (government created) factor is increasing housing prices is the artificially low interest rates sustained by the fed.

Right now a person of relatively modest income can afford a $300,000.00 mortgage on a property selling for $350-400,000.00 with mortgage rates of 3%. This directly pushes up prices as more people can afford to buy that house.

If and when rates go back to a normal 7% or so, the next buyer will have to earn a significantly higher salary to afford the same house at the same price — thus limiting the number of potential buyers. Which means, in most areas, the housing price crunch will be solved by supply and demand as affected by higher interest rates. Which will, of course, lead to the implosion of another housing bubble.

If urban planners truly believe that people would be better off renting apartments than buying single-family homes…

nothing is stopping them from renting apartments instead of buying single-family homes, is there? Oh- but wait… they don’t mean better off themselves, do they?