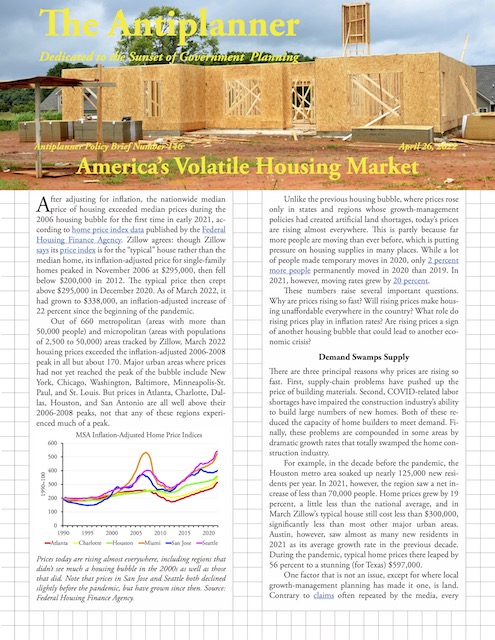

After adjusting for inflation, the nationwide median price of housing exceeded median prices during the 2006 housing bubble for the first time in early 2021, according to home price index data published by the Federal Housing Finance Agency. Zillow agrees: though Zillow says its price index is for the “typical” house rather than the median home, its inflation-adjusted price for single-family homes peaked in November 2006 at $295,000, then fell below $200,000 in 2012. The typical price then crept above $295,000 in December 2020. As of March 2022, it had grown to $338,000, an inflation-adjusted increase of 22 percent since the beginning of the pandemic.

Click image to download a four-page PDF of this policy brief.

Click image to download a four-page PDF of this policy brief.

Out of 660 metropolitan (areas with more than 50,000 people) and micropolitan (areas with populations of 2,500 to 50,000) areas tracked by Zillow, March 2022 housing prices exceeded the inflation-adjusted 2006-2008 peak in all but about 170. Major urban areas where prices had not yet reached the peak of the bubble include New York, Chicago, Washington, Baltimore, Minneapolis-St. Paul, and St. Louis. But prices in Atlanta, Charlotte, Dallas, Houston, and San Antonio are all well above their 2006-2008 peaks, not that any of these regions experienced much of a peak.