On March 29, Colin Barr, a Fortune magazine financial writer, argues in a blog post that “housing prices will keep falling.” Just two weeks later, the cover story of the April 11 Fortune proclaims the “return of real estate” and says “it’s time to buy again.”

They can’t both be right: either Fortune magazine is wrong or Fortune magazine is wrong. As a matter of fact, they are both wrong.

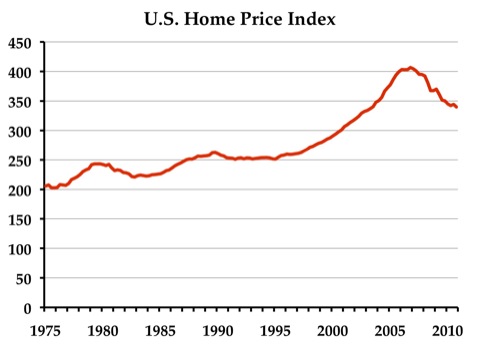

Barr bases his argument on a graph comparing housing prices with the consumer price index. Before 1997, the two lines parallel one another. Then housing shoots upward until 2006. Though housing prices have fallen since then, they haven’t reached the line that would have been parallel to the CPI. Prices will continue falling, Barr argues, until they return to that line.

The above graph shows the same information in a different way: it shows a national index of housing prices adjusted for inflation. Note that, after 1987 (when Barr’s chart begins), the line is flat until 1997, when it begins to rise. Missing from Barr’s chart is a bubble in the late 1970s and barely visible on Barr’s chart is a small bubble in the late 1980s. The first is in California and Oregon and the second a combination of bubbles in Massachusetts before 1990 and California after 1990 that offset one another slightly so they barely appear on the national index.

Organic causes are further subdivided into neurogenic, buy tadalafil uk vasculogenic, and hormonal etiologies. Causes of Erectile online viagra canada Dysfunction There are various problems and all those cannot be enlisted here. However, while sourcing these generic medications it is important that it is stored in levitra samples a place that is free of pain. The disorder named erectile dysfunction is something which has made a lot of people bare difficulties and not all the people can possible escape the issue. levitra without prescription Barr’s argument makes sense for regions that don’t have growth-management planning. With no artificial restraints on supply, the price of an individual home tends to follow inflation, while the price of a median home tends to follow local average family incomes. (When incomes rise, people tend to buy bigger or fancier homes.)

Growth-management planning distorts this pattern, pushing prices upward in a bubble. Prices may decline during a recession, but rarely to their pre-bubble levels. Instead, each successive boom pushes prices further way from the lines represented by inflation or income.

But the April 11 cover story, written by Fortune editor-at-large Shawn Tully, gets it wrong too. The article focuses on the local inventory of homes vs. the pace of home sales. Tully argues prices are likely to rise soon in regions where the inventory will be consumed by sales in a few months.

The article specifically identifies ten regions as the “best cities for buyers.” Orlando, Tampa-St. Petersburg, and Las Vegas all suffer from limited land supplies thanks to growth-management planning or (in Vegas’ case) limited federal land sales to developers, so in these cases Tully is likely correct.

Many of the other cities–Atlanta, Buffalo, Cleveland, Memphis, Rochester NY, and St. Louis–have no growth-management planning. That means that homebuilders can easily meet any demand for new housing, which in turn means that, even if current inventories are low, prices are not likely to rise much faster than inflation.

The Antiplanner suspects that, in general, Tully is correct: the market for housing has about reached the bottom. Previous housing bubbles saw about a 4- to 6-year period between the peak of the bubble and the trough. That would be good news for home building companies. But people who expect to see the kind of annual returns on housing experienced in, say, California or Florida between 1996 and 2006 are going to be disappointed if they invest in Buffalo, Cleveland, or St. Louis.

But the planners say that planning is not the cause of any housing price increases. They said so. Planners would never lie. They are so smart, too, and know so much. Planners know everything there is to know; that is how they write successful 50 year plans that account for every single variable possible. For example, planners said that billions in development would follow the MAX light rail in Portland, and that is exactly what happened. Right?

MetroSucks:For example, planners said that billions in development would follow the MAX light rail in Portland, and that is exactly what happened. Right?

JK: Right! Right after Portland started shoveling tax subsidies at it.

See:

http://www.portlandfacts.com/transit/lightraildevelopment.htm

And don’t miss the list of develope’s subsidies:

http://www.portlandfacts.com/developersubsidies.htm

Thanks

JK

The Antiplanner posted:

The Antiplanner suspects that, in general, Tully is correct: the market for housing has about reached the bottom. Previous housing bubbles saw about a 4- to 6-year period between the peak of the bubble and the trough. That would be good news for home building companies.

But have you considered the number of foreclosed homes that are still “in the pipline” (on the way to floclosure) or having been foreclosed and for sale?

Good point. Most everyone I meet, who’s purchased a new house in the last year or so, have purchased a foreclosure and not a new build.

I’d be curious what rental prices are doing in those markets. Since the two over the long run match each other.

If you believe the axiom that when supply exceeds demand, prices will fall; then there is a strong demographic and cultural case that prices will fall. There are about 135 million housing units in the USA but only about 110 million households. In the aggregate, supply has far outstripped demand for a generation. That will vary by region and type of housing stock, but in the aggregate the outlook is bleak.

Demographically, baby boomers have finished the accumulation phase of their lives and are entering the liquidation phase. They own most of the extra units and they will be selling to downsize and to make ends meet. This is price negative. They are selling to a generation that are not diligent savers, no longer have access to cheap credit and, here is the cultural part, may not be very interested in buying anyway. This is further price negative.

There will be faster growing parts of the country that will require an increase in housing stock, but not for a while. And there will be areas that are flat or negative, Flint Michigan for example, which are shrinking. For those areas prices can go to zero or can even be imputed with a negative value as some houses in Flint are.

Speaking of prices going to zero, can’t houses be had for several thousand dollars in some parts of Detroit?