Last week, the federal debt reached $26.3 trillion, and it is going nowhere but up. In fact, it grew by $1 trillion in just the previous 40 days.

Click image to download a four-page PDF of this policy brief.

Click image to download a four-page PDF of this policy brief.

Not to worry, say some people. After all, federal assets are worth somewhere around $200 trillion. President Trump once suggested that it might be possible to pay off the federal debt by privatizing federal assets. This paper will take a realistic look at whether this is true.

The claim that federal assets are so valuable is a relief to those who worry about the federal debt, which unfortunately isn’t enough people. The problem is that the $200 trillion value is at least 50 times too much.

The $200 trillion is from a report from the Institute for Energy Research that estimates the value of federal oil, gas, and coal. But fossil fuel values have declined since the report was written in 2013. Much more important, the numbers it uses are the values of the resources “to the economy,” not the amounts the federal government would receive for selling those resources. In other words, they are gross, not net, values, and the difference is substantial.

The Value of Federal Energy Resources

The Institute for Energy Research (IER) is probably correct that the most valuable resources owned by the federal government are oil, gas, and coal. After all, the federal government owns more than 600 million acres of land used for growing timber, forage for domestic livestock, recreation, and water supplies, but the only resources that come close to making a profit are fossil fuels.

This creates a problem. If the nation decides to become less dependent on fossil fuels due to climate concerns, then the long-term value of federal assets may be a lot less than their value at recent prices.

A related problem is that the federal government owns more of these resources than almost anyone else in the world, and it can’t simply dump them on the market tomorrow and get recent prices for them. Whoever owns them is going to have to meter them out over many years, centuries in fact, and that will greatly reduce their present value.

The IER estimates that the federal government owns about 1.2 trillion barrels of oil, 2.15 quadrillion cubic feet of natural gas, close to a trillion tons of coal in the contiguous 48 states, and perhaps an equal amount of coal in Alaska. The institute’s report assumed that oil was worth $100 a barrel, natural gas was worth $4 per thousand cubic feet, and coal was worth $15 per ton in the Powder River Basin and $35 per ton elsewhere. In 2019 prices were more like $70 per barrel, $3.50 per thousand cubic feet, $11.50 per ton in the Powder River Basin and $35 per ton elsewhere, and prices this year are even lower.

These aren’t the prices the federal government receives or could receive for these resources. From these gross values must be subtracted the costs of extracting and transporting the resources to markets. Much of the federal government’s resources, including 982 billion barrels of shale oil included in the institute’s calculations, can only be extracted at a high cost, and at pre-pandemic prices it would not be profitable to producers even if the federal government gave it away.

Oil is one of the federal government’s most valuable assets, and the environmental costs of extraction can be low because wells don’t occupy a lot of land. But the federal government’s share of oil’s value is just a few dollars per barrel. Bureau of Land Management photo.

For many years, the federal government has charged a royalty of 12.5 percent of the gross value of oil and gas extractions, though it has begun charging as much as 18.75 percent for off-shore oil. Some argue that it could charge even more, pointing out that Texas collects 25 percent royalties for oil on state lands. However, Texas oil tends to be less expensive to extract that most of the oil on federal lands, so the federal government is not going to get 25 percent royalties. North Dakota charges 18.75 percent; let’s be optimistic and assume that the federal government can get that.

At 12.5 percent, the royalty on a $70 barrel of oil is less than $9. At 18.75 percent, it’s slightly more than $13. Either way it’s a lot less than the $100 per barrel assumed in the IER report. To be fair, I’m pretty sure the report’s authors understood the difference between gross and net. But a lot of people who read the report did not, including writers for Forbes, Time, MarketWatch, and Trump’s own staff—and I haven’t seen any evidence that IER tried to correct their errors.

A 2,600-Year Sale Plan

On top of this, the sheer volume of federal resources will make them difficult to sell. The United States consumes about 7.3 billion barrels of oil per year. The 1.2 trillion barrels that the federal government owns represents a 164-year supply (so much for peak oil). Similarly, we use about 30 trillion cubic feet of natural gas per year, so the federal amounts represent a 72-year supply. Finally, we use about 730 million tons of coal per year, so the federal government owns about 1,300 years worth, and that’s not even counting coal in Alaska.

The federal government owns centuries worth of coal in the Powder River Basin, Wyoming, but its value is low and no one knows whether there will be any demand for coal a century from now. BLM photo.

The federal government is not the only oil producer in the United States. In recent years, federal reserves have produced 40 percent of the coal mined in this country but less than a quarter of the oil and just 13 percent of the natural gas. The Institute of Energy Research claims that these amounts are less than “historic norms,” but the reason for this is not reduced production on federal lands but increased production on other lands.

Let’s be optimistic and say that the federal government can ramp up production to provide half of what we use without encountering serious political opposition from private producers who won’t want to see federal competition. That means it will still take more than 320 years to sell all of the oil, more than 140 years to sell the natural gas, and 2,600 years to sell all of the coal in the contiguous 48 states.

An estimated 10 billion barrels of oil and 9 trillion cubic feet of natural gas lie under Alaska’s Arctic Wildlife Refuge, but selling the fossil fuels is a political hot potato and selling the land would be even more difficult. Fish & Wildlife Service photo by A. Thayer.

Some may point out that a growing population and economy will increase consumption of these resources, allowing the federal government to liquidate its assets sooner. But the counterargument is that competitive pressures, both political and economic, from other sources of energy could easily depress demand for these resources.

Discounting the Future

Calculating today’s value of resources that will take hundreds of years to sell or consume requires the use of a discount rate, that is, an interest rate charged against future values. On one hand, the federal government has to pay interest on the $26 trillion it has borrowed. On the other hand, if it were to sell all of its resources today, any potential buyers would have to borrow funds and cover the interest on those loans or bonds. A lower interest rate means a higher present value, but today’s low interest rates are not a dependable indicator of long-term market values.

At a 3 percent interest rate, assuming the federal government can get 18.75 percent royalties and the resources are worth $70 per barrel, $3.50 per thousand cubic feet, $11.50 per ton of Powder River coal, and $35 per ton of other coal, then all federal energy assets are worth about $2 trillion. That’s far short of the $200 trillion quoted in the article cited at the beginning of this paper. Increasing the discount rate to 4 percent, which is closer to what most private investors require, would reduce this to less than $1.5 trillion.

Even if 3 percent is realistic, $2 trillion is probably optimistic. More than 80 percent of the federal oil estimated in the IER report is in oil shale, which is the most expensive kind of oil to extract, currently costing $75 to $90 a barrel. So long as the price of oil is $70 a barrel, oil producers are not going to pay the federal government $13 a barrel for the privilege of losing money on shale oil.

This means an 18.75 percent royalty is probably unrealistic for a lot of federal energy assets. Alaska coal is probably similarly expensive to mine so royalties there are also going to be smaller. Adjusting for these issues could reduce the value of federal energy assets by at least $500 billion.

Even if the federal government can get $2 trillion for its fossil fuels, there will be a lot of political competitors for that money. Historically, the federal government has given as much as half its mineral revenues to states or counties, and they won’t be happy to lose that amount simply to help the federal government pay off its debt.

The Value of Federal Lands

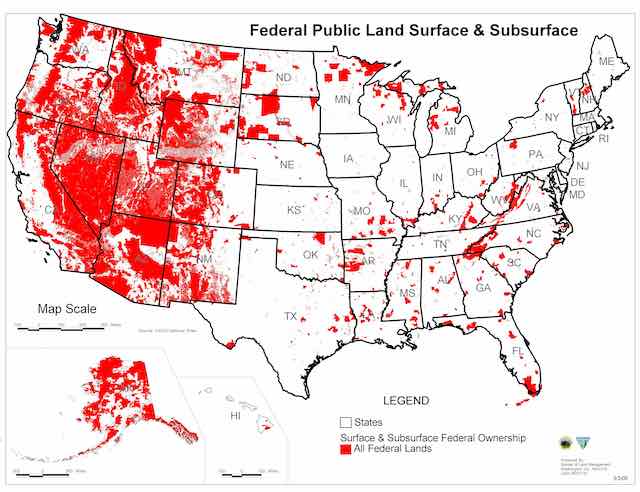

Other federal lands aren’t worth much more. The same writer who assumed that the federal government could sell its energy resources at gross rather than net values added that, “the federal government owns about 28 percent of all land in the USA and that the total land value is about $23 trillion so the land alone is close to $7 trillion in value.” That assumes that land at the top of Mt. Rainier is worth the same as land in Manhattan, which is obviously incorrect.

A 2015 paper by the Bureau of Economic Analysis estimates that land in the United States is worth about $23 trillion, which agrees with the above estimate, but calculates that federal land is worth only $1.8 trillion. Even that is optimistic. The $1.8-trillion figure is based on an average value of $4,100 per acre. Certainly some acres are worth a lot more than that, but any attempt to sell the land would quickly create a glut on the market.

The federal government owns 623 million acres of land, but the majority is shrub-steppe, desert, or arctic tundra, so–except where there are energy minerals–individual acres aren’t worth a lot.

The Bureau of Economic Analysis paper didn’t count federal lands in Alaska, most of which are remote and not worth anything close to $4,100 per acre. Of the 446 million acres considered in the paper, about 70 million acres are in national parks and perhaps another 50 million acres are designated wilderness, and good luck trying to convince Congress to sell those, not to mention another 75 million or so acres of wildlife refuges outside of Alaska. This means that, to get $1.8 trillion, the average price for the remaining acres would have to be at least $7,200 per acre.

According to the Forest Service, only about 150 million acres of federal land outside of wilderness or other protected areas are considered commercial timber lands. Even in the highly productive Oregon Coast Range, such lands typically sell for less than $4,000 an acre in parcels large enough to manage as timber. Weyerhaeuser just sold 630,000 acres of Montana timberland for $230 an acre. While some of the old-growth timber on some federal lands may be worth more than the second-growth timber found on these private land sales, the United States as a whole is growing timber far faster than it is cutting it, so the demand for timber now owned by the federal government is not particularly high.

Old-growth trees like this one were once very valuable, and now they are mainly found on federal lands. But today they aren’t worth much because the mills with saws large enough to cut through logs of this size are all out of business.

Millions of other acres are either alpine or desert tundra. Much of the remaining land might be classified “agricultural” because it grows grass or forage that can be eaten by domestic livestock. With irrigation, fertilizers, and perhaps terracing on steep slopes, a variety of crops could be grown on this land. But the U.S. already has far more private farmlands than it uses for growing crops including all of the food needed by livestock, so the value of federal lands for agricultural purposes is nil.

The most likely use for some of the land would be for second homes. The Census Bureau says the United States has about 80 million families, so if every American family bought one acre for a second home, that would still leave hundreds of millions of acres with no buyers. To produce $1.8 trillion, every family would have to pay an average of $22,500 per acre. But building lots aren’t typically worth $22,500 when they have little or no road access, not to mention no electricity, water, or other services.

Ultimately, the federal government is not going to earn a windfall by selling its land because the United States already has an abundance of private lands in every state except Nevada. Selling more land around Las Vegas, whose expansion is inhibited by a ring of federal lands, could earn some revenue, but not $1.8 trillion. Elsewhere, the timber, forage, and other resources found on federal lands are plentiful on private lands, which are usually more productive and less costly to manage.

The federal government has tens of millions of acres of land like this in Nevada, but except around Las Vegas it isn’t going to sell for $4,100 an acre, much less $7.200 an acre. Photo by Ken Lund.

The Value of Other Federal Assets

Other federal assets include the hydroelectric dams managed by the Corps of Engineers and Bureau of Reclamation. Together, these dams produce about 112 billion kilowatt-hours of electricity per year. The IER report described these power facilities as “underperforming,” mainly because of political pressure to keep electric rates low. While sale of the dams might generate more revenue than the income from the electricity the federal government is currently selling, the difference would be in the billions, not trillions, of dollars.

The IER report mentions other federal assets, including underutilized buildings (most of which are old and dilapidated), Amtrak’s physical plant (which has a negative net value after accounting for its state-of-good-repair needs, and 4 million miles of roads (nearly all of which are owned by state or local governments, not the federal government). These are not going to contribute much towards paying off the national debt.

Why Even $3.8 Trillion Is Unlikely

Still, if federal lands and energy resources are worth $3.8 trillion, that’s a huge amount and represents 14 percent of the current national debt. Yet this calculation represents a lot of questionable assumptions:

- Will creditors be willing to wait the hundreds of years it is going to take to sell energy resources?

- Will the oil shale that represents two-thirds of the $2 trillion calculated value of energy resources really be able to produce royalties of $13 or more per barrel?

- Considering political and economic competition to fossil fuels, will there even be a demand for oil, gas, and coal 100 or more years from now?

- Is 3 percent a reasonable discount rate considering that, historically, investors have wanted to get 4 or more?

- Can the federal government find buyers willing to pay an average of $7,200 per acre for more than 250 million acres of federal lands?

- If the federal government sold land or accelerated the sale of energy assets, would Congress be able to resist demands that the revenues be shared with state and local governments or special programs such as the Land & Water Conservation Fund?

In sum, claims that the federal government can pay off its debt by selling land and energy resources appear to be greatly exaggerated. It is doubtful that the federal government could pay off even $3.8 trillion of that debt by selling all of its land and mineral rights. Some of those lands, such as national parks, aren’t for sale. Some of the sales will lead to political pressures from states and counties to share the revenues with them.

Lessons for Public Land Supporters

This might make people who oppose privatization happy, since if the lands aren’t worth as much there may be less pressure to sell them. Yet the federal debt would reach crisis proportions any time that world currency traders decide the U.S. dollars can’t hold their value as well as Chinese yuan. When that happens, there will be pressure to sell federal lands no matter how little they are worth.

To prevent that, those who want to defend national forests, wildlife refuges, and other federal lands need to show that they can be productive without selling them. Currently, environmentalists do everything they can to hinder sales of federal resources even as they demand that recreation on public lands be free or subsidized. That is the wrong strategy.

Forest Service research in the 1980s found that recreation on federal lands was more valuable than timber, grazing, non-energy minerals, and water combined. While it wasn’t more valuable than oil & gas or coal, these energy resources can be extracted using the surface area of only about 1 percent of the federal lands, leaving the other 99 percent for other resource uses.

This means recreation is a valuable untapped resource, and in some ways it is more valuable with the federal lands kept intact than broken up into small plots. Rather than resist recreation fees, environmentalists should encourage them as a way to insulate federal lands from demands that they be privatized.

Or you could ban state and federal governments from burrowing….and do what new york did in the 70’s to pay off it’s bankruptcy.

Municipal Assistance Corporation to pay off it’s debts in mandatory fashion.

paul summed it up:

Cuts to spending and make sure taxes are increased to cover actual costs. The idea that cutting taxes will somehow decrease the deficit was shown to be false when it didn’t work for President Reagan in the early 80’s. At least Reagan realized the deficit was dramatically increasing and passed a large tax increase in 1986 to at least minimize the deficit. Unfortunately President George H. W. Bush made the foolish promise of “no new taxes” then realized that for the spending demanded of the Federal government there was no option but to raise taxes. President Clinton sensibly kept vetoing tax cuts and at the end of his term the US had a budget surplus.

Want to keep Federal spending down? When the economy is doing well any increase in Federal spending must be paid for with tax increases.

The debt is never getting paid. The US has defaulted on several occasions, the most recent being when Nixon closed the gold window.

The best answer is to repudiate the debt and return to sound money.

Decades ago I asked my seventh grade social studies teacher how the US National Debt could keep growing with no plan to pay it off. He replied that because the US Government was going to go on for ever, it didn’t need to ever pay its whole debt.

Linus: Nothing goes on for ever.

Plan

– Pass a constitutional amendment limiting the federal budget to a certain percentage of GDP.

– Put a moratorium on food stamp/unemployment recipients for the next 6 years.

– STOP BURROWING.

– Axe, not trim. AXE the federal budget. Cut all federal agency budgets by 15%. Cut all salaries exceeding 100,000 by 20%.

– Establish mutual funds and bonds with the money cut from the budget to put in escrow and begin setting up a mutual assistance corporation to pay off debts

Wall Street Journal …

Shell Takes $22 Billion Write-Down, Expecting Lower Oil and Gas Prices

Anglo-Dutch energy giant’s action follows a similarly large move by BP

https://www.wsj.com/articles/shell-takes-22-billion-write-down-expecting-lower-oil-and-gas-prices-11593504718

They literally have to not increase the budget so much and that solves everything. I think Paul Ryan told Stossel that he has people day and day in his office begging for money. He said that the only way for him to say no, was a balanced budget. But the pressure to maintain is so great, look at Bush and his 100+ program cut proposal and the flak he got. Boring stuff doesn’t engage people, but meth heads overdosing in custody do.