According to economists at Moody’s, the housing market will bottom out in 2011–which means now may be the time to hunt for cheap homes and be ready to flip them when prices start going up. Unfortunately, the Antiplanner can’t afford the $250 required to listen to Moody’s webconference, so let’s look at some other data to see how likely it is that prices will start to recover.

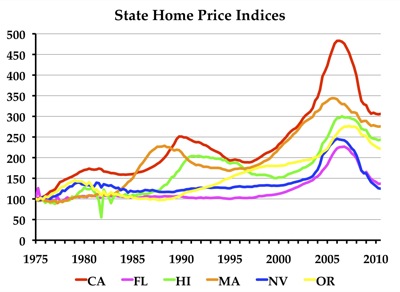

First, we can go to the Federal Housing Finance Agency (FHFA), which publishes home price indices beginning in 1975 for states, metropolitan areas, and the nation as a whole. Many news reports rely on the Case-Schiller index, but that index only covers a selection of metro areas and misses many states. The FHFA uses the Case-Schiller methodology but has a much larger database.

The Antiplanner has made a user-friendly Excel chart from FHFA’s state data. Simply enter the two-letter acronyms of up to six states in cells BK150 to BP150, and the chart should update with those states. Nationally, housing prices peaked in the first quarter of 2007, declined through the second quarter of 2010, and recovered slightly in the third quarter of 2010. But, as averages of the country as a whole, national data do not provide very useful indicators of what is really happening in housing markets.