Many people see the problems with tax-increment financing and think that TIF laws need reform. But in fact, no reforms will work; tax-increment financing should simply be abolished. The Antiplanner attempted to explain why in Boise last week, and here is a summary what I said. (Click any of the charts for a larger view.)

Suppose there is a school district, fire district, sewer district, or some other agency that gets its revenues from property taxes. Then suppose that a city proposes to establish a TIF zone within that taxing district.

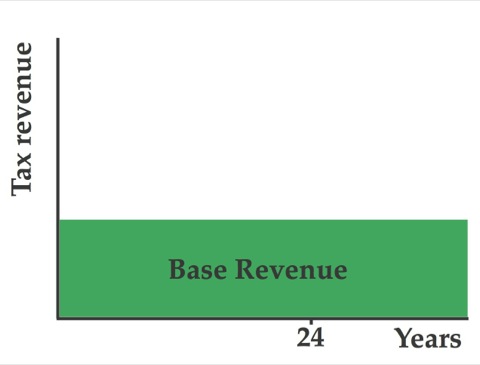

TIF advocates usually explain that TIF establishes a base level of taxes to other tax districts that will never be reduced, so those tax districts won’t end up with less revenue.

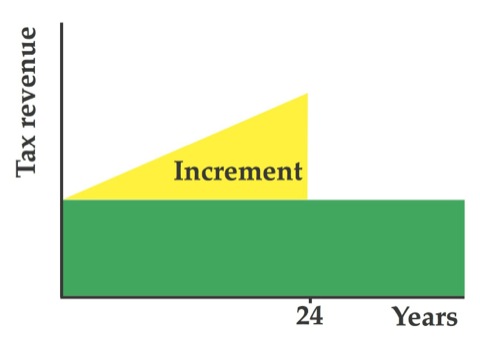

Instead, the TIF zone merely collects the increment in tax revenues after it is established and uses those increased revenues to promote development within the zone. Often this is by selling bonds that will be repaid out of those incremental revenues.

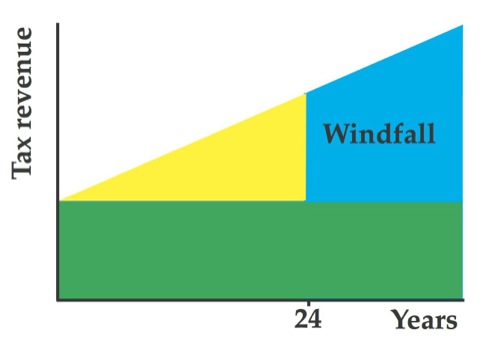

After a certain number of years–no more than 24 in Idaho, up to 30 in a dozen states, up to 40 in three states, and no limit in 13 states–the TIF district ceases to exist and from then on all taxes go to existing taxing districts. Since the new development in the zone supposedly would not have taken place without TIF, this is presented as a windfall for the tax districts.

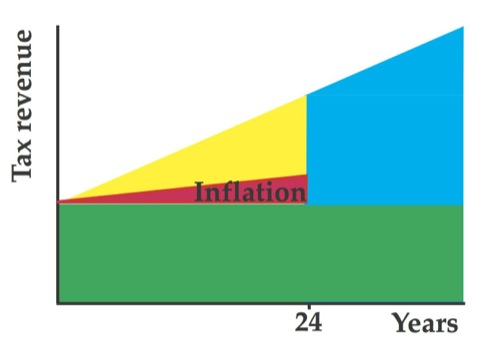

There are several problems with this explanation. First, in many states, some of the increment in tax revenues will simply come from inflation. The TIF zone will capture that increment even if no new development takes place in the zone. But other tax districts will see their costs increasing due to inflation without a matching increase in revenues, so they will end up having to spread their funds thinner or ask district taxpayers to accept higher tax rates.

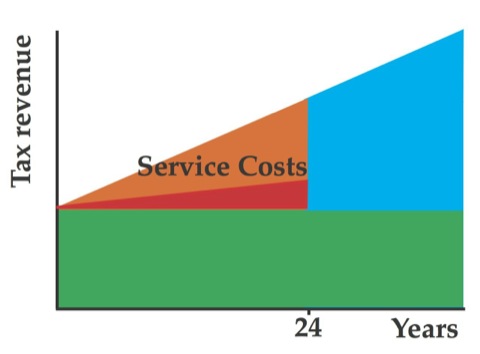

Second, any new development that actually takes place in the zone will impose new costs on the tax district. Fire districts will have to provide fire protection; if there are residences in the TIF zone, schools will have to provide educations for children in those residences. Since taxes on new developments in the zone don’t go to the tax district, other people in the tax district will have to pay higher taxes or accept a lower level of urban services.

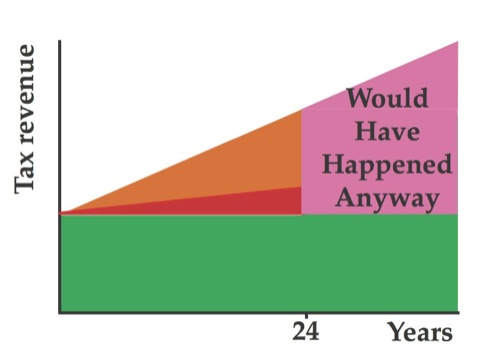

Third, numerous studies have shown that any new development in the TIF zone would have taken place without the TIF, though it might have been elsewhere in the region. All the TIF does is move some of that development to within the TIF zone. If the development had taken place elsewhere in the tax district, the supposed windfall would have happened anyway and the only effect of TIF on the district is the loss of revenues during the period the TIF zone is collecting the incremental taxes. If the development happened to take place outside the tax district, then it would not have had to provide any services to support that development and the effect of TIF on the district is the loss of revenues due to inflation.

Now (I asked the audience), suppose I put a bucket of money by the exit to this room. The bucket has $1 million in it, and I invite people to take some out as they leave but note that I plan to donate all the money that is left over to local schools or other good causes. Would anyone take the money?

It is likely that some people would be virtuous enough to leave the money to the schools. But some people might reason to themselves that schools waste a lot of money on administrative overhead, and those people might think they can spend the money more wisely. Other people, seeing some take the money, would follow suit, realizing that they had better get theirs before it is all gone.

Just who are the scoundrels who would take this money from schools and other worthy causes? For the answer, you’ll have to download my presentation (about 12.5 MB), but regardless of the answer, my point is this: leaving a bucket of money untended is just as foolish as leaving your keys in the car and the doors unlocked: it provides undue temptation for those who might otherwise be honest people. In the same way, no matter how it is reformed, allowing cities and counties to use TIF creates a temptation that will inevitably lead to abuse.

Here is another version of the TIF scam:

http://www.portlandfacts.com/ur/priceofur.htm

thanks

JK

The Antiplanner is being too pro-government. The purpose of TIF is to pay government money to bribe businesses to develop in the which good for the local government instead of a place which is good for business. The result is development which is not in the best place, which will cause further problems and weaken the business.