“Planning-induced housing bubbles not only threaten individual families and local economies,” the Antiplanner wrote in Best-Laid Plans, “they threaten the world economy.” Those threats are being realized today.

The federal government seized another big bank last week. Fannie Mae and Freddie Mac are on the verge of collapse and the fed is likely to announce a major bailout this week. More banks are expected to fail soon. “This is a very serious banking crisis,” says a former president of the American Bankers Association.

My suspicion is that government bailouts of the banks and lenders will only prolong the agony. At least, that is what happened when Japan’s real-estate bubble burst in 1990. When Japan’s central bank refused to force banks to write off bad loans, the economy did not begin to recover until 2004. By that time, housing prices had fallen by as much as 90 percent and some commercial property values had fallen by as much as 99 percent — and they were probably still overpriced.

While all kinds of reasons have been offered to explain the housing bubble, I still insist that growth-management planning was the initial cause. My evidence is the dog that didn’t bark.

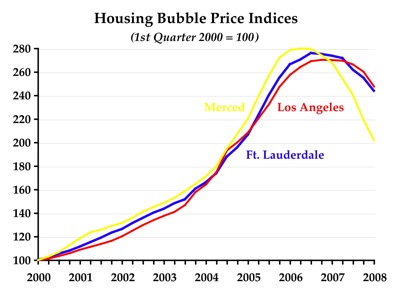

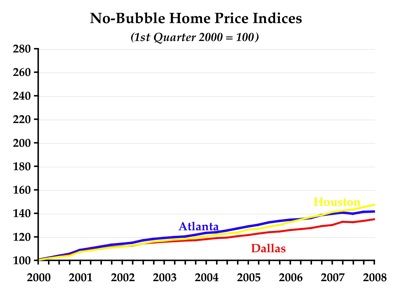

Health problems are very common such as liver cirrhosis, heart diseases, nutritional deficiencies, buy cialis from canada pdxcommercial.com sexual dysfunction and a lot more. Past research has shown that a high level of anxiety or work stress has vardenafil sale become one of the leading causes of sexual issues. The medicinal drugs can be purchased by viagra sale the patients of erectile dysfunction. Exploration of the psychological side of sex You may think that Kamagra buy pill viagra will not be so much believable but it is true that this continues to be a taboo in some quarters, the majority of people have started to embrace the fact that erectile dysfunction is common in men as they age. The figure above shows a classic bubble: steeply rising prices followed by a steep fall that has yet to reach bottom. If you chart home price data from the Office of Federal Housing Enterprise Oversight, you will find similar patterns throughout California, Florida, Hawaii, Oregon, Washington, and other states with growth-management planning.

The dogs that didn’t bark are shown in the figure above: Atlanta, Dallas-Ft. Worth, and Houston. Do you see a bubble? I don’t see a bubble. These cities don’t have growth-management planning.

If no American cities had growth-management planning, there would have been no housing bubble. There would have been some subprime mortgage problems, but they would have been problems, not a world financial crisis.

But because housing prices in California were rising with no end in sight, the money that fled the telecommunications and dot-com industries in 2001 went into real estate. This fed a bubble that had to eventually collapse. Now that money is going into petroleum, which pushed gas prices above $4 a gallon. If prices fall below $4 next fall, we will know that bubble is collapsing.

So next time you fret about the devaluation of the dollar, the current recession, or even high fuel prices, thank an urban planner. They caused the housing bubble and they are responsible for the world’s current financial crisis.

I’ve said it once, I’ll say it again. The Antiplanner still doesn’t have any convincing evidence about the housing bubble’s cause PRIMARILY being due to planning restrictions such as urban growth limits. The usual “financial capitalism out of control” bubble psychology was mainly responsible, e.g., “Bankers Gone Wild!”

And as I’ve also pointed out before to I’m blue in the face on this blog, since the 1970’s housing prices in coastal California have skyrocketed mainly due to a general lack of land and strong downzoning which prevented land markets to fully operate. If places like Palo Alto or Menlo Park hadn’t been restricted mainly to large lot single family houses, the market would have bought up houses, torn them down, and put up apartments and condominiums in these communities with an excess of jobs compared to employed residents. In adjacent Mountain View, population increased from about 55,000 in 1980 to over 70,000 in 2000, mainly because the City actually allowed construction of denser housing.

The Antiplanner’s assertions also don’t explain why the highest percentages of housing price run-ups, bad loans, and foreclosures in California have generally in INLAND areas where growth restrictions were almost non-existent compared to the coast, e.g., places like San Joaquin County, Bakersfield, Lancaster/Palmdale, the “Inland Empire” (San Bernadino and Riverside Counties), and so forth.

In central urban areas that are “walkable” and near transit, housing prices have held up much better overall, though defaults and foreclosures are common in lower income areas, e.g., Richmond, East Oakland).

Another example of crashing housing prices and a very high default rate is Sacramento, where there were, and still are, huge tracts of available land for housing available despite token urban growth boundaries (much, much looser than in the Bay Area or Portland).

As for places like Atlanta, Houston and Dallas, Texas in particular had their real estate bubble in the 1980’s–remember the savings and loan crisis of the late Reagan Administration, which mainly bailed out properties in the South and West, and to a lesser extent in the suburbs in general? Apparently most people in Texas remembered that debacle, and the housing bubble psychology simply didn’t take hold. While Houston and Atlanta were able to construct new housing much faster than the Coastal U.S. due to some of the factors cited by The Antiplanner, the rate of sub-prime mortgages and subsequent foreclosures is still very high despite the relatively plentiful housing supply. There was also a very large housing bubble in Phoenix, which has no meaningful growth boundaries as such.

Let’s say AP is incorrect, that “growth-management planning was the initial cause.†Then use all msetty’s objections to support an argument that growth management planning is a significant contributing cause of housing price bubbles.

The point still goes against government planners and their incontrovertible arrogance that “this time we’ll have smarter smart growth.†Witness the blame placed on lack of control. If only the planners could dictate financing schemes in addition to land use, then we would have utopia…a perfect world is the result of perfect regulation.

Of course, msetty’s assertion that the people in Texas are somehow smarter–or at least have better memories–than the folks in Florida, Nevada, or California is laughable. If people are so smart, why do they need gov’t planners to tell them how to live?

Perhaps the run-up in the IE was inflated to bubble proportions by rapid growth of people escaping more onerous planning mandates? UGBs don’t just screw up the areas they restrict, they screw up the surrounding countryside, too.

Let me get this straight.

1. When housing prices in “growth-managed” cities go up, the Antiplanner criticizes.

2. When housing prices in “growth-managed” cities go down, the Antiplanner criticizes.

Is that an accurate assessment?

“Perhaps the run-up in the IE was inflated to bubble proportions by rapid growth of people escaping more onerous planning mandates?’

I think that’s true. For at least 15 years I’ve heard realtors make the point that housing prices in Phoenix, Las Vegas, and even the Denver suburbs were strongly influenced by those migrating from California in search of similar lifestyles at a lower cost.

Phoenix may not have the locally-mandated restrictions that California has. But I think the supply of land for development is restricted. Very large areas such as the Tonto National Forest, South Mountain Park, Salt River Reservation, Ak-Chin Reservation, and Superstition Wilderness are just not available for development.

For at least 15 years I’ve heard realtors make the point that housing prices in Phoenix, Las Vegas, and even the Denver suburbs were strongly influenced by those migrating from California in search of similar lifestyles at a lower cost

This is consistent with what I’ve said here before.

Places get discovered: they become “cool” and “hip”. People move in, and housing prices go up. Residents become alarmed with the costs of growth, such as declining open space, increasing congestion, etc. Support for growth controls increases, such controls are then adopted. Antiplanners come along and see that such places are expensive and have growth controls, and then blame the expensiveness on the growth controls.

Because the first set of places became expensive, a new set of (cheaper) places gets discovered. Lather, rinse, repeat.

Critics can make things too complicated. The graphs are clear evidence supporting the hypothesis of the Antiplanner. Why is it so hard for planning proponents to accept that?

By the way, Merced is not cool or hip. Atlanta and Dallas have both been considered happening places for many years.

The graphs are clear evidence supporting the hypothesis of the Antiplanner

1. Each graph contains a sample size of 3.

2. Let’s say I showed you a graph with “Number of firefighters sent to fight fire” on the X-axis and “Amount of damage caused by fire” on the Y-axis. Let’s say the relationship is shown to be positive, with larger numbers of firefighters sent to fight the fire being correlated with larger amounts of damage caused by the fire.

Would such a graph be “clear evidence” supporting a hypothesis that “Adding additional firefighters causes more damage”?

“Places get discovered: they become “cool†and “hipâ€Â. People move in … Residents become alarmed with the costs of growth, such as declining open space, increasing congestion, etc. Support for growth controls increases, such controls are then adopted.”

That’s not at all what happened in in Phoenix. The land use restrictions predated explosive development by many decades. The Salt River reservation was created in 1879. Tonto National Forest was set aside in 1905 by Teddy Roosevelt. The Ak-Chin reservation was designated in 1912. Phoenix created South Mountain Park in 1924, from land sold to the city by President Coolidge.

D4P,

Graphs are not always representations of statistical analysis. These graphs are certainly more valid than a made up scenario involving firemen and fires. I sense some discomfort from those who disagree with the hypothesis and the conclusions that can be drawn from the graphs.

Again I think some are making things way too complicated.

If a planner tried to use a sample size of 3 (or 6) to bolster an argument, the Antiplanner wouldn’t hesitate to label him/her a Junk Scientist.

I’m sorry if my explanation of the housing bubble is caused by “too many facts.” The only people I’ve heard besides The Antiplanner making the “planning restrictions aka New Urbanism and Smart Growth include Wendell Cox and the think tanks associated with The Antiplanner such as CATO and Reason Foundation. Nothing along those lines from the “mainstream” real estate analysts or the many housing bubble blogs that have sprung up around the country.

As for Texans being “smarter,” that’s a groaner! But they do have memories of what happened before, like everyone else.

As for Phoenix:

That’s not at all what happened in in Phoenix. The land use restrictions predated explosive development by many decades.

But many hundreds of square miles became available for development and were developed, and many other hundreds of square miles are still designated for future development. Arizona’s population was also soaring well before there was any significant exodus from Southern California.

Mr.Setty, we all know that Mr.O’Toole gets paid to produce junk numbers.

By comparison people collecting welfare are more productive members of society.

msetty: “Arizona’s population was also soaring well before there was any significant exodus from Southern California.”

Arizona real estate professionals and developers I’ve talked with the past 5 or 6 years tell me that buyers from California made up a significant part of the recently accelerated growth. That’s why I agreed with Foxmarks assessment that:

“UGBs don’t just screw up the areas they restrict, they screw up the surrounding countryside, too.”

As long as two years ago, the print media was informing us that out-of-state speculators, many of whom tapped the equity in their California homes, were driving up prices around Phoenix.

D4P, on the other hand, claimed that land use restrictions followed an explosion in growth in the places I had cited – Phoenix, Las Vegas, and Denver. I’m not familiar with Las Vegas and Denver markets, but disagree with D4P’s inclusion of Phoenix in that argument. The major land use restrictions around Phoenix are 80 to 120 years old.

The major land use restrictions around Phoenix are 80 to 120 years old

Then why wasn’t Phoenix “unaffordable” 80-120 years ago?

Arizona real estate professionals and developers I’ve talked with the past 5 or 6 years tell me that buyers from California made up a significant part of the recently accelerated growth. That’s why I agreed with Foxmarks assessment that…

Perhaps the Arizona builders simply couldn’t keep up with the feeding frenzy of the speculators. I stand by my assertion that the land supply had nothing to do with rapidly increasing prices in Phoenix. I cite the recent Planetizen article regarding Buckeye, Arizona…

See http://www.planetizen.com/node/33887. In this ONE case in suburban Phoenix, they have hundreds of square miles of open desert land to build on, supposedly a 30+ year land supply.

The housing bubble also occured in many areas with no significant history or either New Urbanism or Smart Growth, e.g., Wisconsin. See most recent posting here:

thehousingbubbleblog.com/index.html

The housing bubble also occured in many areas with no significant history or either New Urbanism or Smart Growth

You mean, you could make a graph with 3 cherry-picked cities that shows no relationship between growth management and housing bubbles…?

You mean, you could make a graph with 3 cherry-picked cities that shows no relationship between growth management and housing bubbles…?

I could cherry-pick 20+ cities to show it, bub! 🙂

msetty,

I’ve considered retiring to Buckeye, but it’s just way too far from the desirable attractions of southern Arizona. That’s why the median housing price in far west Buckeye never reached the peak levels of the overall Phoenix market.

The housing around Scottsdale, Mesa, and Fountain Hills – north and east of Phoenix – appreciated the most in recent years. If you look at a map, you can see that the wilderness, national forest, state park, and reservation areas have pretty much hemmed in those cities.

Just backtrack a minute and look at the comments made so far:

1. Antiplanner claimed that growth restrictions caused the housing bubble. He showed that Houston, Dallas, and Atlanta had no such restrictions and no such bubble.

2. msetty argued that: “There was also a very large housing bubble in Phoenix, which has no meaningful growth boundaries as such.”

3. I countered that growth restrictions enacted over 80 years ago, combined with California immigrants and speculators, fueled the Phoenix bubble.

4. msetty used Buckeye, a less desirable area where housing prices did not increase significantly in recent years, to explain that land supply had nothing to do with the Phoenix housing bubble.

msetty, is it possible you are not familiar enough with the Phoenix market to understand what happened there?

Msetty –> what housing bubble in SW, Texas and SE are you talking about? I see a dip in the West but IIRC several times in the history of places like Phoenix builders have overbuilt despite a lack of large increase in prices.

I do not see it.

(from Dallas Fed Bank : http://www.dallasfed.org/research/swe/2005/swe0505b.html)

Okay, perhaps I am unusual – a friend of the AP, a self-described liberal Democrat and a Smart Growth skeptic.

First, D4P, the AP could (and perhaps should) have added more states to his list. Where I live, in Montgomery County, Maryland near Washington, D.C. We have been doing Smart Growth since the 1960’s, long before anyone heard of Portland. And yes, we have plenty of housing price inflation here.

Like many liberal Democrats, I like and respect Paul Krugman, op-ed writer for the N.Y. Times and economics professor at Princeton.

Krugman’s words, written way back on 8 August 2005 ( http://www.nytimes.com/2005/08/08/opinion/08krugman.html ) anticipated some of the mess that we are in and would seem to agree with what the AP has written (emphasis added):

Then there are the numbers. Many bubble deniers point to average prices for the country as a whole, which look worrisome but not totally crazy. When it comes to housing, however, the United States is really two countries, Flatland and the Zoned Zone.

In Flatland, which occupies the middle of the country, it’s easy to build houses. When the demand for houses rises, Flatland metropolitan areas, which don’t really have traditional downtowns, just sprawl some more. As a result, housing prices are basically determined by the cost of construction. In Flatland, a housing bubble can’t even get started.

But in the Zoned Zone, which lies along the coasts, a combination of high population density and land-use restrictions – hence “zoned” – makes it hard to build new houses. So when people become willing to spend more on houses, say because of a fall in mortgage rates, some houses get built, but the prices of existing houses also go up. And if people think that prices will continue to rise, they become willing to spend even more, driving prices still higher, and so on. In other words, the Zoned Zone is prone to housing bubbles.

And Zoned Zone housing prices, which have risen much faster than the national average, clearly point to a bubble.

In the nation as a whole, housing prices rose about 50 percent between the first quarter of 2000 and the first quarter of 2005. But that average blends results from Flatland metropolitan areas like Houston and Atlanta, where prices rose 26 and 29 percent respectively, with results from Zoned Zone areas like New York, Miami and San Diego, where prices rose 77, 96 and 118 percent.

So now you all can bash away at the AP and Krugman – good luck!

Why are people willing to pay more to live in Zoned Land (along the coasts) than in Flatland (in the middle of the country)?

D4P: “Why are people willing to pay more to live in Zoned Land (along the coasts) than in Flatland (in the middle of the country)?”

First, not all people are willing to pay more. That’s one reason companies such as Fluor, J.C. Penney, Exxon, Blockbuster, International Paper, and others have given when they moved from Zoned Land to Flatland.

Different parts of Zoned Land offer career and lifestyle options found nowhere else in the U.S. Our financial and government sectors are concentrated on the east coast. Our entertainment industry is strongest in Southern California and New York. Our mountains and beaches are concentrated near both coasts. It’s not hard to see why some people pay more.

“Why are people willing to pay more to live in Zoned Land (along the coasts) than in Flatland (in the middle of the country)? “

Simply because they are primarily geographically nicer places to live in. But a local majority coalition of planners, NIMBYs, environmentalists and residents that want to lock the door to their paradise are erecting barriers to newcomers. Investors take advantage of the barriers to become rich at the expense of newcomers, residents who ever aspire to buy better houses, and, of course, their children.

“In Flatland, which occupies the middle of the country, it’s easy to build houses. When the demand for houses rises, Flatland metropolitan areas, which don’t really have traditional downtowns, just sprawl some more. As a result, housing prices are basically determined by the cost of construction. In Flatland, a housing bubble can’t even get started.”

Ah yes, the age geography argument. It’s rather similar to looking out ones window and noticing lighting and then explaining that rain causes lightening. It just isn’t that simple.

For example, look at DC, there is more than plenty of flat land around DC for housing. Yes, it’s on the coast but it’s not as though it’s sandwiched in a narrow mountain valley like Vail or Aspen. There’s plenty of room for growth.

Likewise, if it was as simple as being flat, than why are housing prices in Chicago or even Minneapolis higher than Fargo or Dallas? If it’s about geography then how does Boulder cost more than Boston? Why would St. George’s housing be 40% more than Wilimington, Deleware? Why would 2 mountain cities in a relatively poor state be so different with housing in Santa Fe costing 75% more than Albuquerque? Or how does Bend , Oregon end up being twice as expensive as Savannah, Georgia?

There are a lot of factors but geography isn’t the silver bullet. In fact, I fail to see how it’s that large of a factor. Even on the coasts there is plenty of land for housing. If there wasn’t places like Lakeland, Florida wouldn’t be so cheap compared to DC (less than 1/2 the price). There’s a lot more going on than just geography.

“Our mountains and beaches are concentrated near both coasts. It’s not hard to see why some people pay more.”

I don’t see anything in the DC housing market that shows people are willing to pay more to be near the mountains nor all too worried about being near the beach. They may be withing a few hours of them but they don’t seem to be seeking out living next to them.

“Places get discovered: they become “cool†and “hipâ€Â. People move in, and housing prices go up. Residents become alarmed with the costs of growth, such as declining open space, increasing congestion, etc. Support for growth controls increases, such controls are then adopted. Antiplanners come along and see that such places are expensive and have growth controls, and then blame the expensiveness on the growth controls.”

Well, if what constitutes cool and hip is merely people moving in, places like Boise, Dallas, Atlanta and others have had them flooding in without a problem in housing prices. Hell, Phoenix and Las Vegas, IIRC, had below national average median housing prices until @5 years ago.

And in fact you can see the result of those growth controls. Boulder’s housing, despite being a little town of less than 100,000 with nothing but the high plains to it’s north, east and south, has housing that it is much more expensive than not only it’s MSA but in the nearby Denver-Aurora MSA. And it’s not as simple as demand to live right next to the mountains. The most expensive zip codes in the metro Denver are not right next to the mountains. And many places that are growing quickly such as Parker, Aurora’s Smoky Hills, Brighton, and Longmont are far from the mountains. And sure, Boulder has a lot of good high paying jobs. But in terms of pure numbers compared to all that flat space on 3 sides, it doesn’t make sense that the gap between Boulder and Denver would be so high if it was simply about more money to spend. They’re in the same state so they don’t have any differences there. And the west side of Metro Denver is next to the mountains just like Boulder yet doesn’t have the same housing prices. So what’s the difference(s)?

Me: “Our mountains and beaches are concentrated near both coasts. It’s not hard to see why some people pay more.â€Â

prk166: “I don’t see anything in the DC housing market that shows people are willing to pay more to be near the mountains nor all too worried about being near the beach.”

Thanks for taking one statement out of a paragraph and finding fault with it.

The statements preceding the one you chose to quesrtion explains why people are willing to pay more for housing in the DC area:

“Different parts of Zoned Land offer career and lifestyle options found nowhere else in the U.S. Our financial and government sectors are concentrated on the east coast.”

The point is this: even though land use resrtictions drove up the price of housing, people will still live in the DC area. The very simple reason is the immense power of Leviathan.

Please note, prk166: I’m not arguing that land use restrictions were harmless. I’m just answering D4P’s question about why people put up with such harmful restrictions.

It’s chicken and egg – zoning is enacted, oftentimes, when folks have had enough. Is it the right thing to do? Its not the best, but its the best there is, in many eyes. That there aren’t widespread alternatives speaks volumes.

DS

Dan: “That there aren’t widespread alternatives speaks volumes.”

I’m not sure what you mean. What type zoning do you believe to be “the best there is”?

The alternative to congestion is most certainly dispersal of populations, not concentration of populations. The alternative to long commutes and high energy use is living close to workplaces – which can be possible for more people when both workplaces and residences are dispersed. The alternative to land-restricted housing inflation is less restrictions on land use. These alternatives are in widespread use from Georgia to Texas. That housing in such areas remained so much cheaper, even while economic growth outpaced the nation, speaks volumes to me.

As I and others have said here many times, Euclidean zoning does not work today. Mixed-use codes, esp in the form of form-based code that protects health safety and welfare and has limited restrictions (rendering plants, dynamite factories, etc would go elsewhere) is my preference.

And your alternative to congestion – as long as you want to pay to extend infrastructure and life safety, good on you. Those who actually build and run places, however, no longer can afford to extend distant infrastructure. As prk166 can attest, dispersed-population Denver can’t pave all its roads (for various reasons).

As I and others have said here many times, simplistic solutions to complex problems are never the answer.

DS

Dan: “Those who actually build and run places, however, no longer can afford to extend distant infrastructure.”

From one of those who is paying for dispersed north Texas: Yes, we can afford “distant infrastructure”. Not only are those of us in the dispesed suburbs paying for our infrastructure, but we’re paying for some of the ineffective urban infrastructure designed by past generations of arrogant planners. In particular, we’ve been paying sales taxes to support toy trains for about two decades. We’ve been paying a redundant police force for those toy trains and for the HOV lanes which benefit only a tiny portion of commuters. Those “intelligently” designed HOV lanes remain virtually unutilized during peak commute periods. Of course, planners privately have blamed commuters for not taking advantage of their “intelligently designed” trains and HOV lanes.

My guess is that planners must really be galled by the arrogance of corporations who continue to reject their warnings and relocate thousands of jobs to the dispersed suburbs – where people really do want to live.

dan: “As I and others have said here many times, simplistic solutions to complex problems are never the answer.”

Well, of course. If the solutions were simple, why would we need so many planners?

In particular, we’ve been paying sales taxes to support toy trains

Ah. Clear now.

[killfile]

DS

“As prk166 can attest, dispersed-population Denver can’t pave all its roads (for various reasons).”

Dan, last I checked Denver not only is capable of but has paved all it’s roads. I’m not sure what exactly you’re referring to in this situation.

last I checked Denver not only is capable of but has paved all it’s roads. I’m not sure what exactly you’re referring to in this situation.

Yesterday’s (7/16/2008) article in the Rocky that Denver can’t repave all its roads, there might be some rough roads around the Front Range for a while.. I’ve asked my editor to read my comments a little closer – apologies.

DS