Taxpayers spend billions of dollars a year subsidizing so-called affordable housing, but much of that money is wasted, says a new report from the Cascade Policy Institute. Affordable housing being built today actually costs much more than market-rate housing, and most of the benefits from building such expensive housing are captured by the developers, not low-income families who need housing.

Click image to download a 3.0-MB PDF of this report.

Click image to download a 3.0-MB PDF of this report.

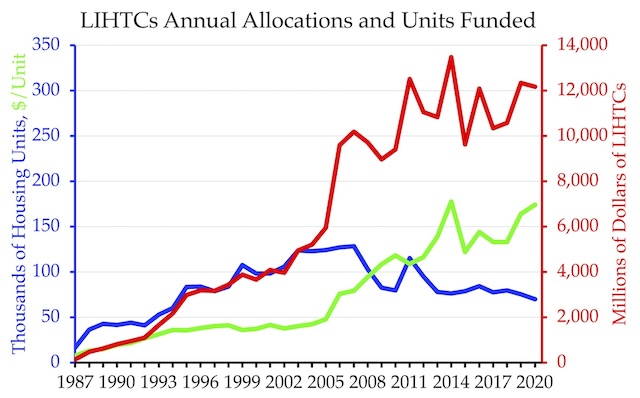

The report, which was written by the Antiplanner, reviews hundreds of housing projects built in the last 35 years to show that the nature of the typical project has changed from inexpensive low-rise apartment buildings to mid-rise and high-rise apartments that cost several times as much to build per square foot. The result — as noted in an Antiplanner post last December — is that the number of housing units built has declined despite a doubling of money spent subsidizing affordable housing. This has effectively cheated both taxpayers and people dependent on affordable housing. Continue reading