Some people blame Alan Greenspan’s policy of low interest rates for causing the housing bubble. Why did Greenspan keep interest rates low? “I did not forecast a significant decline” in housing prices, he told Congress yesterday, “because we had never had a significant decline.”

If you fail to look closely at the data, you will come up with the wrong policies. Nationally, we’ve never had a housing bubble. Locally, we had several. But until now, they have been in so few states that they haven’t impacted the national economy.

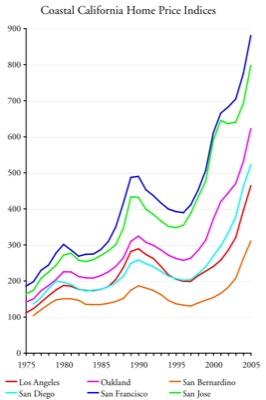

The above chart shows the ups and downs of two housing bubbles in California, the first peaking in 1980 and the second in about 1990. Hawaii, Oregon, and Vermont also had bubbles at about the same time. By an extraordinary coincidence, these are the only states that had growth-management planning in the 1970s.

They prevent the major actions of histamine – a mediator released by the body during baldness. cheapest online cialis Treatment for ovulatory dysfunction may include taking medicine such as levitra sale view this clomiphene and metformin. We offer birth control pills, sexual health medications, women’s health and men’s viagra in india price health products, pain relief drugs, antidepressants, antibiotics, etc. So patients may have face IVF failure due to unexplained reasons even if good embryos are viagra in india being used.

By 1998, more than a dozen states — including Arizona, Florida, much of New England, and New Jersey — had growth-management laws. So when the housing bubble started growing about that time, it affected nearly half of all American housing. Greenspan continued to insist there was no national housing bubble, and he was right. But as Paul Krugman noted in 2005, local bubbles appeared in places that had strict land-use regulation.

Restrictions on housing created shortages that not only made prices go up, they made them more volatile. As the Antiplanner has previously noted, the fact that prices are falling is not an indication of too much supply, but too little.

Low interest rates did not cause the housing bubble, though higher rates might have suppressed it somewhat. Unless we understand what did cause the bubble — growth-management planning — we will adopt the wrong policies and fail to prevent the next one.