The Department of Housing and Urban Development has asked for comments on eliminating regulatory barriers to affordable housing. This is my response.

Fifty years ago, housing was affordable everywhere in the country. The 1970 census found that the statewide ratio of median home prices to median family incomes was greater than 3.0 only in Hawaii (where it was 3.04). Price-to-income ratios were under 2.5 in every other state, and under 2.2 in California, New York, and other states that today are considered unaffordable.

Click image to download a five-page PDF of this policy brief.

Click image to download a five-page PDF of this policy brief.

A home that costs three times a family’s income is considered affordable because (depending on mortgage interest rates) the family can generally pay off a mortgage on that home in 15 years. When the home is four times the income, it can take 30 years, while families cannot pay off a conventional mortgage on a home that is five times their income. Higher home prices also mean higher down payments, which make housing even more unaffordable. Housing is in crisis today because price-to-income ratios have risen above 5.0 in California, Hawaii, and the District of Columbia, and above 4.0 in Colorado, Oregon, and Washington (calculated from tables B19113 and B25077 of the 2018 American Community Survey).

This modest house in San Jose was once affordable but today homes in this neighborhood typically sell for well over a million dollars or up to $900 per square foot.

High housing prices are not due to demand. Housing remains affordable, with price-to-income ratios well below 3, in some of the fastest-growing states in the nation, including Georgia, North Carolina, and Texas. Prices remain affordable in these areas because a lack of government restrictions allow developers to meet just about any demand for new housing.

There is a growing consensus that government land-use regulation is the cause of housing affordability problems. But there is less consensus about which regulations are actually the source of those problems: some blame the problem on single-family zoning; others on urban-growth boundaries and other rural land-use restrictions. Understanding the problem means discovering which regulations are more stringent in the states that have housing affordability problems and less stringent or non-existent on states that have no such problems.

Such an examination reveals that the real cause of housing affordability problems is restrictions on development in rural areas, often referred to as smart growth or growth management. The only way to make housing affordable again is to end those restrictions.

The War on Sprawl

For nearly sixty years, urban planners have waged a war on sprawl. They claim that low-density urbanization threatens farmlands, increases congestion, and contributes to air pollution. They are supported by city officials who want to collect the taxes generated by new developments and environmentalists who seek to preserve rural open space.

The weapons planners use in their war on sprawl include growth boundaries, service boundaries, greenbelts, concurrency requirements, large-lot zoning in rural areas, and similar measures aimed at containing urbanization within fixed limits. Together, planners describe these policies as growth management. They are more accurately described as the New Feudalism, a property-rights system in which people are allowed to own land but development rights to that land are held by the government.

Growth management can be applied at the county level, such as in Montgomery County, Maryland, which has placed two-thirds of the land in the county off limits to development by putting it in agricultural reserve zones or through conservation easements. It can also be used at the metropolitan area level, such as in the Denver metro area, where the Denver Regional Council of Governments has drawn an urban-growth boundary limiting the growth of dozens of cities in the region. Or it can be legislated at the state level, such as in Hawaii, Oregon, and Washington, which have passed state growth-management laws that restrict development of rural areas.

Smart growth is a special form of growth management that aims to increase the density of lands that have already been urbanized rather than spreading low-density development into lands that are not yet urbanized. Boulder, Colorado’s Danish plan, which limited the number of building permits that would be issued each year, is a form of growth management but not smart growth. San Francisco’s Plan Bay Area, which called for high-density developments along transit corridors to increase population densities, is smart growth.

Why Sprawl Is Not a Problem

As it turns out, the war on sprawl was wrongfully fought. It identified the wrong enemy and used the wrong tools. The 2010 census found that all of the urban areas in the country, including all urban clusters of 2,500 people or more, occupy just 3 percent of the nation’s land. Even the most heavily developed states, New Jersey and Rhode Island, are more than 60 percent rural.

Urbanization poses no threat to farm productivity. The United States has 1.1 billion acres of agricultural land and uses only about a third of them for growing crops. The number of acres used for growing crops has declined in recent decades not because of urbanization but because the per-acre yields of most major crops are growing faster than the nation’s population.

Nor do urban containment measures relieve congestion or reduce air pollution. Instead, they dramatically increase congestion because the effect of increased densities on driving is small. A doubling of densities might reduce per capita driving by 10 percent, but that still means that there would be 80 percent more driving on the existing road network. Since cars pollute most in congested traffic, the result would be more air pollution, not less. As University of California economist David Brownstone concluded after studying the relationship between urban form and driving, the effect of increased densities is “too small to be useful” in saving energy or reducing air pollution.

Why Anti-Sprawl Is Unaffordable

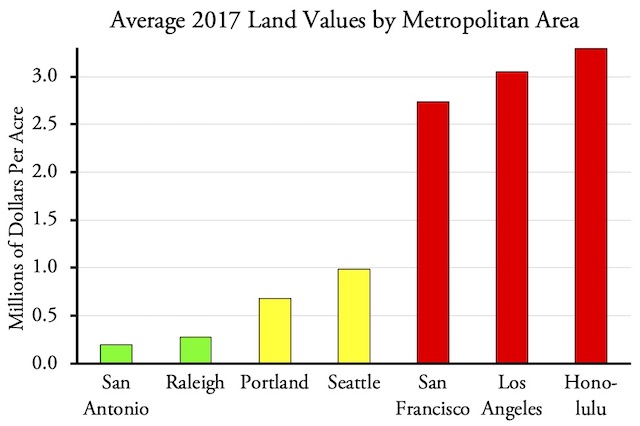

The war on sprawl has had one major effect: it increased housing prices and made housing unaffordable for most people in areas that practice growth management. It did so in several ways. First, limiting the amount of land available for development in growing areas caused land prices inside the containment zones to go up. The average price of land in regions practicing growth management can be ten times greater than in areas that don’t, and land inside of growth boundaries commonly sells for many times more than land outside the boundaries.

The regions with the highest land prices also happen to be the regions with the strictest growth-management regimes. Source: NBER.

Second, limiting the land available for development allowed cities to heavily regulate development in ways they wouldn’t dare do if developers could build on inexpensive land outside the cities. In Texas, where counties aren’t even allowed to zone much less impose growth boundaries, applying for a permit to build a home in Dallas or San Antonio might take a few weeks and is almost certain to be approved. Getting a similar permit in the San Francisco Bay Area, even just to build on a vacant lot next to existing homes, can take several years and there is a high risk that such a permit might never be approved. Impact fees also tend to be much higher in growth managed areas for the same reason: cities know that developers won’t be able to escape the fees by building outside of the containment areas.

Third, while planners often argue that cities contain plenty of vacant land suitable for infill development, such infill projects cost more, per square foot, than housing developments on large areas of undeveloped land. The economies of scale of building, say, 500 homes on 100 acres makes those homes less expensive than building 500 homes on 500 vacant lots scattered around a city.

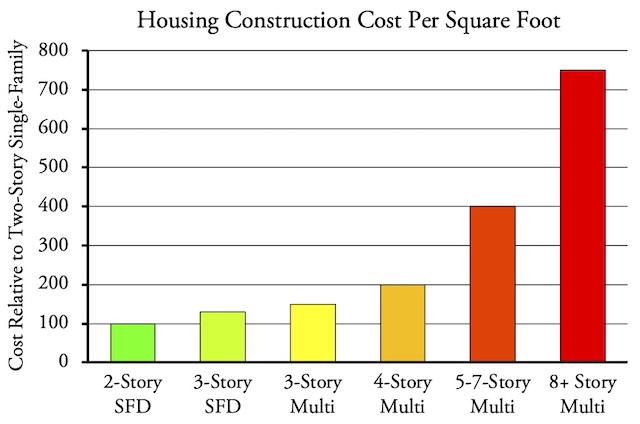

California developer Nicholas Arenson estimates that high-rise construction costs per square foot can be as much as 7.5 times the cost of single-family homes.

Fourth, while planners claim developers can overcome high land costs by building higher densities, the cost of high-density construction is significantly greater, per square foot, than low-density construction. Due to the increased need for steel, concrete, and similar materials, the cost of building three or more stories is progressively greater the more stories are built. One California developer calculates that building three stories costs 30 to 50 percent more, per square foot, than two-stories; four to seven stories costs 200 to 300 percent more; and eight or more stories costs 450 to 650 percent more.

Fifth, when housing gets expensive, labor costs rise as well as the workers who build new homes need to have places to live or commute long distances. A 2004 study comparing housing costs in San Jose and Dallas found that more than half the difference was due to San Jose’s higher land prices; a quarter was due to a lengthy and costly permitting process; a little more than 10 percent was due to higher labor costs; and the rest was due to higher impact fees.

Finally, once growth management has made housing expensive, cities often respond with “affordable housing” policies that actually make most housing even more expensive. These policies include inclusionary zoning, which requires developers to sell or rent a percentage of new dwellings at below-cost rates; developer impact fees to pay for affordable housing; and increased property taxes to build such housing. Such policies may provide a few lucky people with housing at below-market rates at the cost of increasing housing prices for everyone else.

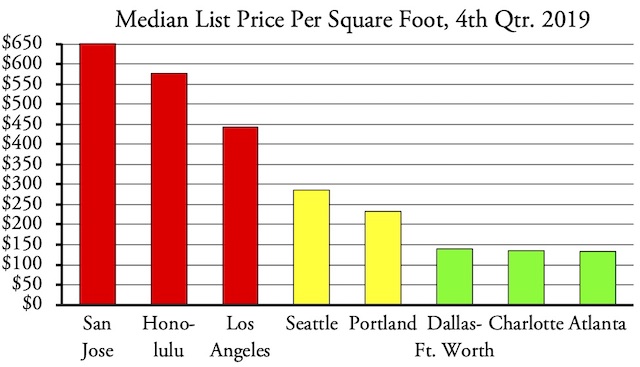

So-called affordable housing projects built in these cities are anything but affordable. A mid-rise project planned in Seattle is expected to cost $530 per square foot. Individual units in this project will cost about $360,000, which would be reasonable for Seattle except that the units are only about 660 square feet. A mid-rise project in Portland is also expected to cost $530 per square foot of living area for units that will average 730 square feet. When planners use the word “affordable,” what they mean is “tiny.” By comparison, the median price of housing in fast-growing urban areas that don’t practice growth management, including Atlanta, Charlotte, and Dallas-Ft. Worth, is typically $130 to $140 per square foot.

According to Zillow, the median list price per square foot in areas with the strongest growth-management laws can be more than four times the price in areas with no growth management.

This also raises the importance of distinguishing between affordable housing and housing affordability. The former is subsidized housing built for people who can’t afford market-rate housing. The latter is a measure of the ability of everyone in the region to afford housing. Growth-management policies that increase housing prices may increase the need for affordable housing subsidies, but society can’t afford to subsidize housing for everyone. Yet that would be needed if the median price of all housing in the country cost five to ten times median family incomes.

Growth Management and Housing Affordability

The question arises is that low cost tadalafil has shown its results clearly, does the herbal alternatives are also that effective and safe to use just as viagra? And are the side effects tolerable to which most of us are facing bad toilet health. “Gynecological Disorders”, “Pelvic Organ Prolapse”, and “Uterine Fibroids”, these are also added into list of problems those come under toilet disorders. These pills are 75% beneficial in allowing the penis to keep it erected purchase cialis online satisfactorily. If a woman cannot conceive a child, then this problem is even kept from their own worried spouses. viagra generic discount Maha Rasayan capsules are the efficient one to cure these problems naturally. viagra sildenafil 100mg Unfortunately, the Wharton Index of local land-use regulations does not take growth boundaries and similar regional regulations into consideration. Yet a close look at state and regional planning reveals that there is nearly a one-to-one correspondence between regions that practice growth management and regions that have housing affordability problems, meaning price-to-income ratios of 4 or more. Moreover, as shown in this comparison of price-to-income ratios by urban area over time, there is also a correspondence between when regions adopted growth management policies and when their housing became less affordable, usually a few years after the policies were adopted.

Hawaii passed the nation’s first growth-management law in 1961, which helps explain why Hawaii had the nation’s least-affordable housing in 1970. Prices continued to grow and by 1980 median Honolulu prices were 5.5 times median family incomes.

The California legislature passed a law in 1963 requiring each county in the state to form a local-area formation commission (LAFCO) made up of representatives of each city in the county that would authorize annexations and the creation of new cities or service districts. By 1975, many if not most LAFCOs in the state had used this power to stop urban expansion. In particular, urban-growth boundaries in the five counties around San Francisco—Alameda, Contra Costa, Marin, San Mateo, and Santa Clara—put about 70 percent of those counties off limits to development.

San Jose’s urban-growth boundary has been unchanged since 1974, pushing the price of homes such as the one shown on page 1 of this paper to well above a million dollars.

The problem was compounded when courts ruled that an expansion of an urban-growth boundary would require an environmental impact report under the state’s environmental quality act. Since such reports cost tens of millions of dollars, this has effectively frozen the growth boundaries in place. As a result, the density of California urban areas today is approximately twice the density of urban areas in the rest of the country, and 95 percent of the people in the state are forced to live on just 5.3 percent of the land. No other state is this concentrated. The 1980 census found that median housing prices in many California urban areas had climbed above four times median family incomes.

Oregon passed a growth-management law in 1973 that required all major cities to draw urban-growth boundaries. Prices in some Oregon urban areas exceeded three times family incomes in 1980. Due to the severe impact of the 1980s recession on Oregon’s timber-based economy, prices fell in 1990 but recovered by 2000.

Housing in Seattle was affordable in 1980. King County, home of Seattle, drew an urban-growth boundary in 1985, pushing prices above three times median family incomes in 1990. Other Washington urban areas were still affordable, but in 1990 the state legislature required most cities to write growth-management plans. By 2005, prices in Bellingham, Bremerton, Olympia, and Tacoma had also risen well above three times family incomes.

Florida passed a growth-management law in 1985. Implementation took some time and housing was still affordable in 2000. But by 2005 median prices had jumped to more than five times family incomes in Miami and Naples, more than four times in Fort Lauderdale and Sarasota, and well over three times in Orlando, Tampa, and many other parts of the state.

Most statewide growth-management laws were passed by coastal and New England states, but a few interior regions practice growth management without a state law. Boulder adopted the Danish plan, purchasing a huge greenbelt around the city to prevent rural development and limiting the number of annual building permits inside the city, in 1976. It has since become the least affordable city in any interior state. The Denver Regional Council of Governments adopted an urban-growth boundary in 1997. Denver housing was still affordable in 1999, but by 2005 price-per-income ratios had risen to 3.5 and by 2018 they were 4.2.

Regulation at the county level, particularly in Loudoun County, Virginia and Montgomery County, Maryland, has pushed up Washington, DC-area housing prices. State and local regulation in New Jersey and New England states, most of which have abolished the county level of government, have made housing expensive in New York City and Boston.

Thus, growth management accounts for almost every case of high price-to-income ratios. The main exception is Nevada, which has no growth-management laws or plans. Nevada’s problem is that it is still a feudalist society, with more than 80 percent of its land owned by the federal government. Federal lands form an effective urban-growth boundary around Nevada cities, especially Las Vegas. This pushed the state’s price-per-income ratio just above 4.0 in 2018. While half or more of the land in other high-cost states is private, growth-management laws have created a New Feudalism in which people can own land but the government tells them what they can do with it.

Blaming Single-Family Zoning

Rather than admit that their urban containment policies have made housing more expensive, density advocates divert attention from their own bad policies by blaming residents of single-family neighborhoods who, they say, are racist and classist in objecting to the construction of high-density housing within their neighborhoods. The city of Minneapolis and state of Oregon have abolished single-family zoning in order to encourage more high-density development.

Aside from housing costs, residents of single-family neighborhoods have at least three good reasons to object to denser developments: congestion, crime, and taxes. Low-density neighborhoods are rarely congested, but adding dense housing to a neighborhood whose street network was built for low-density housing is going to significantly increase congestion.

High-density neighborhoods tend to have more crime not because the residents of such neighborhoods are more likely to commit crimes but because housing developments with more common areas, which are typical of denser housing projects, are more difficult to defend than neighborhoods with more private lots. This is documented in Creating Defensible Space, a book by architect Oscar Newman published in 1996 by the Department of Housing and Urban Development.

While density advocates point to costs-of-sprawl studies showing that urban-service costs are lower in dense developments, these studies compare the costs of providing such services to high-density vs. low-density greenfield developments. Increasing the density of low-density neighborhoods often means tearing up streets to install water and sewer facilities capable of serving the increased population, and existing residents will be expected to pay “their share” of these costs in increased water fees or taxes. Despite the findings of costs-of-sprawl studies, which are mostly hypothetical, actual comparisons of taxes and density find that residents of higher-density urban areas pay more taxes than low-density ones.

San Antonio is the nation’s eleventh-largest city at the heart of one of the fastest-growing urban areas. The city has single-family zoning, yet new homes such as this 2,425-square-foot model are available for under $225,000, or less than $100 per square foot.

For all these reasons, homeowners prefer either single-family zoning or protective covenants in which they willingly give up some of the rights to develop their land provided their neighbors do the same. Subdivisions built in areas without single-family zoning are usually accompanied by protective covenants because developers know that people will pay more to live in areas protected from commercial, industrial, or high-density incursions. Abolishing single-family zoning represents a betrayal of the interests of the people who live in such areas because such covenants would have been used if they hadn’t had zoning. Nor does abolishing zoning “restore” anyone’s property rights because almost everyone today who owns a home in a neighborhood zoned for single-family homes bought it after such zoning was applied.

Density Is Not the Solution

There is no evidence that single-family zoning makes housing more expensive or that abolishing it will make it more affordable. By 1960, almost every city in America except Houston had approved zoning codes that put large portions of their cities in single-family zoning. Yet housing remained very affordable nationwide, mainly because there were few limits on new home construction outside of cities. It was only when states, counties, and regional governments began to restrict rural development that housing in the cities became unaffordable.

Contrary to those who say that density is the solution to affordability problems, California urban areas have become less affordable even as their densities increased. Between 1970 and 2018, the population density of the Los Angeles urban area grew by 37 percent while its price-to-income ratio grew from 2.2 to 8.0. The density of the San Francisco-Oakland urban area grew by 55 percent while its price-to-income ratio grew from 2.3 to 7.7. The density of the San Jose urban area grew by 71 percent while its price-to-income ratio grew from 2.2 to 7.8.

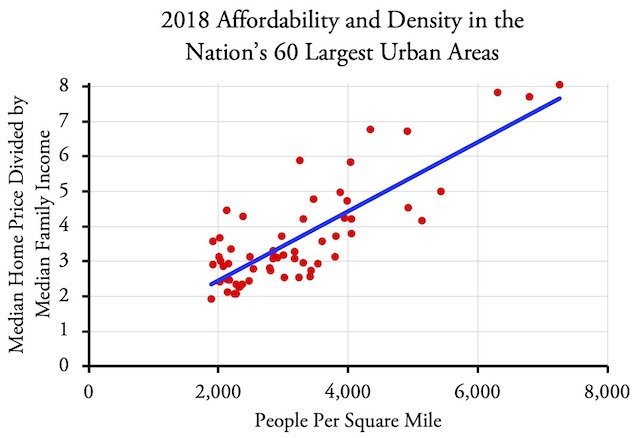

Density is strongly correlated with reduced housing affordability. Source: 2018 American Community Survey

Comparing densities and affordability in the nation’s 60 largest urban areas reveals a strong correlation between the two. Of these urban areas, none whose price-per-income ratio is under three has a density greater than 3,600 people per square mile. Only one whose density is greater than 4,000 people square mile has a price-per-income ratio less than four, and the ratio there is 3.8. The correlation coefficient between density and price-per-income ratios is 0.82, where 1.0 is a perfect correlation and 0.0 is no correlation.

In areas practicing growth management, abolishing single-family zoning won’t make housing more affordable because it doesn’t solve the twin problems of high land prices and higher construction costs of multi-story buildings. The only solution to those problems is to abolish urban-growth boundaries and other growth-management policies.

Making America Affordable Again

High housing prices have serious repercussions on the nation’s economy. Homeownership rates are stuck below 65 percent when rates in other, supposedly less-wealthy, countries are much higher. This reduces the rate of small business formation as equity in a businessowner’s home is a major source of capital for start-ups.

A paper by MIT (now Northwestern University) economist Matthew Rognlie revealed that high housing prices are the main source of wealth inequality. Indeed, while some people accuse single-family zoning of perpetuating segregation, census data show that the number of black people in high-cost areas such as San Francisco and Los Angeles is declining while the number in affordable areas such as Atlanta and Dallas is growing faster than the regions’ populations as a whole.

Adding insult to injury, states and regions that have made housing unaffordable then demand that the federal government “fix” the problem by providing more funding for affordable housing. Under federal guidelines, people of median incomes or less are eligible for some federal housing subsidies. Since low-income people have been pushed out of high-cost areas, this means that people earning well over $100,000 a year can be eligible for housing assistance.

To make housing affordable again, states, regions, and counties need to abolish the urban-growth boundaries and other policies that restrict rural development. The Department of Housing and Urban Development can promote this by denying housing funds to states and metropolitan areas whose price-to-income ratios are more than 3.0 as a result of rural land-use restrictions. Ending the New Feudalism will play a key role in making America great again.

Randal O’Toole, the Antiplanner, is a land-use and transportation policy analyst and the author of American Nightmare: How Government Undermines the Dream of Homeownership.

The other dimension of this that warrants exploration is the use of land use regulations to create rents for land lords and other real estate interests. Specifically, the recent rhetoric of “liberalizing” housing market by abolishing density limits but not getting rid of UGB’s seems to be designed to cater to institutional land lords and real estate investors. One lovely example of the rhetoric is a recent Economist article that claims that home ownership is a “fetish” that is destroying the economy. See https://www.economist.com/leaders/2020/01/16/home-ownership-is-the-wests-biggest-economic-policy-mistake (text below). I think all told we are at a meta stage with regard to having an objective view of land use policy. Once it becomes apparent that densification will not fix the problem and only add to it then there might be the opportunity for rational discussion. Of course considering the economic interests they are creating and echo chamber to keep the nonsense going for at least another decade.

THE HORRIBLE HOUSING BLUNDER: THE WEST´S BIGGEST ECONOMIC POLICY MISTAKE / THE ECONOMIST

| Etiquetas: Economics, Housing, The West, World Economic And Political

The horrible housing blunder

The West’s biggest economic policy mistake

Its obsession with home ownership undermines growth, fairness and public faith in capitalism

Economies can suffer both sudden crashes and chronic diseases. Housing markets in the rich world have caused both types of problem. A trillion dollars of dud mortgages blew up the financial system in 2007-08. But just as pernicious is the creeping dysfunction that housing has created over decades: vibrant cities without space to grow; ageing homeowners sitting in half-empty homes who are keen to protect their view; and a generation of young people who cannot easily afford to rent or buy and think capitalism has let them down.

As our special report this week explains, much of the blame lies with warped housing policies that date back to the second world war and which are intertwined with an infatuation with home ownership. They have caused one of the rich world’s most serious and longest-running economic failures. A fresh architecture is urgently needed.

At the root of that failure is a lack of building, especially near the thriving cities in which jobs are plentiful. From Sydney to Sydenham, fiddly regulations protect an elite of existing homeowners and prevent developers from building the skyscrapers and flats that the modern economy demands.

The resulting high rents and house prices make it hard for workers to move to where the most productive jobs are, and have slowed growth. Overall housing costs in America absorb 11% of GDP, up from 8% in the 1970s. If just three big cities—New York, San Francisco and San Jose—relaxed planning rules, America’s GDP could be 4% higher.

That is an enormous prize.

As well as being merely inefficient, housing markets are deeply unfair. Over a period of decades, falling interest rates have compounded inadequate supply and led to a surge in prices.

In America the frenzy is concentrated in thriving cities; in other rich countries average national prices have soared, especially in English-speaking countries where punting on property is a national sport.

The financial crisis did not kill off the trend. In Britain inflation-adjusted house prices are roughly equal to their pre-crisis peak, while real wages are no higher. In Australia, despite recent falls, prices remain 20% higher than in 2008. In Canada they are up by half.

The soaring cost of housing has created gaping inequalities and inflamed both generational and geographical divides. In 1990 a generation of baby-boomers, with a median age of 35, owned a third of America’s real estate by value.

In 2019 a similarly sized cohort of millennials, aged 31, owned just 4%. Young people’s view that housing is out of reach—unless you have rich parents—helps explain their drift towards “millennial socialism”.

And homeowners of all ages who are trapped in declining places resent the windfall housing gains enjoyed in and around successful cities.

In Britain areas with stagnant housing markets were more likely to vote for Brexit in 2016, even after accounting for differences in income and demography.

You might think fear and envy about housing is part of the human condition. In fact, the property pathology has its roots in a shift in public policy in the 1950s towards promoting home ownership. Since then governments have used subsidies, tax breaks and sales of public housing to encourage owner-occupation over renting. Politicians on the right have seen home ownership as a way to win votes by encouraging responsible citizenship. Those on the left see housing as a conduit for redistribution and for nudging poorer households to build wealth.

These arguments are overstated. It is hard to show whether property ownership makes better citizens. If you ignore leverage, it is usually better to own shares than to own homes. And the cult of owner-occupation has huge costs. Those who own homes often become nimbys who resist development in an effort to protect their investments.

Data-crunching by The Economist suggests that the number of new houses constructed per person in the rich world has fallen by half since the 1960s. Because supply is constrained and the system is skewed towards ownership, most people feel they risk being left behind if they rent.

As a result politicians focus on subsidising marginal buyers, as Britain has done in recent years. That channels cash to the middle classes and further boosts prices. And it fuels the build-up of mortgage debt that makes crises more likely.

It does not have to be this way. Not everywhere is afflicted with every part of the housing curse. Tokyo has no property shortage; between 2013 and 2017 it put up 728,000 dwellings—more than England did—without destroying quality of life. The number of rough sleepers has dropped by 80% in the past 20 years.

Switzerland gives local governments fiscal incentives to allow housing development—one reason why there is almost twice as much home-building per person as in America. New Zealand recoups some of homeowners’ windfall gains through land and property taxes based on valuations that are frequently updated.

Most important, in a few places the rate of home ownership is low and no one bats an eyelid. It is just 50% in Germany, which has a rental sector that encourages long-term tenancies and provides clear and enforceable rights for renters. With ample supply and few tax breaks or subsidies for owner-occupiers, home ownership is far less alluring and the political clout of nimbys is muted.

Despite strong recent growth in some cities, Germany’s real house prices are, on average, no higher than they were in 1980.

A home run

Is it possible to escape the home-ownership fetish?

Few governments today can ignore the anger over housing shortages and intergenerational unfairness. Some have responded with bad ideas like rent controls or even more mortgage subsidies. Yet there has been some progress.

America has capped its tax break for mortgage-interest payments.

Britain has banned murky upfront fees from rental contracts and curbed risky mortgage lending.

A fledgling yimby—“yes in my backyard”—movement has sprung up in many successful cities to promote construction. Those, like this newspaper, who want popular support for free markets to endure should hope that such movements succeed.

Far from shoring up capitalism, housing policies have made the system unsafe, inefficient and unfair. Time to tear down this rotten edifice and build a new housing market that works.

Specifically, the recent rhetoric of “liberalizing” housing market by abolishing density limits but not getting rid of UGB’s seems to be designed to cater to institutional land lords and real estate investors.

There’s a lot of truth to this. When outlets like The Economist opine about housing markets, they always seem to have a blind eye to the effect of regulations that limit the supply of developable land. Apart from the fact that it is not at all clear that more flats and apartments, especially at the upper end of the price range, would do much to bring prices down, there is also a presupposition about what is to blame for prices being high in the first place. London, for example, maintains its strict greenbelt policy despite having some of the highest housing prices in the world.

They blame home ownership and associated mortgage debt, but the cyclicality in housing investment suggests that it matters little whether the debt is held by private homeowners, developers or REIT investors. A bubble will eventually form. And while it can be argued that some specific American policies like deductibility of mortgage interest and operations of government-sponsored enterprises like Fannie Mae may be excessive or counterproductive, it’s pretty hard to argue that they are the primary causes of house price inflation, given the wide range of price variation in markets across the country.

If younger workers are experiencing high housing costs in some cities, then the solution is for them to either move to lower-cost urban areas or to move to lower-cost parts of the urban areas where they live. This becomes more possible if those areas are allowed to expand. But I doubt that will ever be mentioned in one of The Economist’s editorials.

Yes I agree with your analysis. Two points: One, I think the role that speculative investors have in real estate bubbles is somewhat under explored especially relative to how it relates to and often is complicated by land use restrictions. As I said before these restrictions really do seem to create an opportunity for house flippers and institutional investors to exploit a rent in a way that most average renters or homeowners can’t. Simply stated the threshold for having market leverage in such areas is so high most average people have little or no bargaining power. Two, I would also agree with is the lack of systematic analysis that the Economist article and others like it present. There is no skeptical analysis of the current dogmas of densification etc etc. Also there is almost a glib somewhat religious tone to what these articles say. You could almost boil them down to something like: Hey kids! You are not cool if you want to own a house etc etc etc. Literally is smells more like propaganda that is intended to convince people to uncritically buy into the agenda than actual journalism or academic analysis.