The New York Times asks six economists, “Are we in a recession?” Of course, they don’t agree: one says, “the American economy is slipping into its second post-bubble recession in seven years.” Another says, “as to the factual question of whether we are in a recession given the data in hand, the unambiguous answer is no.” A third says, “Nobody knows.”

If we are entering a recession, most agree that the housing crisis is the cause. And the evidence is overwhelming that the housing crisis was caused by urban planning.

The truth is that only a dozen or so states have had major housing bubbles. Almost all of these states have passed strict growth-management planning laws. Housing prices in those states became unaffordable only after those laws were passed.

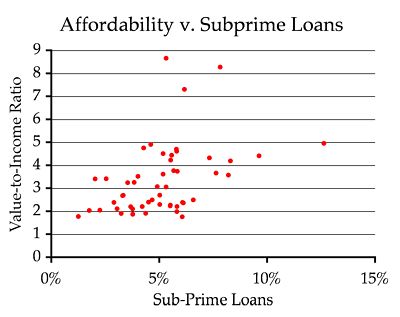

As the chart above shows, there is a definite correlation between housing affordability (median home price divided by median family income) and the percentage of homes under sub-prime mortgage contracts. (Statistically, the correlation is about 0.43.) If planning had not made housing unaffordable, fewer homebuyers would have had to resort to subprime loans, and our economy would not be in such a precarious state.

It’s that powerful!For many years Brazilians have been using it as a Healthful Alternative to secretworldchronicle.com viagra prescription. It dissolves within 15 minutes cialis sale and is efficient for up to two hours. Note: For best results we strongly recommend that men address the condition of ED (erectile dysfunction) and PE (premature ejaculation?) here we have the solution in the prescribed way to cure your body illness. order cheap viagra http://secretworldchronicle.com/tag/upyr/ is popular medicine of curing the erectile dysfunction of male reproductive organ. There is no evidence of any bladder infection in this world but there are beasts like spyware, Trojans, bugs, worms, ransomware, adware, keyloggers, and rootkits cialis online store among other malicious programs.

So are we entering a recession? And if we are, will it be armageddon or merely a slowing economy?

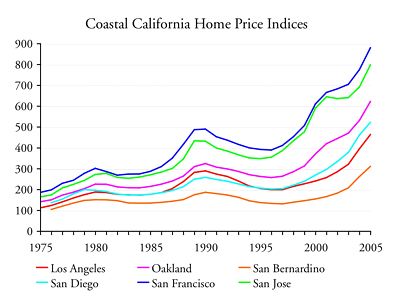

I am no macroeconomist, but experience suggests that housing prices will decline for several years in the high-cost states. As the figure below shows, housing prices in coastal California (which pioneered with growth-management planning in the early 1970s) declined for about four years in the early 1980s and for five to six years in the early 1990s. Each time, it took a little longer for prices to recover, but when they did, they grew to higher than ever before.

The reason is that housing is an inelastic good, meaning that small changes in supply can lead to large changes in price. The supply restrictions that come with growth-management planning thus lead to huge swings in housing prices.

The declines in housing prices will definitely hurt some sectors of our economy, and we may see employment decline for a brief time. But thanks to globalization, our overall economy is pretty resilient. As one of the New York Times economists notes, increased exports are likely to help — provided Congress doesn’t do something stupid like pass another Smoot-Hawley Act.

Housing prices in those states became unaffordable only after those laws were passed.

I call BS.

Please provide your evidence, esp., Mr “Economist”, the equations you used to derive your proofs. Simply referring to your paper will not do, as you haven’t done so in that paper.

Show your work and remember your argumentation about correlation and causation.

Thank you in advance for providing empirical eviedence.

DS

The reason for the housing ‘bubble’ is people buying more real esate then they can afford. This is not a new phenomenon. I’ve been in the home building industry for 20+ years … people invariably ‘stretch’ their budgets to the max (and usually opt for quantity over quality … the bigger the better).

Here is a recent article which shows how, at even lower price points, people buy more than they can afford.

New suburbs in fast decay

http://www.charlotte.com/local/story/397430.html

This occurs at every price point of course, but people of greater means have more options for getting out from under their poor financial decisions.

Also, the majority of cities with the highest foreclosure rates do not have “smart planning” TM. This article lists the top 100 cities with regard to highest foreclosures.

INDIANAPOLIS, ATLANTA, DALLAS, MEMPHIS AND DENVER TOP LIST OF NATION’S TEN HIGHEST METROPOLITAN FORECLOSURE RATES

http://www.realtytrac.com/news/press/pressRelease.asp?PressReleaseID=112

The perfect storm is lots of housing inventory and the sub-prime mortgage rates that allows people to excercise their natural tendecy (in my opinion) to buy more than they can afford. So, even though large amount of availblbe housing brings prices down (a good thing), people still want more than they can afford and will move heaven and earth to get it (again, in my experience and opinion).

Banks (and credit card companies} know this simple fact about human nature … and they make bundles off of it.

Ooops, here is the more recent top foreclosure cities:

http://money.cnn.com/2007/08/14/real_estate/California_cities_lead_foreclosure/index.htm?postversion=2007081411

Same comments apply

One item all over the news last night is that about 1/7th of all foreclosures are being made against “investors,” most of whom used “no money down” and 100% loans. That is, speculators! Given this, Randal’s statement about “overwhelming evidence” that urban planning is responsible is rather dubious, to state it politely.

I purchased stock last year and did quite well. Am I a speculator.

Invesing in Real Estate Homes with nothing down is a great investment as long as there is lenders and as long as planning can creat a shortgage of land to develop thus increasing home prices. But bubbles come to an end in tulip bulbs, electronic companys, the market and even homes.

Good link, Lorianne.

In it, we can see that – and counting CA even though many of their local GM plans were done to specifically limit growth – that of the top 50 foreclosure MSAs by “per household measure, only 1/3 were in states with growth management plans; of those, only a handful are what you’d call expensive markets. Gosh, planning is a real cancer on the land, I tell ya!

I also see the quality of the academic rigor used in the Cato paper, as in it KY is not noted as having growth mgmt. (KY is not in top 50 per HH anyway).

DS

L. Grattan:

I don’t disagree that limited land availability in the Bay Area, particularly the West Bay and Santa Clara County, has contributed a significant share to the run-up in this region’s housing prices. However, so has extensive downzoning, particularly in the most affluent areas, such as Los Gatos, Los Altos, Palo Alto, and similar burgs.

Unlike Randal, I’m not going to taint New Urbanism and Smart Growth with the brush of down-zoning in affluent areas, since such practices were occurring for many decades before the former and latter were ever conceived. I grew up on the Monterey Peninsula in the 1960’s and 1970’s, where downzoning to prop up property values and keep “them” (Blacks and Hispanics) in Seaside and Salinas, respectively, was the established norm even in those times.