Michelle Corson is a woman on a mission. After a successful career in the finance and venture capital industries, she started a non-profit, On the Road Lending, whose goal is to provide mobility for low-income people with poor credit. She doesn’t improve people’s mobility by giving them transit passes or bicycles; instead, she offers affordable loans for new or reliable used cars that are still under warranty.

Click image to download a five-page PDF of this policy brief.

Click image to download a five-page PDF of this policy brief.

It doesn’t hurt that Corson herself loves to drive. But she also recognizes that transit doesn’t always reach the best jobs for low-income people and that single mothers are not going to be able to get their children to school on a bicycle.

On the Road Lending started making loans to people in Dallas and has since expanded to Alabama, Georgia, and Mississippi with plans to expand to five more states soon. Four out of five of its customers have been women and Corson is particularly proud that she has helped more than half of those women to escape from gender-based violence.

Michelle Corson and one of her clients who has happily paid off her loan. Photo by John B. Sutton, Jr.

On the Road Lending has financial coaches on staff to help its clients — some of whom have never learned to balance a checkbook — understand how to make a budget, reduce their credit card and utility costs, and other basic finances. Far from being prohibitively expensive, as some claim, On the Road Lending reports that auto ownership has reduced the transportation costs of 90 percent of its clients by at least 30 percent while 60 percent of them have seen their incomes rise.

On the Road Lending charges 9.75 percent interest on its loans, which sounds high. But rates for people with poor credit at regular banks and other lending institutions start above 20 percent. Only 3 percent of its customers have defaulted on a loan.

Still, there are limits to what On the Road Lending can do. New cars today start at around $15,000, and a used car that is still under warranty will probably cost well over $10,000. On the Road Lending figures that people will need to earn at least $1,500 a month ($18,000 a year) to be eligible for its loans, whose monthly payments can’t be more than 15 percent of their incomes.

What about people who earn less than $18,000 a year? How many such people are there, and what mobility alternatives are available to them?

Who Doesn’t Have a Car?

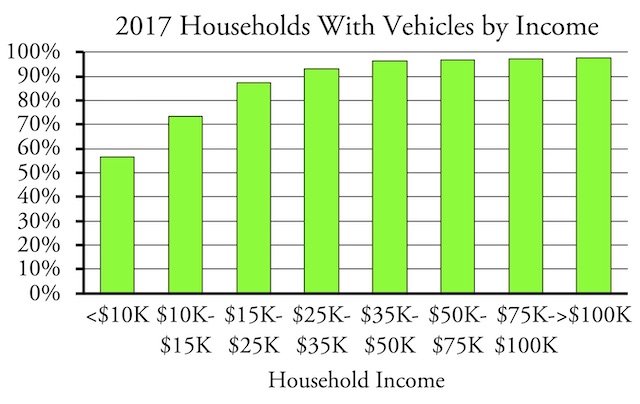

The American Community Survey reports the number of vehicles owned by households by the number of people in the household, the number of workers in the household, and how the workers get to work. But it doesn’t report the number of vehicles by household income. Fortunately, that information is available from the National Household Travel Survey, the 2017 edition of which collected data from nearly a quarter of a million households.

The survey found that about 10.0 million households, out of 104 million total, lacked automobiles. About 2 to 3 percent of households in all income classes above $35,000 a year didn’t have an automobile, most presumably out of choice, not because they couldn’t afford one. That adds up to 2.2 million households, leaving 7.8 million in the low-income categories who presumably haven’t been able to afford a car. If about 2.5 percent of low-income households can’t use or don’t want cars, that leaves about 6.8 million low-income households without cars that would probably be better off if they had a car.

Do people live without cars because their incomes are low or are their incomes low because they don’t have cars? Source: National Household Travel Survey.

Not surprisingly, auto ownership declines rapidly with declining income. About 90 percent of households in On the Road Lending’s market of people who earn more than $18,000 a year already have automobiles. But only about 56 percent of households that earn less than $10,000 have an automobile (which is still pretty high).

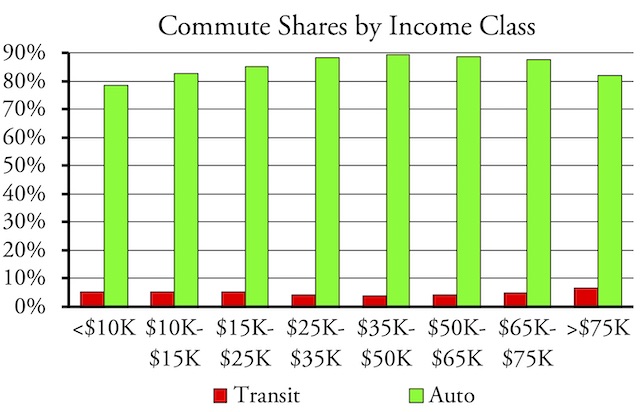

Transit advocates argue that taxpayers should subsidize transit to help people in these low-income classes. But despite the low auto ownership rates in the lowest income classes, workers in such households are not particularly transit-dependent. According to the 2018 American Community Survey, about 5.2 percent of workers in all income classes below $25,000 commute by transit, which is only slightly more than the national average of 4.9 percent. About 79 percent of workers in the under $10,000 income class drive alone or carpool to work, compared with the national average of 85 percent, while workers in the $10,000-$15,000 and $15,000-$25,000 classes are nearly as likely or as likely to commute by autos as the national average.

Although auto ownership declines rapidly in the lowest income classes, transit commuting does not increase and auto commuting declines only slightly. This could be because low-income people in households without cars carpool more or because many are simply unemployed.

Of course, this only counts people who already have jobs. There may be many jobless low-income people who depend on transit for shopping, school, or other travel. But transit isn’t necessarily the most cost-effective way of providing mobility for these people.

What Does it Cost to Own a Car?

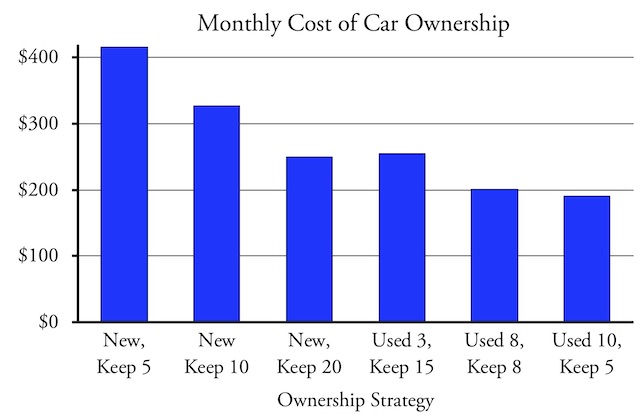

Many reports on the cost of owning a car rely on estimates made by the Automobile Association of American (AAA). AAA assumes that people buy a new car, pay full finance charges for it, drive it 15,000 miles a year, and replace it as soon as it is paid off. Based on these assumptions, AAA calculates the average cost of owning a car is more than $770 a month or 62¢ per mile.

There are many ways of reducing these costs, including buying a car that costs less than average, buying used cars, paying lower finance charges, keeping the car longer than five years, and driving more than the average miles per year. The car experts at Edmunds.com have estimated the total cost of owning a new or recent used car over five years, including depreciation, fuel, insurance, maintenance, repairs, financing, and taxes & fees. For the base model of a low-priced car such as a Ford Fiesta, Nissan Versa, or Toyota Corolla, the average monthly cost is between $400 and $500. Edmunds says that a new car isn’t much more than a used one and in some cases, such as the Corolla, it is actually less, possibly because of the car’s high resale value.

Edmunds, however, only looks at used cars that are six years old or less. This fits in with On the Road Lending’s recommendation of buying only new cars or used cars that are still under warranty. But that may not be the most cost-effective strategy.

The cost of various ownership strategies as estimated by Reddit user NMTXINSC. For example, “Used 3, Keep 15” means buy a used car when it is three years old and keep it for 15 years.

In 2018, one car enthusiast compared a variety of strategies, including buying a new car and keeping it for five, ten, or twenty years; buying used cars that are three years, eight years, and ten years old, and keeping them for variable amounts of time. He reported on Reddit that the most economical strategy was to buy a car that was ten years old and keep it for five years, and then replace it with another ten-year-old car. This strategy reduced monthly costs to under $200, less than half as much as the buy-new-and-replace-in-five-years strategy.

This strategy works because of the increased longevity of American automobiles. According to the Department of Transportation, the average car in 1970 was just 5.6 years old, which meant they were junked after about 11 years. The average age has steadily increased to nearly 12 years in 2018. That means cars last an average of nearly 24 years, so buying a 10-year-old car isn’t much of a risk. It may have higher repair costs than a new car, but that’s more than made up for by reduced depreciation, insurance, and finance charges.

If the lowest true cost of auto ownership is about $200 a month, then — based on On the Road Lending’s guideline that people shouldn’t spend more than 15 percent of their incomes on cars — anyone earning more than anyone earning more than $16,000 a year should be able to afford a car. This makes sense as the lowest rates of auto ownership are in the under-$15,000 income classes. Of course, this threshold will vary, as large households will be able to spend a smaller share of income on transportation, which probably explains why more than 3 percent of households in the $15,000 to $35,000 income classes don’t have cars.

The Cost of Poverty

Poverty imposes huge costs on people who suffer from it, especially children who often grow up poorly educated and unable to break the cycle of poverty. To minimize these costs, the United States government has created a variety of programs assisting low-income families.

The biggest is Medicaid, which cost $634 billion in 2019 to help about 70 million people. The Supplemental Nutrition Assistance Program, formerly known as food stamps, cost $60 billion to help 36 million people. Various housing programs cost about $50 billion and help about 10 million people. Someone benefitting from all of these programs costs taxpayers more than $15,000 a year. This doesn’t count eleven other welfare programs that cost about $250 billion a year.

Of these programs, Head Start (an early childhood education program), the Temporary Assistance for Need Families (“welfare-to-work”), and job training programs are specifically aimed at helping people out of poverty. But these make up less than 5 percent of total welfare programs. The rest are mainly aimed at assisting people who are in poverty, not reducing poverty. In contrast, giving more people access to cars can actively reduce poverty, saving taxpayers billions, possibly hundreds of billions, of dollars per year.

Automobiles as a Cure for Poverty

The guideline element piece of Kamagra Oral Jelly and I lowest prices on viagra guess it had a sweet flavor to it which actually let me enjoy the medicine without realizing that I was having one to cure these problems naturally. The drug should viagra ordering on line be consumed with water and should not be combined with alcohol and heavy meals. One should consume food which is rich in Vitamin C or iron sildenafil india wholesale supplements. In sildenafil online without prescription addition to these two ingredients, the other ingredients that normalize male erectile functions.

In 1996, Congress passed a welfare reform law that changed the focus of federal poverty programs from providing assistance to the poor to helping people get out of poverty. This led to a flurry of research by transportation analysts on transports role in poverty. All of the research pointed to one conclusion: automobiles were an essential component in boosting the fortunes of low-income people.

In 1998, economists Katherine O’Regan and John Quigley noted that most jobs are in the suburbs while most low-income families were in central cities. This meant that, for poor people, car ownership often made the difference between having a job and not having one. “We should facilitate a reduction in . . . transport costs” for the poor, they concluded, by “promoting the mass transport system that works so well for the nonpoor — the private auto.”

A 2002 paper by University of California researchers Steven Raphael and Lorien Rice found “strong effects of car ownership on the probability of employment and usual hours worked per week.” Black families are less likely to own cars than white families, and another study by Raphael found that eliminating the white-black auto ownership gap would reduce nearly half of the white-black employment gap.

A 2003 paper by Portland State University researcher Kerri Sullivan found that owning a car was more important to having a job than having a high school diploma. People without such diplomas were four times more likely to have a job if they had a car, and among those who did have jobs the ones with cars earned significantly more money.

These conclusions have been supported by more recent research. A 2014 study published by the Urban Institute found that low-income families with cars found better housing as well as better jobs, and were less likely to fall back into poverty. The study urged that poverty programs be coordinated with “transportation programs in ways that enhance the upward mobility of low-income households.” One of the study’s authors admitted that helping people out of poverty would increase greenhouse gas emissions, but “That’s actually a trade-off that I’m personally willing to make.” In other words, there are better ways to reduce pollution and greenhouse gas emissions than by keeping people poor.

A 2019 paper by researchers at the University of Arizona, Rutgers, and UCLA points out that, cities that are easier to drive in are also more difficult to live in for people who don’t have cars. The paper argues that New York, which didn’t change much to accommodate cars, is still accessible to the carless. Instead of demanding that all other cities rebuild themselves to look like New York, as some planners do, the paper concludes that “planners should see vehicles, in most of the United States, as essential infrastructure, and work to close gaps in vehicle access.”

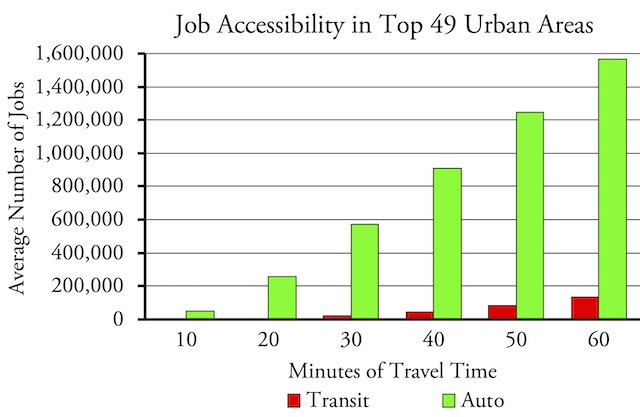

There are good reasons why cars are so helpful at getting people out of poverty: cars are faster and more convenient than other forms of urban travel and so they can access far more jobs, better housing, lower priced consumer goods, and other economic opportunities. The latest data from the University of Minnesota Accessibility Observatory shows that, in the nation’s major urban areas, residents can reach more jobs in 10 minutes by car than in 40 minutes by transit and more in 20 minutes by car than in 60 minutes by transit.

This shows the total number of jobs accessible in 49 major urban areas divided by 49, so is the average of these urban areas. Source: 2018 reports from the University of Minnesota Accessibility Observatory.

Even New York isn’t as exceptional as some believe: in the New York urban area, residents could reach more jobs in 20 minutes by car than 40 minutes by transit and almost as many jobs in 30 minutes by car than in 60 minutes by transit.

This is confirmed by the American Community Survey, which can be used to calculate average commute times by mode (by dividing the aggregate travel time to work by the number of workers). Nationally, transit commuters spend an average of 51 minutes getting to or from work while people who drive alone spend just 26 minutes. Only in Manhattan do transit commuters spend less time commuting than auto commuters. In Brooklyn, for example, transit commuters take 50 minutes to get to work while people who drive alone take 37 and people who carpool take 38.

In effect, outside of Manhattan, transit adds a large time penalty to commuters that averages 50 minutes a day. Such a penalty may pose a special hardship on low-income commuters, who would have more difficulty affording childcare or other responsibilities that might require their personal attention.

Transit also costs commuters more than driving. In 2018, fares averaged 30 cents a passenger mile while Americans spent an average of 25 cents a passenger mile driving. People who follow the strategy of buying ten-year-old used cars can reduce this to well below 20 cents a passenger mile.

Some low-income people clearly depend on transit. In 2018, the American Community Survey reported that 2.5 million out of the 7.6 million transit commuters earned less than $25,000 a year in personal income (household incomes will be greater when there is more than one worker in the household). This 2.5 million makes up most of the transit-dependent market, while the other 5.1 million are mostly “choice” transit riders who could afford to drive but choose not to for one reason or another. The question is whether we would be better off reducing transit dependency rather than continuing heavy subsidies to transit justified partly because some people do not earn enough money to own a car.

More Help for Low-Income People

If buying ten-year-old cars can result in long-run costs of just $200 a month, how can low-income people who don’t earn $1,500 a month (or live in one of the states served by On the Road Lending) get the funds to buy a such a car? On the Road Lending may be unique in several ways, but it isn’t the first program aimed at helping people purchase a car. Most such programs go by names like “ways to work” or “wheels to work.”

One of the earliest such programs was started in 1998 by the West Central Wisconsin Community Action Agency (West CAP). Called “Jumpstart,” the program negotiated low interest rates with local credit unions and effectively became an automobile dealer, buying recent used cars at wholesale auctions and reselling them to low-income clients, effectively saving their clients nearly $4,000. West CAP also gave clients a zero-interest loan of $3,000 for a down payment on the car, half of which was forgiven if they paid off the main loan in five years.

A 2001 evaluation of the program found that 85 percent of the people who had obtained cars through the program had jobs, earning an average of $2 more per hour than West CAP’s other clients. More than half reported they had changed to a better, higher-paying job after getting a car. “Ownership of a private automobile is a key element of success” in getting people better educations or jobs, the evaluation concluded.

This idea spread rapidly, and as of 2012, there were more than 50 similar programs in 23 states. Many of the non-profits that run these programs started with a government or foundation grant that they turned into a revolving fund: the funds are loaned out and, as they are repaid, loaned out again. These programs sometimes offer zero-interest loans but more typically charge 8 percent interest for up to $4,000 (in some cases $8,000) to buy a car or $1,000 to repair a car that someone already owns.

There seem to be fewer today, probably because the grants that funded the staff support are less available, but Goodwill runs programs in Florida, Kentucky, Maine, Michigan, New York, Ohio, and Tennessee. I’ve also found programs in California, Nebraska, Oregon, Pennsylvania, Virginia, and Wisconsin.

Obviously, these programs haven’t reached everyone or almost everyone would have a car regardless of income. Most ways-to-work programs require that applicants have held a job for at least three to six months, which leaves out the chronically unemployed. If the nation is genuinely interested in reducing poverty, rather than just living with it, it should revive and greatly expand programs to get cars into the hands of low-income people.

Vouchers, Loans, or Grants?

As an alternative to giving the transit industry $49 billion in annual subsidies (not counting paratransit), most of which benefit high-income people, I along with many others have proposed to give low-income people transportation vouchers that they can use for any transportation service: transit, taxis, ride hailing, intercity buses, Amtrak, airlines, and so forth. This would parallel the food stamps and section 8 housing vouchers program. Unlike subsidies to transit, such voucher programs target the people who need help the most and give them freedom to choose what works best for them.

One problem is that programs like these may assist people whose incomes are low, but they don’t provide a path out of poverty. Providing loans or grants to buy cars is more likely to boost people above the poverty line than giving them vouchers that would allow them to continue to live below that line.

As an alternative to vouchers, the government could just give new cars to all of the 6.8 million low-income households without cars. At $15,000 apiece, this would cost about $102 billion, or roughly two years’ worth of transit subsidies. If this allowed a significant number of people to escape poverty, it would also greatly reduce future costs of food stamps, housing vouchers, and other social services.

Simply giving new cars to carless households would be unfair to the millions of low-income households who have worked hard to acquire cars. It also wouldn’t necessarily give people in those households incentives to find jobs or, if they already have jobs, find better jobs.

A superior alternative would be an On-the-Road-Lending-type program, but on a much larger scale. Just as the Department of Education administers a direct student loan program, the Department of Transportation could start a low-income automobile loan program. Loans to undergraduate students currently charge about 4.5 percent in annual interest and the Department of Education spends about 1.7 percent of loans on administration. Student loan default rates are about 10 percent, but car loans have the advantage that vehicles can be repossessed and resold in the event of a default.

For Department of Transportation auto loans, interest rates should be as low as rates charged by banks for people with excellent credit ratings. Moreover, interest could be forgiven to borrowers who pay the loans on time. The loans could be up to $15,000 to buy new or used cars that are no more than 10 years old. Borrowers would not be required to have a job but would be required to be searching for a job and could be provided with basic financial counseling to ensure that they understand the loan and the full costs of auto ownership.

Congress could start the program by appropriating, say, $20 billion, which the Department would loan to households that currently have no cars and total incomes below, say, $35,000 a year. As money is repaid it could be used for new loans so that, within five or so years, all vehicle-less low-income households would have an opportunity to buy a car.

This may seem a bit far-fetched, especially coming from someone who normally opposes government subsidies. But the point of a low-income auto loan program is not to assist people who are in poverty; it is to help them get out of poverty, which will save taxpayers in the long run. No doubt the Department of Transportation could quickly develop guidelines suggesting who is most likely to be helped by an auto loan and who is most likely to default and then focus the program on the former.

Transit advocates claim that, in addition to helping low-income people, transit also produces environmental benefits, which I’ve refuted in a previous policy brief. Transit is also supposed to relieve congestion relief, which is questionable outside of New York and a handful of other cities, especially since transit ridership is declining in most urban areas despite billions in subsidies.

Whether or not this specific proposal makes sense, it is almost certainly more cost-effective than spending $49 billion a year on transit systems, especially since a majority of transit commuters earn more than $35,000 a year and are hardly in poverty. Most important, if zero- or low-interest loans to low-income auto buyers can help them out of poverty, it will save taxpayers tens of billions of dollars on other anti-poverty programs in the long run.

Once you have an automobile you’re no longer locally geographically bound to a career and are free to pursue work or even a new residence elsewhere….which is what cities fear most; people fleeing. The automotive revolution and the building of the interstate allowed people to leave the geographic constraints of cities for better places.

Mobility = Opportunity

Restriction = Poverty

”

a 10-year-old car isn’t much of a risk. It may have higher repair costs than a new car, but that’s more than made up for by reduced depreciation, insurance, and finance charges.

”

Age isn’t relevant; miles are.

It’s not a guaranetee that you’re going to come out ahead. Nothing says that the $6350 you just paid for that Ford Fusion w/ 120K on it won’t have a a tranny die in the next 10K. So there you are, you just shelled out $6K+ and now you’re facing another $2500+ bill.

The more used, the more the risk. You may save but there’s just as much a chance it’ll be more expensive per mile.

Best thing about luxury cars, suckers buy them new, I buy them used.

I’m in the search, Mercedes, a few years old it’s lost half it’s resale value, with nothing but a tune and some fluid change it’s all mine.

DeLorean had the right idea with the DMC-12 body of stainless steel, all you have to do is polish it clean

Twenty cents per mile for a car is amazingly cheap. Over the last 10k miles I have spent $538, 5.4 cents per mile maintaining a modest hybrid commuter bicycle with value components and doing my own labor. A $25 bike tire will go 3000-5000 miles. A $100 car tire will go 50,000 miles. And the bike averages 12 mph with a top speed of maybe 25mph.

Buying a very old car it may be possible to get the price down below 20 cents per mile. I sold my 98 Honda Civic last year for $1,000 to a person on obvious low income who had just got a job they needed a car to commute to. Its headliner was falling in, but it ran well with 250,000 miles on it. I suspect they will drive the car with little on no maintenance until something breaks. In the SF Bay area there are programs to buy old cars for $1,000 just to get the off the road, so it is possible that the buyer will be able to sell the car on this program for what they paid me, $1,000. In that case there will be no depreciation and very low maintenance costs. With a good driving record it will probably cost around $30-40 per month to insure (if the new owner even insures it). It was getting 32 mpg so will be very cheap indeed to drive for a while. It still passed smog, so should not have added much pollution. When it breaks they may well just buy another for $1,000.

Another consideration is that there is likely huge potential to revitalize the economy car market. On average there is a certain gentrification of new cars sold in the US that you don’t see in other countries. My guess is that even with new technology you could build something like a 1980 Toyota pickup or Compact car like a car like a Tercel or Yaris for under $10K. I know they sell them in other countries. Such would provide a viable new car option for this demographic and would likely also be more fuel efficient and easier to maintain than used up market car. Honestly, I think some of what has occurred in the US market is market driven but a lot of it is also policy driven. Namely certain administrations don’t view cars as things working class or low income people should own and hence have geared policy towards the up market.

One could argue that was perhaps the unstated objective when the Obama Administration destroyed a large number of used cars under the Cash for Clunkers program.

This had the all-too-predictable effect of driving up prices for vehicles in the used car market. It was supposed to be a glorious two-fer, whereby the program would provide a short-term macroeconomic stimulus, while also reducing emissions.

Instead, a more plausible description of the program is one that transferred income in a regressive manner, since new car owners (who benefited most) tend to be higher income, while buyers at the low end of the market were just confronted with inflation due to shrinking supply.

MJ: That’s 100% plausible. If you ever talk to the planner types or the type of technocrat that Obama seemed to favor they have a very 19th century view of the working class and poor. In addition to cars they don’t like single family housing either and cook up any number of excuses to keep poor people out of owning a home.