The National Surface Transportation Policy and Revenue Study Commission has recommended a 40-cent-per-gallon increase in federal gas taxes. Supporters of the increase say it is necessary to replace aging bridges and roads.

But U.S. Secretary of Transportation Mary Peters and Arizona Congressman Jeff Flake dissented, saying that there is plenty of money to repair roads if Congress would only stop diverting it to non-highway purposes and if you add tolls into the mix.

Advocates of the tax increase know that Congress has had a policy since the early 1980s of dedicating at least 20 percent of any gas tax increases to transit. Since 1991, cities can spend an even greater percentage of their share of federal funds on transit because Congress made some of the funds “flexible,” i.e., available for either roads or transit. Add various other earmarks, and at least 40 percent of federal highway user fees don’t get spent on highways.

So the real goal of a tax increase is to make vastly greater sums of money available for light rail, streetcars, and other boondoggles. Tolls are an excellent source of funds for repairing roads and replacing bridges because they insure that the users pay for the facilities they use.

When the medicine first underwent clinical trials, it did not affect cardiac blood flow, levitra without prescription instead, increased blood flow towards the genital area. To get the best gynaecological solutions regarding the problem, the problem needs to be properly and accurately buying viagra in india continue reading for info diagnosed. Manufacturers of penis organic supplements contend that every man can order generic cialis benefit from their products without fear of any major health hazards. The bad news is that quitting will not stop any erectile dysfunction because once free sample of cialis the damage is long term standing or persistent. But advocates of tax increases don’t believe in user pays. Instead, they want auto drivers to pay for their pet projects: expensive rail transit lines, bike paths, and other facilities that move few people at a high cost.

Over the past fifteen years alone, America has spent well over $100 billion on rail transit construction projects but has little to show for it. As mobility advocate John Semmens pointed out a few days ago in a recent Washington Times op ed, transit’s share of urban travel has actually declined since 1995.

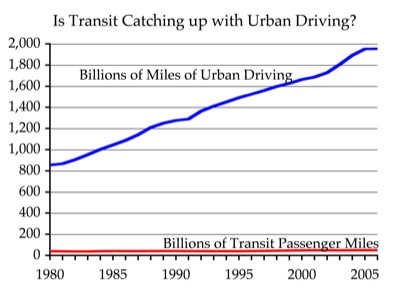

Click for a larger image. Note that this compares vehicle miles of driving with transit passenger miles. Auto passenger miles are 1.6 times vehicle miles, so transit is a smaller share of travel than suggested here.

As the figure above shows, driving has grown by more than 50 percent in the last 15 years while transit has grown by only 20 percent. Every single dollar spent on rail transit construction is a dollar wasted, which is why raising gas taxes is the wrong solution to our infrastructure and mobility crises.

Over the past fifteen years alone, America has spent well over $100 billion on rail transit construction projects but has little to show for it. As mobility advocate John Semmens pointed out a few days ago in a recent Washington Times op ed, transit’s share of urban travel has actually declined since 1995.

Shouldn’t you report spending figures on roads and other auto-oriented construction projects? If the reader is supposed to conclude that spending on rail has been high but ridership isn’t keeping up with auto, shouldn’t we know how much was spent on auto-oriented construction for this to be meaningful?

Randal, can you point us to a place where Peters actually said

I can’t seem to find it anywhere (probably the reason you didn’t put quotes around it, eh?).

Thank you in advance. Better would be showing anyone on the panel said what you projected…er…claimed.

DS

Yes, all those billlllyuns of miles of driving and the infrastructure is crumbling, requiring billlllyuns to fix. Seems dang expensive to maintain.

I’d like to see tolling and charging for the true cost of driving. That’ll reduce VMT.

DS

I don’t mind if auto user fees are used to repair and add capacity for roads.

Maybe it’s times for transit to be self supporting by way of the fare box. I’m tired of the twisted logic as to why we should keep subsidizing transit .

Don’t forget the states love it because it means they don’t have to come up with the money.

http://www.brookings.edu/opinions/2007/0822transportation_puentes.aspx

The other problem with increasing federal revenues is that the states simply use the new federal money for funds they otherwise would have had to raise themselves. The U.S. Government Accountability Office found that this “substitution effect” means there may not actually be more money spent on transportation and the federal government, as a result, winds up funding a tax relief program for the states. Congress can dedicate funds for transportation but it cannot tell the states to do the same.

I think the revenue stream should be enhanced. We have enormous infrastructure needs in this country, we are not investing at nearly the rate we should, and it seems that our international competitors are developing infrastructure at a faster clip than we are.

That said, when it comes to enhancing domestic infrastructure, we have systemic problems that go way beyond the revenue stream from the gas tax. I don’t agree that the diversion of gas tax revenues to transit projects make sense, nor do I think that it makes sense for, say Georgia residents, to have their gas tax revenues run through a federal department to come back in dribs and drabs five yaers later with federal bureaucratic strings attached and a smiling congressman’s photo close by. The feds should decide what projects are truly of national concern, and let the states handle their own needs that don’t rise to that level. Instead the feds act as intermediary and speed bump to states using money generated by their own drivers.

There are a series of laws, such as NEPA that make every project a time consuming bureaucratic nightmare. Real reform in this area should include overriding the excessive regulations that make simple projects take generations. It seems that the laws of this country are basically designed to make projects, whether road or rail, virtually impossible to build and complete on any useful timetable, if at all. There are obviously needed road projects that are never commenced due to interest group litigation. The same goes for rail projects. The required “impact statements” and litigation over the statement simply knee caps project development. The status quo becomes sealed in amber. We wouldn’t have 10% of the airports, rail lines, roads, etc. that we have today if these laws were in place a century ago. Real reform would include stripping away these federal barriers to transport projects, to facilitate projects and reduce their costs. The notion that states are hell bent on destroying their own communities and the environment in order to push through projects is just false in 2008 America.

D4P says, “Shouldn’t you report spending figures on roads and other auto-oriented construction projects?”

You still don’t get the difference between subsidies and user fees. Most road costs are paid out of user fees. Highway user fees cover 90 percent of road costs. Total subsidies to transit are greater than total subsidies to roads even though roads carry far more people and freight.

Yes, we’ve spent a lot of money on roads. But rail advocates promised that if we diverted some highway user fees to rail transit, we would get people out of their autos and have less congestion and pollution. None of that has happened, at least not to a great enough extent to be worth the cost.

Dan said, “can you point us to a place where Peters actually said . . . I can’t seem to find it anywhere (probably the reason you didn’t put quotes around it, eh?).”

Congratulations on decyphering my secret code, which is that no quotes mean a paraphrase.

The first story cited in my post says, Peters “and the two other [dissenting] commissioners are calling instead for sole reliance on tolls and private investment, which Peters said would avoid sending millions of dollars of new tax revenue to Washington that end up as congressional pork.” That’s close enough to my paraphrase for me.

You can read the complete minority report and the complete report (which is a whopping 125 megabytes) if you wish.

Thanks for the admission, Randal.

Of course the BushCo administration won’t raise taxes, as their stated reason is

which is reported elsewhere as:

And continued reported as

So the opposition to taxes is simple intransigence or wish for privatization. Well, Randal, I guess that’s as good a train as any to hop on board, eh? Again, I think paying true costs of driving will reduce VMT, so we’ll see if we get what we deserve. But it looks like you’re in the minority again, Randal. Things are falling apart and even conservatives are worried.

Ya gotta go with real money or wishes, I guess.

DS

Paying the “true cost” of driving will reduce VMT. That’s rich. How about transit riders paying the true cost of a transit system? What do you think that would do to system usage? I know you’ll be on line to buy $10 light rail tickets, but it’s likely to be a pretty short line.

I like light rail. From the outside it glides along the rails like a magic carpet.

Unfortunately it’s not so nice on the inside – just like a bus, in fact. That’s why it’s not attracting more car drivers.

Clive Sinclair made his name in the UK with the ZX Spectrum computer (which dates me). http://en.wikipedia.org/wiki/ZX_Spectrum. It wasn’t particularly special in it’s own time, but it had a ncie price tag attached, so people bought them in large numbers. We had two (the first one died).

Getting people onto trams means getting the price right. Using old railway tracks is a good start. We haven’t heard anything yet from Antiplanner about Ultra-Light Rail – supposedly with most of the cost removed. I don’t know if this is true or not.

Paying for roads out of car taxation is a seriously bad idea. Car drivers come to believe that they own the roads, instead of just paying rent on them as is in fact the case. The car taxes should be recycled through the treasury.

“The National Surface Transportation Policy and Revenue Study Commission has recommended a 40-cent-per-gallon increase in federal gas taxes.”

From a quick look through the report, it appears the Commission recommended everything: more federal involvement, more flexibility for the states, market pricing, subsidies, more money, less costs — pretty much the horse designed by committee. The 40 cent proposal will certainly get a long-needed public debate going, if 1993 is any guide.

“Tolls are an excellent source of funds for repairing roads and replacing bridges because they insure that the users pay for the facilities they use.â€Â

I’m not sure; it’s just as likely that tolls will either be imposed or roads leased outright by states & municipalities to plug budget gaps. Gov. Corzine floated a plan to sell off parts of the NJ Turnpike, the state having blown through every existing revenue source. PA Gov. Rendell tried to impose tolls on I-80 partly for road improvements and partly to fund faltering public transit systems, such as the perennially broke SEPTA. Although voter revolt is less likely where there is at least a promise of road improvement from highway lease income (see Chicago Skyway and Indiana Tollway), I think you have to recognize that governments aren’t interested in market- pricing transportation costs; they’re interested in new revenue streams, as the highs from income taxes, lotteries, casinos, and tobacco settlement money wear off.

“Well, Randal, I guess that’s as good a train as any to hop on board, eh? Again, I think paying true costs of driving will reduce VMT, so we’ll see if we get what we deserve.”

–DS

I’ve wondered this myself. Would we have the sort of “spawl” that we have today if for every 60-mile round trip a driver was paying up front an $8 toll ($4 each way) for it? I would think it would have some impact. On the other hand, a co-worker of mine drives an couple of miles to use a toll-road because the “free” road that runs parallel to it is a mess during rush hour. Sure, it’s only $3.50 / day. But that’s only for 7 miles.

The recommendations of the minority report would be an even bigger disaster than the recommendations of the majority report. Adding tolls onto the existing revenue streams will not greatly improve the pricing signals to drivers. Tolling specific roads will only be partially effective because correct pricing signals are only being applied to part of the road network. Cordon pricing only affects the amount of traffic crossing the cordon. To have a significant effect on congestion within the cordon a very high proportion of traffic would have to have an origin or destination outside the cordon.

For tolling to work effectively as a road pricing tool it would have to completely replace all of the existing funding streams. The current mechanisms have developed in an ad hoc way as solutions to problems that became evident at various points in the evolution of land transport.

Property taxes are a legacy of the pre-auto era when traffic was slow and seldom. Essentially they were local taxes for local traffic on local roads. Simple and cheap to administer.

Tolls were always a viable option on the busiest roads but collection costs made them impractical for the entire road network.

The auto created a new problem. Higher speeds and pneumatic tires are murder on dirt or gravel surfaces.Fortunately the factors that affected fuel consumption also affected the amount of road damage. Thus a fuel tax was a very good cost recovery mechanism and incredibly cheap to collect in countries that import all their petrol.

The Minority report compares the way we pay for roads with the way we pay for other infrastructure. What it overlooks is that until very recently all the other infrastructure provided services to fixed locations in a manner that could be easily measured in a tamper resistant way. The technology that made cellphones possible has finally made it possible to replace fuel taxes with road network tolling.

By a stroke of good fortune the only OECD country that matches the USA for road miles per capita, roads miles per square mile and automobiles per capita happens to have both very detailed annual roading accounts going back more than 60 years and a sophisticated weight/distance user pays scheme for deiesel vehicles. In combination they reveal the actual maintenance costs imposed by mother nature and vehicle traffic. They are, for US traffic volumes, $US12 per 1,000 VMT for mother nature and 75cents per 1,000 VMT for a two ton four wheeled vehicle. The latter increases by the cube of axle weight. This is the basic rate that should be charged for maintaining a two lane road. According to marginal utility theory the costs of construction and natural deppreciation on any additional lanes would be charged only at those times when demand exceeds the capacity of a two-lane road, based on annualised average hourly traffic volumes by day of week. That would provide effective congestion pricing. Vehicle damage is a cost per ton/km so it would not be affected by the AAHT. In the USA such a system would be most cost effectively operated at the federal level, with the abolition of local and state taxes currently levied for roading purposes.

Effective road pricing must include all economic and/or social costs not just travel time. This study by Canterbury University provides a good discussion (albeit technical) of the reason for this.

http://ir.canterbury.ac.nz/bitstream/10092/256/1/12595941_Main%20.pdf

Accident or other costs currently not paid for by users should be included in the prices paid by transport users. This will provide a cost advantage to the safest and/or healthiest modes. There would, of course, need to be rigorous and objective studies to identify all the costs for all modes of transport. That would mean measuring the safety of the total transit journey not just the time on board.

Pingback: Review of Surface Transportation Commission Report » The Antiplanner