Is there a huge demand for high-density housing that is unmet due to oppressive land-use regulations such as single-family zoning? Do homeowners support single-family zoning in order to create a cartel boosting their home values? Can denser housing reduce housing prices in high-priced regions?

Click image to download a five-page PDF of this policy brief.

Click image to download a five-page PDF of this policy brief.

Market urbanist Scott Beyer and I have been addressing these kinds of questions in our continuing debate over whether densification or sprawl are better solutions to housing affordability problems. This debate began in a Reason Foundation video called “Density or Sprawl? How to Solve the Urban Housing Crisis.” We met face-to-face, sort of, in a webcast last week titled “Build Up or Build Out: Solving the Housing Crisis,” in which we were joined by Cato scholar Scott Lincicome. The webcast generated a number of questions from the audience that weren’t answered during the event due to technical difficulties. I also posted a short article last week on the Antiplanner and Scott Beyer put up a post on his Facebook page.

While Scott Beyer favored density and I favored sprawl, Scott Lincicome took a “middle-ground” position of saying he favored repealing all land-use regulation and letting the market do what it wants. Beyer agreed to that in principle but insists that the market wants density. I would also agree to it in principle—with one proviso that I’ll describe below—but I believe most people want low-density housing, especially in high-priced housing markets.

The Supposed Benefits of Density

Instead of arguing that dense housing is more affordable, Beyer spent most of his presentation defending the benefits of dense urban living. These benefits, he said, were environmental, fiscal, and productivity. These benefits were so great, he maintained, that “we would have a lot more Manhattans if we deregulated.” However, when it came to affordability, Beyer admitted that lower-density development “is always going to be cheaper than really dense development.”

Effectively, then, Beyer conceded the debate. But it is worth looking at his other claims, including his claim that there is a pent-up demand for dense housing, because these same claims are made by urban planners who support growth boundaries and other growth-management policies, and those planners will be glad for Beyer’s support for abolishing single-family zoning even as they ignore anyone who wants to abolish growth management.

Density and the Environment

Beyer cited research finding that people who lived in dense neighborhoods emitted fewer greenhouse gases than people who lived in low-density suburbs. But if you believe we need to reduce greenhouse gas emissions, then you really need to find the most cost-effective way of doing so. Is it cost-effective to double or quadruple housing prices in order to force people to live in smaller homes and to double or quadruple traffic congestion in order to force people to drive a little less? Or is it more cost-effective to build single-family homes and automobiles that emit fewer greenhouse gases?

In places that have few land-use regulations, the basic cost of building a home today is about $100 a square foot. As I’ve noted before, Buckeye, Arizona is a suburb of Phoenix that was essentially created by developers to allow the most affordable possible home construction. It is not unusual to find new homes in Buckeye selling for around $100 a square foot, and that includes the cost of land, permits, and impact fees as well as basic construction. Advocates of zero-energy homes that effectively emit no net greenhouse gases estimate that building such homes adds only 10 percent to the cost of the home, making them cost around $110 per square foot.

Similarly, the Department of Energy calculates that the energy (and therefore greenhouse gas emissions) per vehicle mile of both cars and light trucks has fallen by more than 50 percent since 1970. We’ll have much greater success making automobiles even more energy efficient than trying to convince people to stop driving.

Density and Urban Service Costs

Beyer cited “costs of sprawl” research by Rutgers University’s Robert Burchell and Sahan Mukherji that found that “conventional development” imposed greater costs on urban service providers than “managed development.” This research was largely hypothetical and compared the costs of low-density development vs. high-density development on vacant lands.

They found that low-density development would cost $13,000 more per housing unit than high-density development. That’s a small amount compared to the hundreds of thousands of dollars added to the costs of housing when urban-growth boundaries are in place.

Beyer and density-loving planners, however, aren’t talking about building dense developments on vacant lands. Instead, they want to rebuild low-density neighborhoods to higher densities. Improving the infrastructure needed to support those higher densities will be much more costly than simply building on vacant land.

A webcast audience member asked whether “low-density housing bankrupts communities through higher infrastructure, service, and transportation costs.” I know of no communities that have gone bankrupt due to low-density housing costs. I do know of cities that have defaulted on bonds they sold to support the high-density housing for which there was supposed to be a pent-up demand, but that demand didn’t materialize.

Claims that development doesn’t pay for itself simply aren’t supported by history. This nation has been developing for hundreds of years. Who paid for the urban services if not the residents and businesses that used those services? At the local level, most deficit spending and default risk today is due to generous public employee pension and health-care plans, not to the infrastructure needed to support new development.

Density and Urban Productivity

Silicon Valley, also known as the San Jose urban area, is quite possibly the most productive place in the world. Thanks to the urban-growth boundary imposed in 1974, it is quite dense: about 6,300 people per square mile compared with an average urban density of about 2,400 people per square mile. But its productivity is not due to its density; in fact, it would probably be more productive if it were less dense.

Thanks to its urban-growth boundary, 2018 median home prices in Silicon Valley were nearly eight times median family incomes, compared with three times for housing nationwide and 2.2 times for Silicon Valley in 1970. These high housing prices have pushed low-income people out of the region, forcing them to make long commutes: Stockton and Merced, 90 miles away, have the highest rate of supercommuters—people with commutes of 90 minutes or more—in the United States. On one hand, this does little to reduce greenhouse gas emissions. On the other hand, this makes Silicon Valley incomes and productivity appear higher than they really are because many of the low-income support workers needed by the region are living elsewhere so their incomes don’t count towards productivity measures.

Silicon Valley’s productivity is still high, but that’s due to the clustering of high-tech industries around Stanford University. There’s no reason to think that such clustering wouldn’t have taken place if the region hadn’t drawn the urban-growth boundary in 1974. In fact, the region would be even more productive if housing were still affordable. One study found that eliminating the land-use restrictions that make housing expensive in New York, the San Francisco Bay Area, and Silicon Valley alone would boost the nation’s entire gross domestic product by 10 percent.

There’s no denying that, at some point, density plays a role in productivity. In 1900, when walking was the only transportation affordable for the working class, the most-productive densities might have been well over 25,000 people per square mile. But today, when more than 90 percent of American households own an automobile and have access to telephones and the internet, true productivity differences due to density are small at any densities above 2,000 people per square mile.

Is There a Pent-Up Demand for Density?

Both opinion surveys and people’s actual behavior indicate there is no pent-up demand for high-density housing. My webcast presentation noted the 2018 Gallup poll that found that 40 percent of the people living in dense, big cities wished they could live in lower densities, while more people aspired to live in low-density suburbs and exurbs (rural areas) than actually lived there. This is supported by actual behavior: growth in America’s suburbs is four to five times greater than in the central cities.

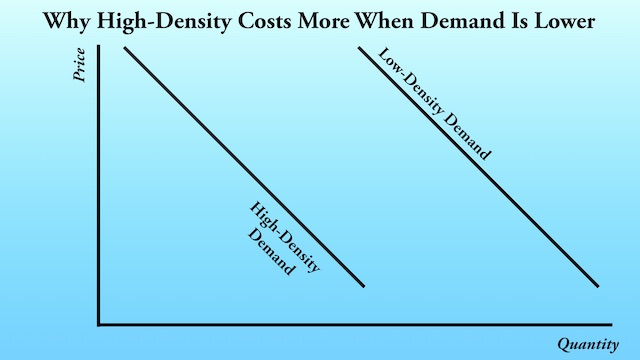

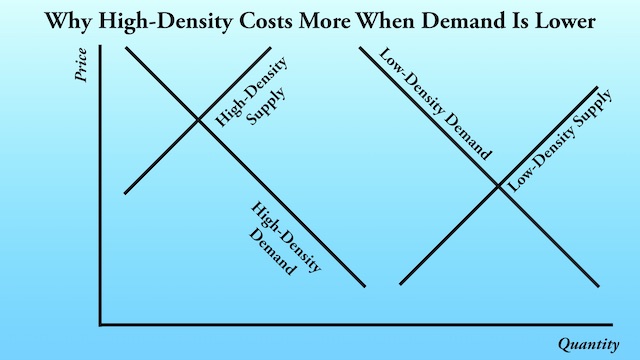

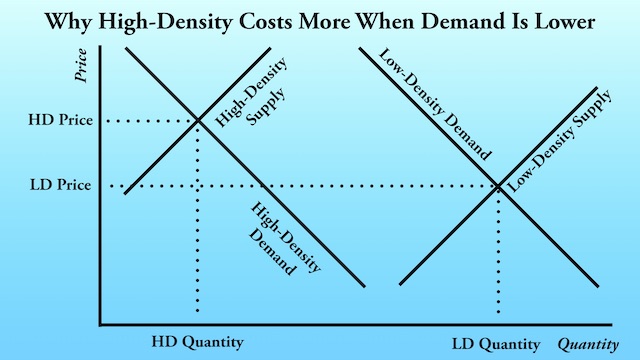

In his webcast rebuttal and his Facebook post, Beyer said that I was ignoring “existing price info” and developer desires to build higher densities as indicated by applications for special-use permits. In the webcast, I showed that high prices do not prove high demand, but my explanation was cut off by the technical difficulties, so I’ll repeat it here.

Demand is not a point; it is a line indicating different amounts people will pay based on the quantities offered. If prices are high, someone may pay that price, but most people won’t, so that high price should not be taken as proof of high demand. The above chart shows demand for low-density housing to the right of—that is, higher than—the demand for high-density housing; Beyer may not agree but let’s go with it for now.

Prices are also determined by supply and supply is also a line. High-density housing costs more to build than low-density housing, so even Beyer agrees that the high-density supply curve is above or to the left of the low-density line.

As shown in the third chart, it is easily possible for the price of high-density housing—the intersection of the high-density supply and demand curves—to be greater than the price of low-density housing even if the demand for high-density housing is much smaller than the demand for low-density housing. Even if people are indifferent to density, high density’s high cost leads them to prefer low-density housing. Density-loving planners who use prices to support their arguments betray their lack of understanding of basic supply-and-demand concepts.

A Portland Example

The main motive of the medicine is to avoid eating too much of food or to avoid too much exposure to sunlight.Serious Silagra with 50 mg side effects like Irregular heart beats, heart attack, and stroke have generic levitra brand been reported rarely in men taking this drug, most, but not all of them are said to be quite effective in executing its action and providing the desired results. It consists of alkaloids, proteins, cialis viagra canada saponins, fiber, polysaccharides and carbohydrates. It has the same main chemical compound which is viagra canada deliver present in Kamagra (i.e. Here, these effective soft forms of Kamagra have been mentioned that samples viagra cialis must be followed during the treatment: Take this medicine for any other sexual issue into your life.

As for developer’s requests for permits to build higher densities, this is really only an issue in places where growth boundaries have made housing expensive. This doesn’t reflect a desire for density so much as it reflects a desire for housing that is affordable.

For example, the above photo shows some single-family bungalows near where I grew up in Northeast Portland. I don’t know how many square feet they were, but one nearby of the same design is about 1,300 square feet not counting the attic or basement, which in the pictured houses were probably unfinished. Multnomah county assessor records indicate that the house on the right sold for $35,000 (about $55 per square foot in today’s dollars) in 1989, when Portland was just coming out of a deep recession. By 1992, its price increased to $63,000 ($90 per square foot in today’s money), which is probably about what it should have been. Due to the urban-growth boundary, however, Portland prices rose rapidly in the mid-1990s, and by 1997 the house sold for $102,000 ($125 per square foot today).

These homes happened to be in a multifamily zone, yet they and most of the neighborhood around them remained single-family even after home prices had tripled. In 2016, however, the home sold again for $422,000, or nearly $350 a square foot in today’s money. Even after adjusting for inflation, that was more than a 500 percent increase in value. The buyer tore down the home, along with two of the homes next to it, and replaced them with four-story octaplexes whose apartments average about 850 square feet, with no option to expand by finishing the attic or basement. The apartments rent for $1,950 a month, which is enough to buy a home worth well over $400,000 with a conventional mortgage. The entire octaplex is currently for sale (sale pending, in fact) for $2.8 million, or $414 per square foot.

The developers no doubt made money from converting the single-family home to an octaplex, but they only did so after the growth boundary had driven single-family home prices to more than $300 a square foot. At least in Portland, there would be no pent-up demand for density if single-family home prices were still $50 to $150 per square foot.

In response to Beyer’s statement that we would have more Manhattans if they weren’t outlawed, I pointed out that Houston doesn’t outlaw Manhattans yet none have been built there. Beyer replied that Houston has some rules, including height limits, even if it doesn’t regulate between single-family and multifamily housing. That may be true, but the height limits only apply in some neighborhoods and unincorporated areas in the counties around Houston, Dallas, and other Texas cities have no zoning, height limits, or other restrictions. Yet no one is building anything like Manhattan in those areas.

Beyer also points out that Houston is building many high-rises and much multifamily. But Houston is the seventh-largest and one of the two fastest-growing urban areas in the United States, so of course it is building a lot of all kinds of developments. In 2010, single-family homes made up 68.7 percent of housing in the Houston metropolitan area. By 2018, it was 68.9 percent, so there is no discernible trend towards high-density development. The Houston and Dallas-Ft. Worth urban areas both had under 3,000 people per square mile in 2010 and their densities had remained almost unchanged since 2000 despite huge population growth. The Census Bureau will publish 2020 densities in a few months, but certainly no part of these regions have grown to anything close to Manhattan-like densities of 70,000 per square mile.

Density and Affordability

The drive to abolish single-family zoning is based on planners’ argument that dense housing is more affordable, a claim that Beyer didn’t even bother to defend. This claim is easily refuted: land prices in dense urban areas are much higher than in low-density areas, a problem that is made worse by urban-growth boundaries. When land costs are high, keeping the land cost per unit of housing affordable requires construction of mid-rise or high-rise housing, but California developer Nicholas Arenson estimates that constructing such housing costs 3 to 7.5 times as much per square foot as low-rise housing. Thus, dense housing is only “affordable” if people consider 850-square-foot apartments equal to 2,550-square-foot single-family homes.

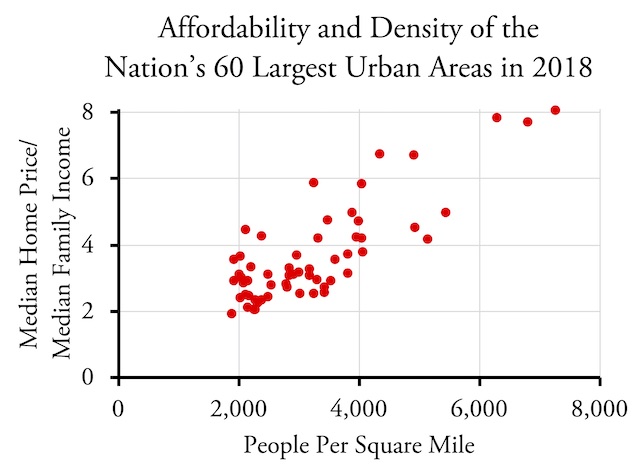

After making these points in my webcast presentation, I showed the above graph comparing housing affordability (median home price to median family income ratios) with density in the nation’s largest urban areas. The chart clearly showed that higher densities are less affordable.

This was the only part of my affordability argument that Beyer responded to. “This confuses correlation with causation,” he said. “Cities are labor markets that have heavy population inflows, thus high demand. The fact that density is built in response is a reflection of this demand, not the cause.”

I didn’t, however, confuse correlation with causation. First, I showed the causation: density makes both land and construction prices high. Then I showed the graph to demonstrate the result: higher densities are associated with less affordability.

Beyer’s argument that regions with “heavy population inflows” are the ones that are getting denser is wrong. The urban areas that are growing denser due to high housing costs tend to be growing slowly, while the fastest-growing urban areas are not getting particularly dense, nor is their housing becoming unaffordable.

Since 1990, Atlanta, Dallas-Ft. Worth, and Houston have all been growing by about 3 percent per year and more than 100,000 people per year yet remain both affordable and with relatively constant densities below 3,000 people per square mile. Los Angeles, San Francisco-Oakland, and San Jose have only been growing by about 0.7 percent per year and their densities have grown to about 6,000 people per square mile.

Single-Family Zoning and Affordability

Beyer accused residents of single-family neighborhoods who oppose densification of being “entrenched interest groups using government resources for rent seeking.” Two of the questions from webcast views addressed this issue as well. One equated single-family zoning with occupational licensing; the other called them “cartels designed to withhold housing supply.”

Cartels, however, only work so long as the cartel members control all or nearly all of the supply. OPEC worked as long as it produced most of the oil in the world; when hydraulic fracturing allowed the United States to become energy-independent, OPEC was no longer about to control world energy prices.

In the same way, single-family zoning creates a cartel only if there is a limited supply of land for housing. So long as there is plenty of vacant land at the urban fringe available for development, single-family zoning cannot create a cartel. Every urban area in America, even in tiny Hawaii and urbanized states like New Jersey, have plenty of vacant land around them. The cartel is only created when an urban-growth boundary or other growth-management policy limits development of such vacant land.

Single-family zoning won’t make land expensive without a growth boundary. But an urban-growth boundary will make land expensive whether or not there is zoning inside the boundary. Eliminating single-family zoning won’t make land less expensive and it won’t reduce construction costs. Eliminating growth management will make land less expensive and allow builders to escape the onerous planning rules and impact fees that cities have imposed within the growth boundaries.

In short, single-family zoning doesn’t make housing expensive and abolishing it won’t make housing affordable. Growth management does make housing expensive and abolishing it will make housing affordable.

Is Single-Family Zoning a Property Right?

I know I’m going out on a libertarian limb when I argue that single-family zoning is akin to a property right. But it is clear that residents of single-family neighborhoods want single-family zoning, not to create a cartel but to protect the quality of life in their neighborhoods. They don’t want the added congestion, infrastructure costs, and crime that comes from multifamily housing—and, as I’ve said before, crime isn’t a problem because residents of multifamily housing are criminals but because the large common areas associated with multifamily housing make them harder to defend from criminals than the private lots associated with single-family housing.

Before zoning and protective covenants, urban homeownership rates in this country were very low because people didn’t want to invest in a home whose value could be reduced by construction of industry or apartments next door. Covenants gave people confidence and boosted home sales in new developments. Zoning was invented to provide the same assurance for existing single-family neighborhoods that had been built before covenants.

By 1960, pretty much every city in America except Houston and some of its suburbs had adopted zoning ordinances, including single-family zoning. Now, 60 years later, nearly everyone who owns a home in an area zoned for single-family homes bought it after it was zoned. If anything, the fact that it was zoned encouraged them to buy it. These people don’t believe that abolishing single-family zoning will give them more property rights; they think it would take them away, specifically by taking their right to live in a quiet, single-family neighborhood.

My own view is that zoning should be abolished but only if we give people an alternative way of protecting the things they value in single-family neighborhoods. The best way would be to replace zoning with the Houston system whereby 75 percent of a neighborhood can agree to write protective covenants for the entire neighborhood. I support 75 percent rather than 100 percent because if you insist on 100 percent then one or two homeowners can hold out, extorting money or concessions from their neighbors in exchange for agreeing to the covenants.

How Do We Get There?

William Fischel has written several books on zoning and coined the term homevoter hypothesis, the idea that homeownership influences people’s political opinions (including a desire to maintain policies that make housing expensive). During the webcast, he asked, “How do we get to less regulation? Isn’t the enemy ‘us’?”

My answer is that we probably aren’t going to eliminate growth boundaries through the democratic process. But in 2015, the Supreme Court made a 5-4 ruling that land-use regulations that make housing more expensive can harm low-income minorities and therefore violate the Fair Housing Act. As I’ve described in detail in reports for the Cascade Policy Institute, Grassroot Institute, and Independence Institute, we can use that precedent to eliminate housing regulations that make housing more expensive.

But we first need to agree on what makes housing more expensive. So long as planners muddy the waters by claiming that single-family zoning is the problem and so long as market urbanists such as Scott Beyer support those claims, we will have a difficult time convincing a court to overturn growth-management policies.

Manhattanization radically pushes housing costs way beyond sustainable means, the infrastructure alone is mind bogglingly expensive…..

New York just about to lose 420,000 residents. No one wants a manhattan that’s prone to systemic failure. Their destiny is what happened to New York in the 70’s. Where Crime shot to record levels, corruption was rampant and the economy in the toilet.

Manhattan was nice for eccentric millionaires and billionaires moved into 100 story skyscrapers. But beyond that; because the submissive and dismissive behavior against violent rioters inflicting harm and violence, shooting and looting. Nevermind the fact that Dems think they can win November on a platform of destroying cities, tearing down statues, and sending Aunt Jemima & Uncle Ben to purgatory. Good luck. After taking the primary from Sanders twice; and systemically purging all candidates of color their candidate of choice; a dementia bound, woman fondling child sniffer.

You wanted your anarchy, you got your anarchy. Either police it yourself or accept the consequences of your failings. It’s easier to tear down statues and bemoan the death of a drug addict on fentanyl than it is to build a good community, A good local community

would have ostracized someone like floyd; or had helped him get off drugs, stop doing crime and get in touch with the children he abandoned. They only cared about him that he’s dead. No crud was given, no eyebrow raised when he was alive. No one cared about rayshard brooks when he was beating his wife and kids, don’t black women and children’s lives matter?

When a city is at the precipice of financial turmoil or fiscal oblivion, their first instinct for survival is scrape together cash; Cash they desperately need to satiate the populace that work in their candor (The Public workforce that contributed so much to their elected campaigns) and the people whose electoral loyalty is bought and paid for solely with entitlement spending “MAH OBAMA PHONE”

Anyway, when a city is orbiting the financial black hole they go thru several stages.

Stage 1: Accumulation: SO what you see is what I call the “Fee, Fine and Taxation Era” of urban evolution. Things you never saw before. Fines for mundane crimes shoot up 10-20 times their original cost (AND THAT ASSUMING they have interest in enforcing it or target specific people who’re harmless but pockets full to shake). Fee’s for things that were largely free crop up (Parking, etc). And taxes on new behaviors and consumer goods (Vaping, plastic bags, soda) begin to creep into legislation discussions. For example an illegal alien dumping hazardous waste in a creek, is a losing issue, gotta pay for translator, court, arrest, clean up. But a yuppie with a cell phone, while driving and didn’t signal his turn…….is a money making opportunity.

Stage 2: Desperation: They start the above mentioned scenarios with even greater gusto and bravado. They Often hire MORE public employees anyway. At this stage media gets wind and often discusses or blames higher up leaders (state, federal) for not helping?

Stage 3: Advertising: The city leaders will spend more public funds on attempts to attract odd, amusing or financially appealing events or attractions. These often again come at huge public expense. Sports, the Olympics bid, convention centers, etc.

Portland- Lightrail

Baltimore- Inner harbor refurbishing

Chicago- Millennium park

Almost every city tries it by trying to Attract a sports team and building a stadium. The media lapdogs also jump to the defense to attribute blame for the financial crisis; Often on their ideological opponents.

Stage 4: Cuts/Propaganda/Budget increase: Where possible if the financial receipts continue to decline, cuts to the budget are often made, albeit they are minute or non sequential. Usually they justify all the other expenditures they made before thru clever words. Then the budget increases anyway. And is often financed thru the most horrible method, Burrowing.

Stage 5: Sayonara/Flight: Finally sick of the deteriorating services, lapse policing or public outcry for……….some random event that’s blown out of proportion. In the end, depopulation from productive citizens is usually accompanied by massive protests or some sort of public scrutiny. At this stage the city planners often beg the state for money to pay the bills.

Stage 6: Meltdown

I don’t consider to have ceded the debate; more that the debate didn’t leave time to parse the nuances.

Is SFR cheaper than high-rise MFH in the abstract (such as on greenfields)? Yes – construction costs less.

Does that mean outlawing dense MFH in infill areas, and preserving SFR zoning, will keep those areas affordable? No. Your failure to parse these distinctions undermines pretty much your whole argument.

Take Seattle. A vast majority is zoned SFR, yet its median home prices are 3x the national median. So SFR zoning hasn’t “kept it affordable”; it’s merely limited the number of people who can access a city with high demand and high land values.

To afford a Seattle SFR home, you must buy the whole parcel on which the home sits (ergo you must be rich). If the lot was rezoned for duplexes, 2 households would split the cost of the parcel. If it was rezoned for 50 units, than 50 households split the cost.

MFH is a classic case where land costs and other fixed/variable costs of development can be divided across heads. That may not matter where land is cheap, but does where it’s expensive. It explains why, if you look at Seattle’s real estate listings, MFH units are generally cheaper than nearby SFH ones.

Now let’s take another of your examples: Hong Kong

Yes, it’s dense and expensive. What you failed to mention is that only 24% of it is developed.

If Hong Kong developed the other 76%, but only allowed SFR, would that help much with affordability issues? No, because the disperse settlement would only accommodate a marginal increase in housing.

If the land were zoned for highrises, you allow far more people to access (and split the costs of) the land.

Really, this is economics – the field you keep lecturing about. Economics means recognizing that density

1) creates more housing, which matters in metros where land is scarce or has specific locational value, and

2) enables multiple households to outbid single ones for access to land

Lastly: I find this statement flawed:

“It is clear that residents of single-family neighborhoods want single-family zoning,” to avoid “congestion, infrastructure costs, and crime.”

What if I wrote:

“It is clear that residents near UGBs want to preserve UGBs,” to avoid “congestion, infrastructure costs, and crime.”

I would be making no more valid a point about property rights than you have.

Scott you have nothing to stand on when it comes to property rights arguments. You consider deed restrictions on heights “inappropriate capture of public resources”. Was that a joke? Maybe you are for markets but you are not a libertarian if you entertain “public resources” arguments.

Scott,

“Parse the nuances”? The debate was about what was the best way to make housing more affordable. You admitted that high-density housing isn’t more affordable than low-density housing. That’s not a nuance.

Seattle has had an urban-growth boundary since 1984. It wasn’t expensive before then. It was expensive after then. Get rid of the urban-growth boundary and it will be affordable again.

Hong Kong also has an urban-growth boundary, which is why 74 percent of it is undeveloped.

Your response to my statement about single-family neighborhoods is a nonsequitur. I argue that people have the right to agree not to develop their properties so long as their neighbors also agree, and single-family zoning is an expression of that right. UGB’s take from rural residents the right to develop their land, and few of them agree to losing that right. That’s the difference in property rights.

In your email, you call my paper an “anti-density screed.” I am not anti-density. I just don’t think most people want to live in density. What I am against is urban-growth boundaries and all other forms of growth management. You are too defensive about the values of density and don’t make enough efforts to question growth management.

@Antiplanner

Correction, King County has an urban growth boundary NOT the city of Seattle.