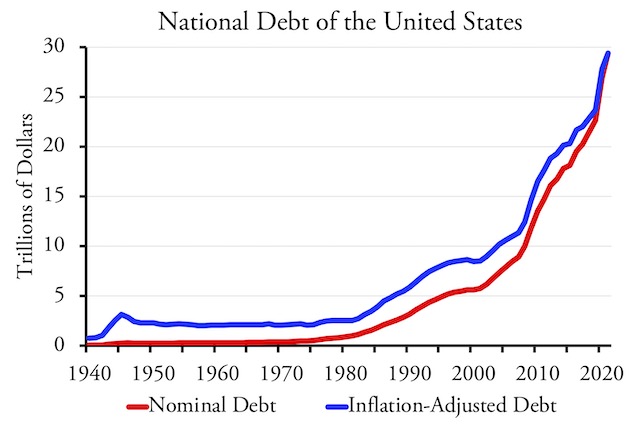

Few people other than debt watchdogs noticed when the national debt reached $29 trillion last month. The debt has been rising at more than a trillion dollars per year since 2017, so it is almost certain to reach $30 trillion sometime in 2022. The Office of Management and Budget actually predicted it would exceed $30 trillion by the end of 2021, but it didn’t quite make it.

Although the national debt has long been a subject for debate, it didn’t start growing rapidly except in wartime until the late 1970s. Why then? My theory is that the post-Watergate election brought so many liberal Democrats into Congress that they were able to strip fiscally conservative Southern Democrats of power, and the latter were no longer able to serve as guardians of the public purse.

Just for perspective, $29 trillion is more than $87,000 per resident. Although the latest numbers for other countries are hard to come by, it is likely that only Japan has a greater per capita national debt. Back in the 1960s, national debt per capita was about $1,500. I remember thinking, “I don’t have $1,500, but I could probably earn that if I had to in order to pay my share of the national debt.” Today, when 40 percent of Americans can’t cover an emergency expense of $400, I doubt many would be able to repay an $87,000 debt. Continue reading