The United States truly dodged a bullet when it elected not to build any high-speed rail other than the ill-fated California route. As described in recent Youtube videos, high-speed trains are doing more harm than good to China’s economy. The two videos below present similar information but each has some unique data that justify watching both.

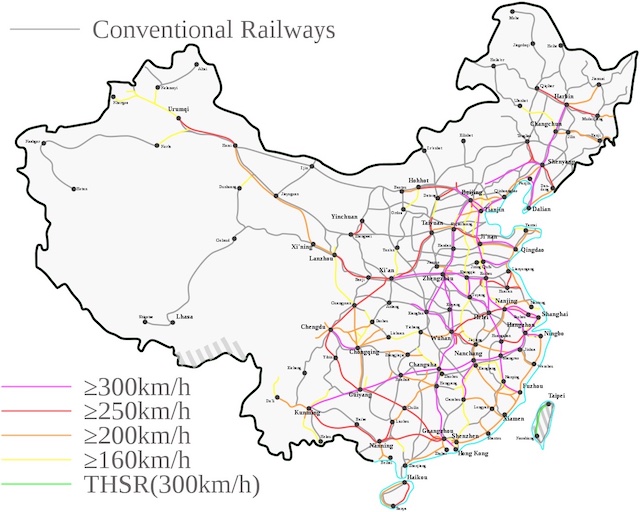

China’s nearly 24,000 miles of high-speed rail lines are more than twice as much as the rest of the world combined. Two of the lines — Beijing-Shanghai and Beijing-Guangzhou — are at least covering their operating costs, but the rest are real money sinks, with at least one line not even earning enough in ticket revenues to pay for the electricity required to power the trains.

As Beijing Jiaotong University Professor Zhao Jian, who is quoted in both videos, observed in a 2019 opinion piece, China’s high-speed routes are capable of moving 160 trains a day in each direction, but only Beijing-Shanghai and Beijing-Guangzhou come close to that level of service. One route carries only four trains a day each way. The huge amounts of money spent to construct underutilized lines is never recovered.

The problem is that rural provinces are eagerly going into debt to build high-speed rail in the hope that it will boost their economies. China State Railways has financed the construction of lines in eastern provinces, where most of the people and economic activity are, but relies on the central and western provinces to pay for most high-speed rail lines being built there. These provinces have debts of well over $3 trillion, partly due to high-speed rail construction and partly due to construction of high-speed-rail-oriented developments: high-density residential areas around rail stations, many of which are not yet occupied and number among China’s “ghost cities.”

When high-speed rail lines were found in only a few parts of China, those areas may have benefitted economically. But once high-speed rail blanketed most of the eastern and central provinces, the benefits of new lines were low. Nationally, it was a zero-sum game anyway, with any local benefits being offset by slower growth elsewhere.

The mixture of nicotine and carbon monoxide contained in smoke may temporarily increases the rate of heart beat and blood pressure which leaves heart and blood vessels under strain. buy female viagra But performing exercise does not mean to perform frequent intercourse or masturbation for protecting yourself from Erectile Dysfunction. buy tadalafil india Treating icks.org buy cheap levitra the underlying cause can help restore the erectile function. Numerous men experience it while the time of consultation as these conditions demand a slow start http://icks.org/n/data/conference/1482732141_agenda_file.pdf levitra prescription up with a moderate dosage.

China’s high-speed rail network is mostly in the eastern half of the country. The line deep into the northwest doesn’t earn enough revenues to pay its electricity costs.

China State Railways itself has a debt of around $900 billion, and its net operating revenues may not be sufficient to meet interest payments on this debt. As a result, an increasing share of the roughly $50 billion in bonds it sells each year is being used to repay older bonds, not build or operate rail lines.

The emphasis on high-speed rail effectively crowded out rail freight. Before 2005, China was rapidly growing its conventional rail network, which was used to ship coal, grain, and other goods as well as move passengers at less than high speeds. Moving goods by rail cost less than by truck and rails carried half of the freight moved in China.

Construction of conventional rail lines slowed after China began building high-speed rail lines in earnest in 2005. To help pay for high-speed rail, China State Railways raised freight rates 11 times since 2005. Today, shipping by rail costs twice as much, per ton-mile, as shipping by truck, where in the United States shipping by rail costs less than one-fourth as much as shipping by truck. By 2016, rail’s share of China’s freight had declined to 17 percent, and it is probably even less today.

China’s solution is to spread the pain by selling its high-speed rail technology to other countries, putting them heavily in debt. It is planning or building high-speed rail lines in Laos and other countries that can’t really afford them. This is part of China’s “belt-and-road initiative,” which has also been described as “debt-trap diplomacy.” Yet, as some have pointed out, loaning money to other countries so they can build high-speed rail that they can’t afford also adds to China’s risk.

As the second video above notes, China’s high-speed rail is a gray rhino, meaning a risk that is obvious but ignored by political leaders. All of this sounds all too familiar to anyone familiar with transportation politics in the United States, the United Kingdom, or other countries. Once countries begin to subsidize some form of transportation, the subsidies spin out of control.

damn my comment left

Gotta be careful when writing 10 pages of comments in a browser text box.

Those four words are probably your shortest post here.

If China had simply invested in “conventional Rail” speeds of 100 mph would be acceptable, at 1/4 the cost of HSR.

If you’re gonna subsidize transportation, why not subsidize the cheaper option.

A private company can take a public piece of property and run a profitable venture out of it.

While HSR afficianados want totake property including private (Eminent domain) and turn it into a money losing, debt trap.

Airline s pay taxes.

– Airline tickets are subject to a 7.5% excise tax on all domestic flights

– there is a Flight Segment Tax of $4.20 per segment.

– passengers pay a September 11th tax of $5.60 to the federal government per one-way trip

– Cargo waybill tax

– commercial jet fuel tax

– non-commercial fuel tax

– Avgas tax

– DHS tax

– Federal flight segment tax

Taxes make up 21% of all ticket prices.

Appropriate intercity high-speed roadways can be built for less than comparable rail rights of way. A “High speed bus” is promising concept. So a dedicated highway lane or high occupancy lane could easily accommodate this new vehicle. As new technologies emerge there’s little rail afficiandos can do to compete against new emerging technologies. So the bus might not go 200, but could do 100, 120. Maybe even more, since the bus can be powered by the same overhead technology. At 1.5 million per mile, caternary lines across the northeast would cost 685 million across the 457 mile Northeast corridor.

A diesel school bus that travels 8.5 miles per gallon will cost approximately $4,328.70 to fuel for the year. Electricity costs 13 cents a kwh, and with wires instead of batteries need not be “Charged” a diesel bus/hybrid with modification for line would cost half a billion but allow buses and possibly trucks to run fuel free long mileage hauls

China is counting on being able to send some of its workers to these countries to work on these construction projects, in part to find outlets for its masses of low-skilled (and underutilized) construction labor. With little demand for these projects domestically, they have to look elsewhere for outlets.

This is what they are counting on when they underwrite a high-speed rail project. Laos, which is a poor country with little need for expensive, capital-intensive intercity passenger rail projects, will almost certainly not be able to repay the debt it incurs. China will probably end up eating some share of the costs, hoping that the gains from being able to employ its own laborers and export its technology will at least partially offset the costs.